Description

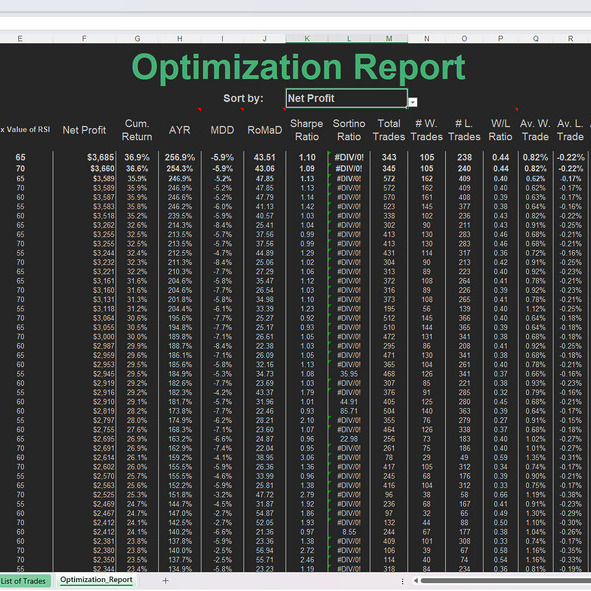

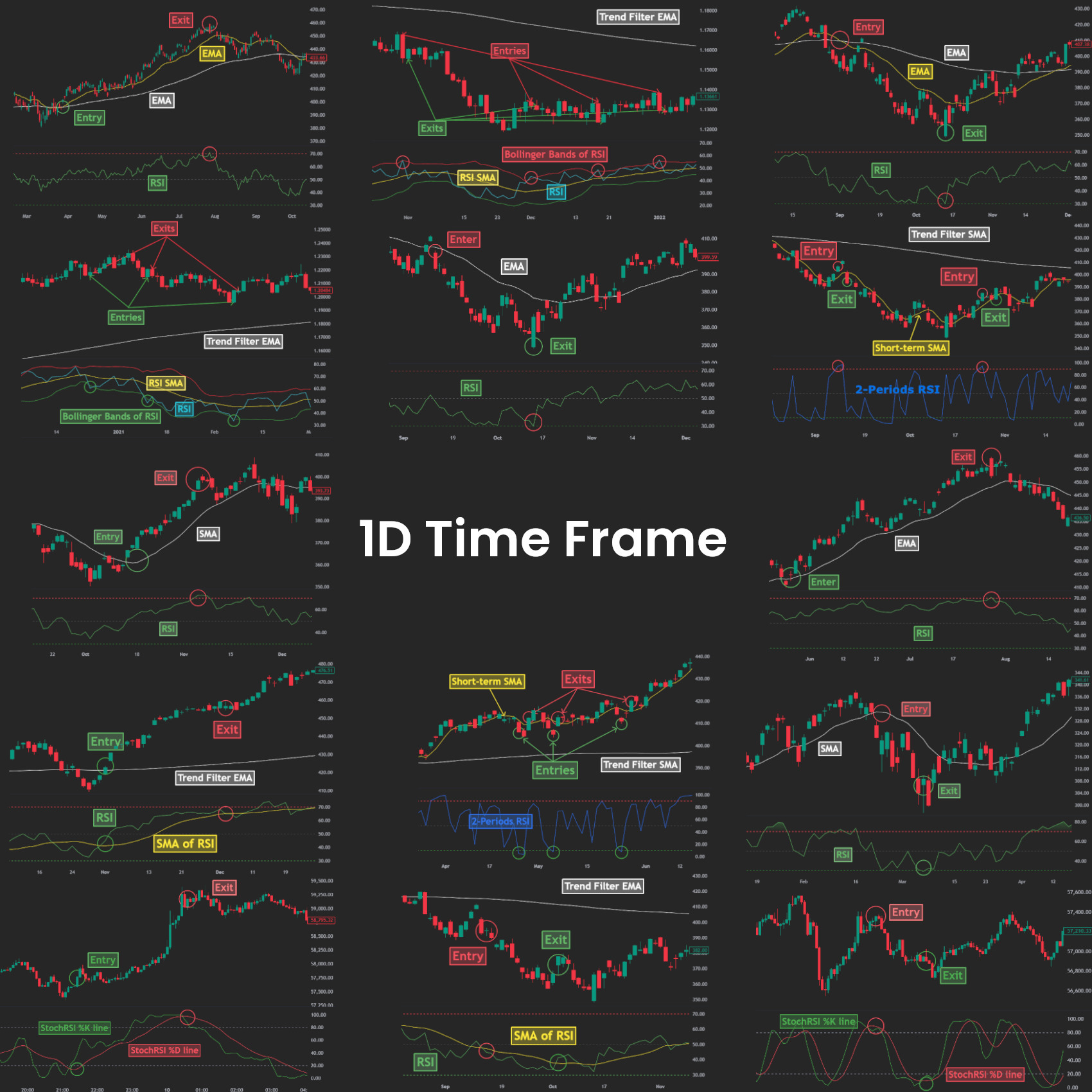

The RSI Daily Pro Pack offers a complete set of prebuilt spreadsheets (see content table below) focused solely on backtesting with the 1D (daily) timeframes. It provides a variety of trading strategies designed to cover different market conditions, entry/exit rules, and stop loss options. With built-in automated optimization, the pack evaluates thousands of indicator parameters combinations to ensure optimal strategy performance. No programming skills are required — just basic Excel knowledge. The pack delivers detailed performance metrics, such as Average Yearly Return (AYR), Maximum Drawdown, Sharpe Ratio and 15 more metrics enabling traders to make well-informed decisions based on robust analysis.

For more details, see the tutorial video below.

See Tutorial

Content

Requirements

- PC or Laptop: Microsoft Excel offers all necessary features exclusively on PC or Mac versions.

- Operating System: Windows 11 or Windows 10 for PC, or Mac OS for Mac.

- Memory: A minimum of 4GB RAM is required, but for optimal performance, 8GB or more is recommended.

- Processor: A modern processor is advised for smoother operation.

- Microsoft Excel: Version 2021 or newer is required. Microsoft 365 is an excellent choice for optimal compatibility and regular updates.

- Historical Price Data: OHLC (Open, High, Low, Close) data is required. Volume data is not necessary since the current spreadsheets do not include volume-based indicators.

Delivery Options

All products on TraderArchive are digital and will be delivered electronically. Upon successful payment, you will receive a download link via email to access your purchase immediately. No physical product will be shipped.

Important: Please ensure the email address you provide is correct. If you do not receive the download link within 24 hours of purchase, please check your spam or junk folder before contacting us for assistance.

Refund Policy

Due to the digital nature of our products, all sales are final. Once the files have been downloaded, we cannot offer a refund, exchange, or cancellation.

If you experience any issues with the product, such as file corruption or download errors, please contact our support team within 14 days of purchase. We are happy to assist you in resolving any technical issues to ensure your product works as intended.

Reviews

There are no reviews yet.