One of the most appealing aspects of selling puts is the ability to generate consistent income through the premiums collected from selling options. This income can boost your existing returns or serve as a standalone source of profit. In this article, we’ll explore how selling puts works, the benefits and risks involved, and key practices to help you succeed with this strategy.

Free Backtesting Spreadsheet

Understanding the Basics

An option is a financial derivative that provides the holder with the right, but not the obligation, to buy (call option) or sell (put option) a specified asset at a predetermined price within a set timeframe. When an investor sells a put option, they are essentially entering into a contract to buy the underlying asset at a predetermined price (known as the strike price) if the option is exercised by the buyer before expiration.

The Mechanics of Selling Puts

The selling puts strategy involves two primary parties: the seller (also known as the writer) and the buyer (holder) of the put option. As the seller of a put option, traders receive a premium upfront from the buyer in exchange for taking on the obligation to buy the underlying asset at the strike price if the option is exercised before expiration. The seller profits from the transaction if the price of the underlying asset remains above the strike price, allowing the option to expire worthless.

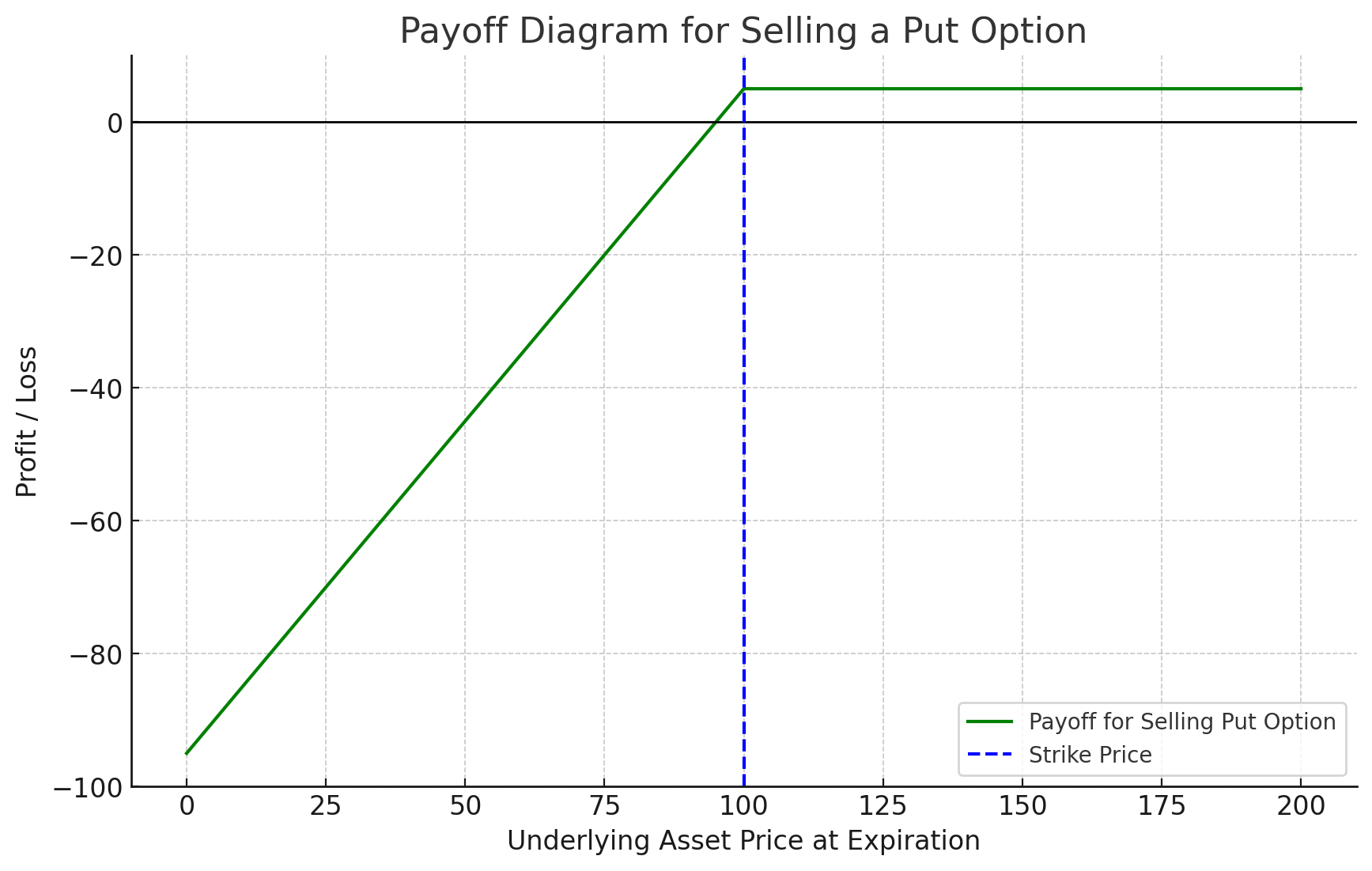

The payoff diagram for selling a put option is illustrated above. The diagram highlights several key aspects:

Flat Line Above Strike Price: When the price of the underlying asset at expiration is above the strike price ($100 in our example), the put option is not exercised by the buyer. The seller’s profit is the premium received ($5), represented by the flat line at the top.

