In the dynamic realm of financial markets, where volatility reigns supreme and trends can shift at a moment’s notice, traders and investors often seek reliable tools to aid their decision-making processes. Among the myriad of technical analysis indicators available, the Simple Moving Average (SMA) stands as one of the most widely used and respected tools in the arsenal of market participants. Its simplicity belies its effectiveness, making it a cornerstone of many trading strategies across various asset classes. In this article, we will delve into the intricacies of the SMA indicator, exploring its mechanics, applications, and practical side.

Understanding SMA Indicator

At its core, the SMA indicator is a straightforward yet powerful tool used to analyze price trends over a specific period. Unlike more complex indicators, such as the Exponential Moving Average (EMA), which assigns greater weight to recent price data, the SMA treats all data points equally within the chosen timeframe. This simplicity makes it particularly useful for smoothing out price fluctuations and identifying overarching trends.

The calculation of a Simple Moving Average is relatively straightforward. It involves summing up a predefined number of closing prices over a specified period and then dividing the total by the number of periods. Formula of SMA indicator can be represented as follows:

For example, a 20-day SMA would sum up the closing prices of the last 20 trading sessions and divide the total by 20 to arrive at the average closing price for that period.

Applications of SMA Indicator

1. Trend Identification

One of the primary applications of the SMA indicator is trend identification. By plotting the SMA on a price chart, traders can visualize the direction of the prevailing trend. When the price is trading above the SMA, it is often interpreted as a bullish signal, suggesting that buyers are in control. Conversely, when the price falls below the SMA, it may indicate a bearish trend, signaling potential selling pressure.

The SMA indicator on the price chart of Nvidia stocks

2. Support and Resistance Levels

SMA can also serve as dynamic support and resistance levels. During uptrends, the SMA tends to act as a support level, providing a floor for prices as they pull back before resuming their upward trajectory. Similarly, in downtrends, the SMA may act as a resistance level, capping upside movements as sellers dominate the market.

3. Entry and Exit Signals

Traders frequently use crossovers between different SMAs or between the price and SMA to generate entry and exit signals. A bullish crossover occurs when a shorter-term SMA crosses above a longer-term SMA, signaling a potential uptrend. Conversely, a bearish crossover occurs when a shorter-term SMA crosses below a longer-term SMA, indicating a possible downtrend. These crossovers can be used in conjunction with other technical indicators to confirm trading signals and manage risk effectively.

Choosing the Right Parameters

The choice of the SMA’s period depends on the trader’s investment horizon, trading style, and the asset being traded. Shorter-term traders may opt for shorter SMA periods, such as 10 or 20 days, to capture more immediate price movements. On the other hand, long-term investors may prefer longer SMA periods, such as 50 or 200 days, to filter out short-term noise and focus on broader trends.

Experimentation and backtesting are essential when determining the optimal SMA length for a particular trading strategy. Traders should consider the historical performance of different SMA configurations across various market conditions to identify patterns and refine their approach.

Free Backtesting Spreadsheet

Backtesting with SMA Excel Template

Backtesting is an important stage of developing and validating trading strategies, including those involving the SMA indicator. By analyzing historical data and simulating trades based on predefined rules, traders can assess the performance of their strategies and identify potential strengths and weaknesses before deploying them in live markets. Let’s explore how to conduct backtesting using historical data and an Excel spreadsheet.

Gathering Historical Data

The first step in backtesting is obtaining high-quality historical data for the asset or market being traded. Many financial websites and data providers offer historical price data for various instruments, including stocks, forex pairs, and commodities. It’s essential to ensure that the data is accurate, reliable, and covers a sufficiently long-time horizon to capture diverse market conditions. You can start with Investing.com which provides free historical data in 1D time frame.

Setting Up the Excel Spreadsheet

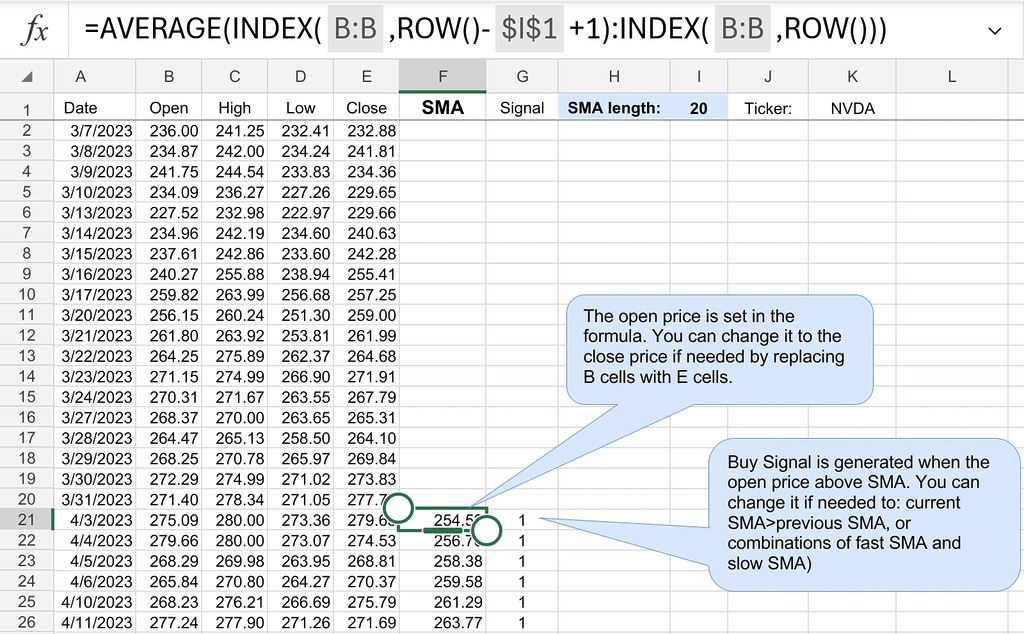

Once the historical data is acquired, you can create a simple Excel spreadsheet to conduct your backtesting. The spreadsheet should include columns for date, open, high, low, close prices, as well as any additional indicators or variables used in the trading strategy. You can download Excel template for SMA indicator which was created for your convenience.

Data Input: Enter historical price data into the spreadsheet, including date, open, high, low, and close prices.

SMA Calculation: Add column to calculate the Simple Moving Average for different periods. Utilize Excel Average function to calculate the SMA based on the specified length.

Signal Generation: Create columns to generate buy and sell signals based on predefined rules. In template, a buy signal occurs when price is above SMA. Part of the job is done in our template, so you just need to fit it to your strategy backtesting spreadsheet.

Trade Execution: Implement columns to track trade executions, including entry and exit prices, position size, and profit/loss calculations.

Limitations of SMA Indicator

While the Simple Moving Average is a versatile tool with many applications, it is not without its limitations. One of the primary drawbacks of SMA is its inherent lagging nature. Since SMA assigns equal weight to all data points within the chosen period, it may not react swiftly to sudden price changes or market developments. As a result, traders relying solely on SMA signals may experience delayed entry or exit points, potentially missing out on profitable opportunities or incurring unnecessary losses.

Moreover, SMA may generate false signals during periods of consolidation or choppy price action. In range-bound markets, where prices oscillate within a narrow range, SMA crossovers may occur frequently without indicating a meaningful change in trend. Traders should exercise caution and use additional technical indicators or filters to confirm SMA signals and avoid whipsaws.

Final Thoughts

The SMA indicator provides traders and investors with valuable insights into price trends and market dynamics. Its simplicity, versatility, and effectiveness make it a popular tool among market participants across various asset classes and timeframes. By understanding the mechanics, applications, and limitations of SMA, traders can harness its power to make informed trading decisions, manage risk, and navigate the complexities of financial markets with confidence. As with any technical indicator, prudent use, proper risk management, and continuous refinement are essential for maximizing the utility of SMA in trading strategies.

Share on Social Media:

Leave a Reply