Scalping is a day trading strategy employed in financial markets, where traders aim to make small profits by entering and exiting trades rapidly. It involves taking advantage of short-term price movements, often relying on high-frequency trading and leveraging small price differentials. Unlike other trading methods that focus on long-term trends, scalpers seek to capitalize on immediate market inefficiencies. In this article you will find out scalping strategies, risks, rewards, and the tools and techniques utilized by scalpers in various financial markets.

The Strategy Behind Scalping

At the core of scalping lies the principle of capturing small price movements over a short period. Scalpers often trade on highly liquid instruments such as currencies, stocks, futures contracts, and cryptocurrencies, as these markets offer frequent price fluctuations and narrow bid-ask spreads conducive to rapid trading.

One of the key strategies employed by scalpers is to identify short-term momentum or volatility in the market. They utilize technical analysis tools such as moving averages, Bollinger Bands, and stochastic oscillators to pinpoint entry and exit points for their trades. By analyzing price action, volume, and market depth, scalpers attempt to forecast short-term price movements and exploit them for profit.

Another critical aspect of scalping is risk management. Since scalpers hold positions for a brief duration, they aim to minimize exposure to market risk. This often involves setting tight stop-loss orders to limit potential losses and adhering to strict risk-reward ratios. Scalpers typically target small gains per trade while maintaining a high win rate to offset transaction costs and generate consistent profits over time.

Rewards of Scalping

When executed correctly, scalping can offer several rewards for traders, including:

- Quick Profits: Scalping enables traders to capitalize on small price movements and generate profits within minutes or even seconds. By leveraging high-frequency trading and tight risk management, scalpers can accumulate gains rapidly throughout the trading session.

- High Win Rate: Scalping strategies typically aim for a high win rate, allowing traders to maintain profitability even with small gains per trade. Consistently identifying profitable opportunities and minimizing losses through effective risk management can contribute to sustained success in scalping.

- Flexibility: Scalping can be adapted to various financial markets and trading styles, offering flexibility for traders with different risk preferences and objectives. Whether trading forex pairs, stocks, or cryptocurrencies, scalpers can tailor their strategies to suit prevailing market conditions and personal preferences.

- No Overnight Risk: Unlike swing or position trading, which involves holding positions overnight, scalping avoids exposure to overnight risk. By closing all positions before the end of the trading day, scalpers avoid potential adverse events or market gaps that may occur outside regular trading hours.

- Enhanced Trading Skills: Scalping requires traders to develop sharp analytical skills, quick reflexes, and effective risk management techniques. Through regular practice and experience, scalpers can hone their trading skills and gain a deeper understanding of market dynamics, contributing to long-term success in trading.

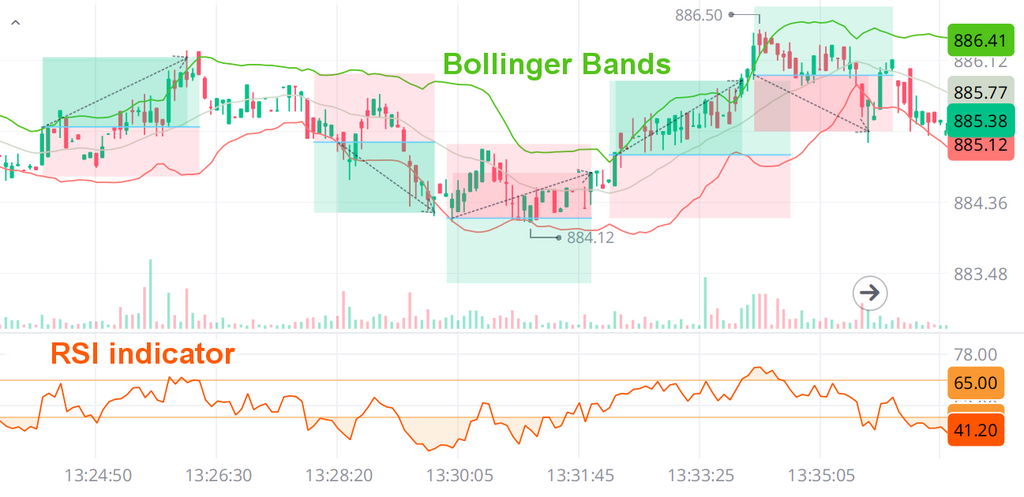

Example of scalpers trades in 5s intervals (NVDA)/WeBull App

Scalping Techniques and Tools

Scalpers employ various techniques and tools to execute their trading strategy effectively. Below are most used techniques and tools.

Direct Market Access (DMA)

Scalpers often use DMA platforms provided by brokers, which allow them to execute trades directly on the exchange without intermediaries. This ensures faster order execution and lower latency, crucial for capitalizing on short-term price movements.

Level II Quotes

Level II quotes provide real-time information on bid and ask prices, along with market depth and order book data. Scalpers rely on this information to identify liquidity levels and detect buying or selling pressure in the market.

Algorithmic Trading

Many scalpers use automated trading algorithms to execute high-frequency trades based on predefined criteria. These algorithms can analyze vast amounts of data and react to market conditions swiftly, enabling scalpers to capitalize on fleeting opportunities.

Scalping Indicators

In scalping, traders often rely on technical indicators that provide quick and precise signals to capitalize on short-term price movements. Some commonly used technical indicators in scalping include:

- Moving Averages (MA): Traders may use short-term moving averages, such as the 5-period or 10-period moving averages (EMA, SMA, WMA, HMA, ALMA, AMA), to identify trends and potential entry or exit points based on crossovers or price interactions with the moving average lines.

- Bollinger Bands: Bollinger Bands consist of a middle line (typically a simple moving average) and upper and lower bands that represent volatility levels. Traders use Bollinger Bands to identify overbought or oversold conditions and potential reversal points.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. Scalpers may use RSI to identify overbought or oversold conditions, signaling potential reversal opportunities.

- Stochastic Oscillator: Similar to the RSI, the Stochastic Oscillator is used to identify overbought or oversold conditions. Traders look for divergence between price and the Stochastic indicator to anticipate trend reversals.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that consists of two lines – the MACD line and the signal line. Traders use MACD crossovers and divergence to identify potential trend changes and entry/exit points.

- Volume Indicators: Scalpers often monitor volume indicators, such as Volume Weighted Average Price (VWAP) or Accumulation/Distribution Line, to gauge the strength of price movements and identify potential reversals or continuation patterns.

- Fibonacci Retracement Levels: Fibonacci retracement levels are used to identify potential support and resistance levels based on the Fibonacci sequence. Scalpers may use these levels to identify entry and exit points or to set stop-loss orders.

Besides technical indicators it is worth to apply price action analysis which involves analyzing raw price movements and patterns without the use of indicators. Scalpers may use candlestick patterns, chart patterns (like triangles or flags), and support/resistance levels to make trading decisions based on price movements alone.

Scalping Strategies

Scalpers employ various strategies, such as trend following, range trading, and breakout trading, depending on market conditions. Trend-following scalpers aim to capitalize on sustained price movements, while range traders profit from price oscillations within a defined range. Breakout scalpers, on the other hand, enter trades when price breaks above or below key support or resistance levels.

Free Backtesting Spreadsheet

Risks Associated with Scalping

While scalping offers the potential for quick profits, it also involves inherent risks that traders must manage effectively. Some of the primary risks associated with scalping include:

- Market Volatility: Scalping thrives on short-term price movements, making traders vulnerable to sudden spikes or fluctuations in volatility. Unexpected news events, economic data releases, or geopolitical developments can cause rapid price changes, leading to unexpected losses for scalpers.

- Execution Risk: Scalping relies on fast and accurate order execution, which can be challenging during periods of high market activity or low liquidity. Slippage, delays in order processing, and order rejection can erode profits and increase trading costs for scalpers.

- Transaction Costs: Scalping involves frequent trading activity, resulting in higher transaction costs due to spreads, commissions, and fees. These costs can significantly impact profitability, especially when targeting small price differentials.

- Psychological Pressure: Scalping requires traders to make quick decisions under pressure, which can lead to emotional stress and psychological fatigue. The constant need to monitor markets and execute trades can take a toll on mental well-being, affecting judgment and decision-making abilities.

- Overtrading: The allure of quick profits may tempt scalpers to overtrade, leading to excessive risk-taking and impulsive decision-making. Overtrading can deplete trading capital and increase the likelihood of sustaining substantial losses.

Despite these risks, many traders are drawn to scalping for its potential to generate consistent profits in a short time frame. However, success in scalping requires discipline, patience, and a thorough understanding of market dynamics.

Advanced Risk Management Techniques

Scalping, by its nature, involves rapid trading and exposes traders to various risks. Advanced risk management techniques are crucial for mitigating these risks and preserving capital. Below are presented some advanced risk management techniques tailored for scalping. Implementing these techniques requires discipline, patience, and a deep understanding of market dynamics. By prioritizing capital preservation and effectively managing risk, scalpers can increase their chances of long-term success in the competitive world of scalping.

Dynamic Stop-Loss Placement

Instead of using fixed stop-loss levels, scalpers can employ dynamic stop-loss placement techniques that adjust based on market conditions. This may involve trailing stop-loss orders that move in tandem with price movements, allowing traders to lock in profits while minimizing potential losses.

Volatility-Based Position Sizing

Scalpers can adjust their position sizes based on the volatility of the market. During periods of high volatility, position sizes can be reduced to account for increased price fluctuations and mitigate the risk of significant drawdowns. Conversely, during low volatility periods, position sizes can be increased to capitalize on potentially larger price movements.

Correlation Hedging

Scalpers trading multiple assets simultaneously may utilize correlation hedging to diversify risk and offset potential losses. By identifying correlated assets and opening offsetting positions, scalpers can reduce overall portfolio risk while still capitalizing on short-term trading opportunities.

Risk-Adjusted Returns

Scalpers should focus on achieving risk-adjusted returns rather than solely maximizing profits. This involves assessing the risk-to-reward ratio for each trade and ensuring that potential profits justify the associated risks. By maintaining a favorable risk-to-reward ratio, scalpers can achieve consistent profitability over the long term.

Adaptive Position Management

Scalpers may employ adaptive position management techniques that respond to changing market conditions. This could include scaling into positions gradually as the trade moves in their favor or scaling out of positions to lock in profits while minimizing exposure to potential reversals.

Challenges and Criticisms

The debates surround the benefits of scalping for the market. On one side, proponents argue that scalping can bolster market liquidity by increasing trading activity. The frequent buying and selling of assets by scalpers can facilitate smoother price discovery and tighter bid-ask spreads, which ultimately benefits all market participants. Additionally, the rapid pace of scalping can enhance price efficiency by swiftly incorporating new information into asset prices.

However, on the other side, critics raise several concerns about scalping. One of the primary apprehensions is its potential to disrupt market stability. Critics contend that high-frequency scalping activities may exacerbate market volatility, especially during periods of heightened uncertainty or thin trading volumes. The rapid-fire nature of scalping can amplify price fluctuations, leading to erratic market movements that pose challenges for investors and regulators alike.

Furthermore, there are apprehensions regarding the fairness and integrity of markets due to the dominance of high-frequency traders engaged in scalping. These traders often possess sophisticated technology and substantial financial resources, which enable them to gain a competitive edge over traditional market participants. This technological arms race can create an uneven playing field, disadvantaging retail investors and smaller institutions.

Ethical Considerations

Scalping also raises ethical questions regarding its impact on market integrity and investor trust. The pursuit of short-term profits through rapid trading may prioritize self-interest over the long-term health of financial markets. Critics argue that excessive focus on scalping profits can lead to market manipulation, as traders seek to exploit inefficiencies and distort price signals for their gain.

Furthermore, the prevalence of scalping activities can contribute to market fragmentation, where liquidity is dispersed across multiple trading venues. This fragmentation complicates price discovery and increases the risk of market fragmentation, potentially undermining market efficiency and investor confidence.

Regulatory Responses

In response to concerns surrounding scalping and high-frequency trading, regulators have implemented various measures to enhance market oversight and mitigate risks. These measures include the introduction of circuit breakers, trading halts, and enhanced surveillance systems to detect and deter manipulative practices.

Additionally, regulators have sought to improve transparency in financial markets by requiring greater disclosure of trading activities and imposing restrictions on certain types of high-frequency trading strategies. For instance, some jurisdictions have implemented minimum resting time requirements for orders to prevent excessive order cancellations and promote market stability.

However, regulating scalping presents challenges due to its complex nature and rapid evolution. Regulators must strike a balance between fostering market innovation and safeguarding against systemic risks and investor harm. Furthermore, the global nature of financial markets necessitates coordination among regulatory authorities to address cross-border issues effectively.

Impact on Market Participants

The prevalence of scalping has implications for various market participants, including retail investors, institutional traders, and market makers. Retail investors may face challenges competing with high-frequency traders engaged in scalping, as they lack the advanced technology and resources to execute trades rapidly.

Institutional traders may adapt their strategies to accommodate the presence of scalpers, employing algorithms and execution tactics to minimize the impact of short-term price fluctuations on their portfolios. Market makers, who play a crucial role in providing liquidity, must navigate the evolving landscape of high-frequency trading and adjust their market-making strategies accordingly.

Furthermore, the rise of scalping has prompted exchanges and trading platforms to invest in infrastructure upgrades and technology enhancements to support the growing demand for low-latency trading and high-frequency data feeds.

Final Thoughts

Scalping is a trading strategy that offers the potential for quick profits by capitalizing on short-term price movements in financial markets. While it involves inherent risks, including market volatility, execution risk, and psychological pressure, scalping can be rewarding for traders with the right skills and discipline.

By employing advanced tools and techniques, managing risks effectively, and maintaining a high level of discipline, scalpers can generate consistent profits and thrive in dynamic market environments. However, it’s essential for traders to recognize the challenges associated with scalping and invest time and effort in mastering this demanding yet rewarding trading strategy.

Ultimately, success in scalping requires a combination of technical expertise, risk management skills, and psychological resilience. With dedication and perseverance, traders can unlock the full potential of scalping and achieve their financial goals in the competitive world of trading.

Share on Social Media:

FAQ

What is scalping in trading?

Scalping is a trading strategy that involves making numerous small trades within a short period, aiming to profit from small price movements. Scalpers typically hold positions for a very short duration, often seconds to minutes, and capitalize on rapid fluctuations in asset prices.

Is scalping trading legal?

Scalping itself is not inherently illegal. However, the legality of scalping can vary depending on jurisdiction and compliance with relevant financial regulations. Traders engaging in scalping must ensure they adhere to regulatory guidelines and avoid practices that may be considered market manipulation or abusive trading.

Is scalping good for beginners?

Scalping can be challenging for beginners due to its fast-paced nature and the need for quick decision-making. It requires a high level of skill, discipline, and emotional control to execute effectively. Beginners may benefit from starting with longer-term trading strategies to gain experience and develop a solid understanding of market dynamics before attempting scalping.

Can you get rich from scalping?

While scalping can yield profits, getting wealthy solely from scalping is challenging. Success requires skill, discipline, and adaptation to market changes. Consistency in profitability demands continuous learning and risk management. Approach scalping with realistic expectations and understand that it necessitates dedication and perseverance.