Downward Sloping Line Below Strike Price: If the price of the underlying asset falls below the strike price, the option is likely to be exercised by the buyer. The seller then starts to incur losses. These losses increase as the price of the underlying asset decreases but are initially offset by the premium received. The slope indicates that the seller has to buy the asset at the higher strike price, which could be sold only at the lower market price, resulting in a loss.

Break-even Point: This is the point where the line crosses the X-axis, slightly below the strike price. It is calculated by subtracting the premium received from the strike price ($100 – $5 = $95). If the price of the underlying asset at expiration is exactly $95, the seller breaks even.

Benefits of Selling Puts

One of the most appealing aspects of selling puts is the ability to generate consistent income through the premiums collected from selling options. This income can supplement existing investment returns or serve as a standalone source of profit. Additionally, in instances where the option is exercised and the seller is assigned the underlying stock, selling puts enables investors to acquire stocks at a discounted price compared to the current market value. This discounted acquisition can be especially advantageous for investors aiming to accumulate shares of a fundamentally strong company at a lower cost basis, thereby enhancing their long-term investment potential.

7 Best Practices and Strategies

- Thorough Asset Selection: Prioritize selecting underlying assets that align with your investment goals, whether it’s income generation, capital appreciation, or risk mitigation. Focus on companies with robust fundamentals, stable earnings, and a history of consistent performance to enhance the probability of success.

- Strategic Strike Price and Expiry Selection: Strike prices and expiration dates play a pivotal role in option selling. Opt for strike prices that strike a balance between premium income and the likelihood of assignment, considering the asset’s volatility and market conditions. Similarly, choose expiry dates that provide adequate time for the underlying asset to move in the anticipated direction while accounting for your risk management approach.

- Setting Stop-Loss Orders for Risk Management: A stop-loss order is a predefined instruction placed with a broker to sell a security if it reaches a specified price level. By setting a stop-loss order on a sold put option, traders can limit potential losses and protect against adverse market movements. If the price of the underlying asset declines and triggers the stop-loss level, the put option will be automatically closed out, limiting further losses. This proactive approach allows traders to manage risk efficiently and avoid significant drawdowns in their trading account. Additionally, stop-loss orders can help traders maintain discipline and stick to their predetermined risk tolerance levels.

- Embrace Portfolio Diversification: Diversification remains a cornerstone of sound investment practice. Avoid overexposure to any single position or sector by diversifying your portfolio across a spectrum of underlying assets, industries, and market segments. This helps mitigate concentration risk and enhances overall portfolio resilience.

- Utilize Cash-Secured Put Strategy: Consider implementing the cash-secured put strategy, where you maintain sufficient cash reserves to cover the potential obligation of purchasing the underlying asset at the strike price if the put option is exercised. While this approach requires a larger capital outlay upfront, it offers a lower-risk alternative to naked puts.

- Explore Put Spread Strategies: Explore the use of put spread strategies, which involve simultaneously selling a put option while purchasing a put option with a lower strike price. Put spreads allow for controlled risk exposure while still enabling profit potential, making them a prudent choice for risk-averse traders.

- Employ Rolling Put Options: In the event of adverse price movements in the underlying asset, consider rolling put options to a later expiration date or adjusting the strike price to manage risk effectively. This maneuver allows you to adapt to changing market conditions while maintaining flexibility in your options trading approach. By rolling put options, traders essentially buy back the current put options they have sold and simultaneously sell new put options with a later expiration date or a different strike price. Rolling put options allows traders to preserve their capital by avoiding potential losses that may result from the exercise of the original put options at an unfavorable price. Instead of accepting assignment and buying the underlying asset at a higher price, traders have the opportunity to adjust their position and potentially improve their risk-reward profile.

Risks and Considerations

While selling puts can offer attractive benefits, it is not without its risks. It’s essential for traders to understand and carefully manage these risks to avoid potential pitfalls. Some of the key risks associated with selling puts include:

- Obligation to Buy: As the seller of a put option, traders are obligated to buy the underlying asset at the strike price if the option is exercised by the buyer before expiration. If the price of the underlying asset declines significantly, the seller may be forced to purchase the asset at a higher price than its current market value, resulting in a loss.

- Market Risk: Selling puts exposes traders to market risk, including fluctuations in the price of the underlying asset. If the price of the underlying asset falls below the strike price, the seller may incur losses, especially if the decline is significant.

- Assignment Risk: Assignment risk refers to the possibility of being assigned the underlying asset when selling puts. While assignment can occur at any time before expiration, it is more likely when the option is in-the-money (i.e., the current market price is below the strike price). Traders should be prepared to fulfill their obligation to buy the underlying asset if assigned.

- Opportunity Cost: By selling puts, traders tie up capital that could be deployed elsewhere in potentially more lucrative investment opportunities. It’s essential to consider the opportunity cost of tying up capital in the form of margin requirements when engaging in the selling puts strategy.

Final Thoughts

The selling puts strategy can be a valuable tool for investors seeking to generate income, manage risk, and potentially acquire stocks at a discount. By understanding the mechanics, benefits, risks, and practices associated with selling puts, traders can effectively incorporate this strategy into their investment arsenal. However, it’s essential to approach options trading with caution, conduct thorough research, and adhere to sound risk management principles to navigate the complexities of the financial markets successfully. With proper planning and execution, selling puts can be a rewarding strategy for traders looking to enhance their investment returns and achieve their financial goals.

Share on Social Media: