The landscape of US stock market investing has witnessed a monumental shift in recent decades. Exchange-Traded Funds (ETFs) have emerged as powerful vehicles, offering investors a diversified and cost-effective way to participate in the market. Among these titans, the SPDR S&P 500 ETF Trust (ticker symbol: SPY) stands as an undisputed behemoth. This article covers features of SPY ETF, exploring its characteristics, investment strategies, and potential benefits and drawbacks for investors.

What is SPY ETF

The SPY ETF was introduced by State Street Global Advisors in 1993, making it one of the oldest and most established ETFs in the market. It was designed to track the performance of the S&P 500 Index, one of the most renowned benchmarks for the U.S. stock market. The S&P 500 Index comprises 500 of the largest publicly traded companies in the United States, spanning various sectors of the economy and representing a significant portion of the total market capitalization. By investing in SPY, you gain exposure to a diversified basket of these leading corporations, essentially mirroring the performance of the broader market.

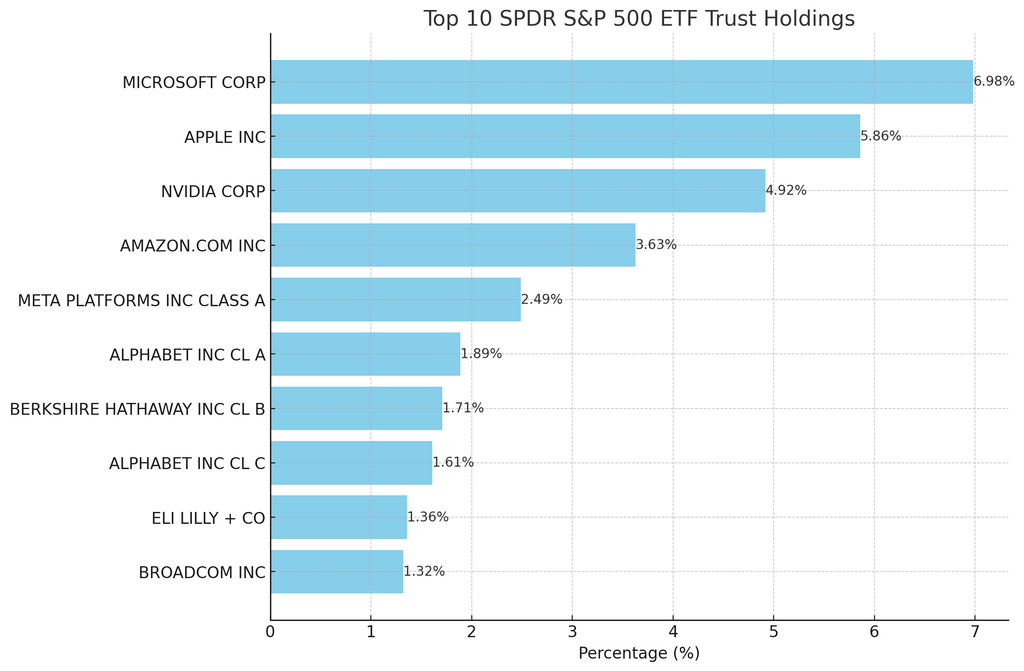

Top 10 Holdings as of Mar 11 2024. Source: SSGA

SPY ETF Investment Strategy

SPY ETF employs a passive investment strategy. Unlike actively managed funds that seek to outperform the market through selective stock picking, SPY aims to replicate the holdings and performance of the S&P 500 as closely as possible. This strategy offers several advantages:

- Diversification: SPY provides instant diversification across various sectors and industries, mitigating the risk associated with overexposure to any single company.

- Low Cost: Compared to actively managed funds that typically charge higher fees, SPY boasts a low expense ratio, keeping investment costs minimal.

- Transparency: The composition and weighting of holdings in SPY are readily available, allowing for clear investment insights.

Free Backtesting Spreadsheet

Benefits of Investing in SPY ETF

Several compelling reasons make SPY ETF an attractive option for a wide range of investors:

- Long-Term Growth Potential: Historically, the S&P 500 has exhibited long-term growth, offering the potential for capital appreciation over time.

- Liquidity: SPY is one of the most heavily traded ETFs globally, ensuring high liquidity and ease of buying and selling shares.

- Accessibility: SPY is readily available through most brokerage platforms, making it accessible to investors of all experience levels.

Role in a Diversified Portfolio

The SPY ETF can serve as a core building block in a diversified investment portfolio, providing broad exposure to the U.S. stock market. Investors can utilize the SPY ETF to gain exposure to large-cap equities, complementing other asset classes such as bonds, international stocks, and alternative investments. Its low cost, diversification benefits, and liquidity make it an attractive option for both individual and institutional investors seeking broad market exposure. Investing a fixed amount of money in SPY at regular intervals through dollar-cost averaging helps to average out the cost per share over time, thereby mitigating the impact of market volatility. Additionally, it can serve as a complement to active investing, forming the foundation of your portfolio while allowing you to employ active strategies with a smaller portion of your assets.

SPY ETF option chain demonstrates an active option market/Webull

SPY Options Strategies

The previous section explored SPY as a buy-and-hold investment. However, the existence of an active options market unlocks a whole new dimension for investors seeking to potentially amplify returns, hedge existing holdings, or generate income. You can use the following strategies:

- Calls for Bullish Bets: Call options grant the right, but not the obligation, to buy SPY shares at a specific price (strike price) by a certain date (expiration date). If you believe the price of SPY will rise above the strike price before expiration, buying calls allows you to profit from this upward movement.

- Puts for Bearish Hedges: Put options grant the right, but not the obligation, to sell SPY shares at a specific strike price by a certain date. These are valuable tools for hedging existing holdings of SPY or for profiting if the price of SPY declines.

- Covered Calls for Income Generation: If you already own SPY shares and are bullish or neutral on the short-term outlook, you can sell covered calls. This strategy generates income by collecting the premium from the option buyer, but it also limits potential upside if the price of SPY surges significantly.

- Cash-Secured Puts for Income and Potential Investment: Cash-secured puts involve setting aside cash equal to the strike price of the put option you’re selling. This strategy generates income from the premium but also carries the obligation to buy SPY shares at the strike price if the option is exercised. This can be a way to potentially acquire SPY at a discount if the price falls.

Important Considerations for Options Trading

While options offer exciting possibilities, they also involve significant risks:

- Time Decay (Theta): The value of options erodes over time, irrespective of the price movement of SPY ETF. Options closer to expiration lose value faster.

- Volatility (Vega): Option prices are sensitive to implied volatility, a measure of market expectation of future price swings. Higher volatility leads to higher option prices. Understanding how volatility affects option pricing is crucial.

- Leverage: Options are leveraged instruments, meaning small price movements in SPY can lead to magnified gains or losses in your option positions. This can affect both profits and potential losses.

Conclusion

The SPY ETF has cemented its position as a cornerstone of US equity investing. Its simplicity, diversification, and low cost make it an ideal choice for investors seeking broad market exposure. However, a thorough understanding of its characteristics and potential drawbacks is essential to align SPY with your investment objectives and risk tolerance. By carefully considering these factors, SPY can be a powerful tool for building wealth and achieving your long-term financial goals.

Share on Social Media: