That’s why paper trading is sometimes called forward testing. It lets you try out your approach in real-time market conditions.

Let’s dive into five compelling reasons why paper trading is a smart next step after backtesting. Plus, we’ll cover some free virtual trading platforms to help you get started.

- What is Paper Trading

- Free Paper Trading Websites

- Reason #1. Test for Unaccounted Parameters in Backtesting

- Reason #2. Paper Trading Helps to Account for Broker-Specific Factors

- Reason #3. Test Automated Execution and Workflow

- Reason #4. Build Discipline Through Consistent Record-Keeping

- Reason #5. Understand Your Emotional Reactions to Trading

- How Long to Paper Trade Before Going Live?

- FAQ

What is Paper Trading

Paper trading is a way to test your strategy using simulated trades with virtual funds instead of real money. It’s like a practice run, where you place trades, track performance, and see how your strategy reacts in live market conditions without risking any cash.

You can do this through simulated trading tools provided by brokers or on platforms that support simulated trading.

While it doesn’t fully capture the emotional side of trading with real money, it lets you explore how your setup would perform right now. This can you spot any issues that might not show up in backtesting.

Free Paper Trading Websites

Paper Trading in TradingView

TradingView is one of the most popular charting platforms out there, and for good reason. It’s packed with features, from customizable charts to a wide variety of indicators. Moreover, it even lets you create automated strategy bots with Pine Script.

This scripting feature is a standout because it allows you to automate trading setups and test them in real-time. TradingView offers a paper trading account where you can practice using all these tools without any financial risk.

Plus, TradingView often runs paper trading competitions with cash prizes, so you might even make some money while trading virtually!

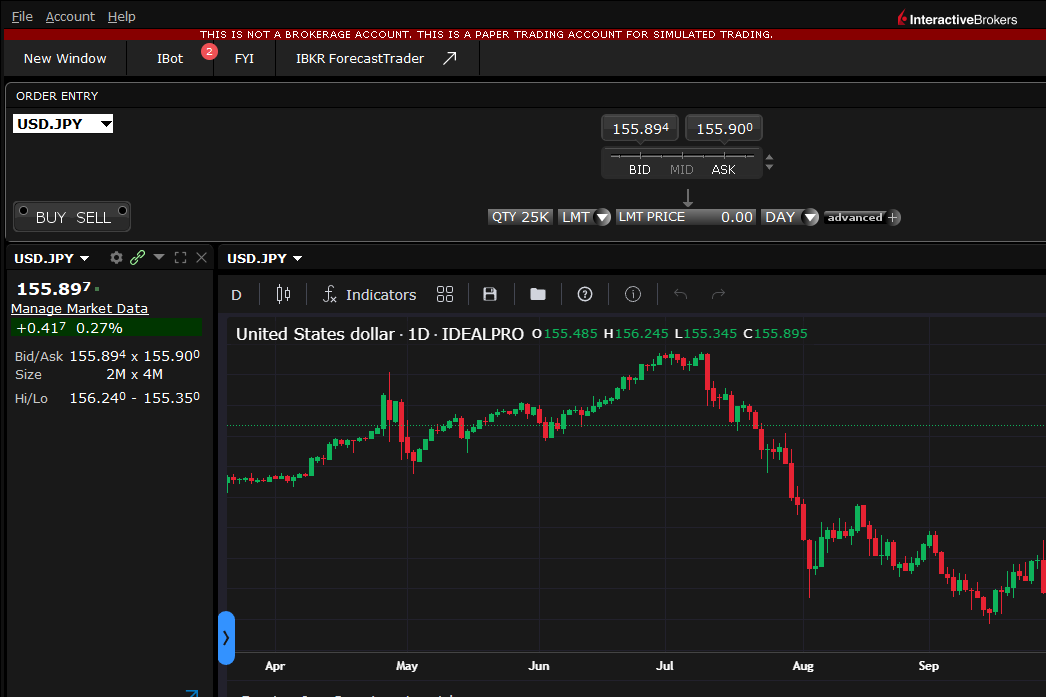

Interactive Brokers Paper Trading Account

To use paper trading with Interactive Brokers, you’ll need an actual account with them. But if you’re serious about trading, this can be a big plus. Why? It allows you to test not only your strategies but also their platform and services.

And you’re not limited to Interactive Brokers; other brokers like Fidelity, Charles Schwab, Webull, and Robinhood also offer paper trading accounts.

When using a broker’s simulated trading account, think of it not just as practice but as a way to evaluate the broker’s overall service quality, including their fees, execution speed, and customer support.

Automated Paper Trading Websites

If you’re into a systematic approach and don’t want to watch the screen constantly, automation might be your thing.

A popular method for this is using webhooks. TradingView or other platforms can send a webhook to different services that connect to your broker and handle trading automatically. Here is a list of such websites:

These websites all offer paper trading accounts, so you can try out different automation features and find the setup that best fits your needs, all without using real money.

Reason #1. Test for Unaccounted Parameters in Backtesting

While backtesting, you might overlook certain details that affect a strategy’s performance in practice.

Paper trading gives you a controlled space to observe and test these often-overlooked elements. It can be slight delays in order execution, changes in market depth, partial fills, or other unaccounted parameters. While simulated trading doesn’t fully replicate live trading conditions, it allows you to get closer to understanding how these factors might influence results.

Additionally, virtual trading lets you assess how the strategy responds to shifting conditions, without being bound to a historical dataset. For example, you can observe how it reacts in periods of higher volatility or unusual trading volume.

This phase offers valuable feedback, giving you a chance to fine-tune your approach and improve your strategy’s preparedness for live trading.

Reason #2. Paper Trading Helps to Account for Broker-Specific Factors

Each broker is different, and things like fee structures, data feeds, or routing can make a big difference.

While backtesting tools let you input broker fees and slippage, it’s tough to replicate the true structure. With paper trading, you get a hands-on feel for your broker’s specifics, including real commission costs based on trade size.

If you’re planning to go live with a certain broker, use their simulated trading tool. This will help you gauge the actual costs, real spreads, and speed.

For example, if your broker charges a tiered commission based on trade volume, trading different amounts in simulated mode gives a much clearer picture than simply guessing during backtests.

Free Backtesting Spreadsheet

Reason #3. Test Automated Execution and Workflow

If you plan to automate trading, paper trading is where you can safely spot errors. Automation sounds great in theory, but in practice, it involves many moving parts.

One popular automation method involves using webhooks. TradingView or similar platforms can send a webhook to services (like Capitalize.ai, SignalStack, TradersPost and others) which can connect to your broker and automate the trading process.

Since this setup involves linking several services, connectivity issues can arise and should be tested thoroughly. Try different combinations of platforms and tools and find the best fit for your needs and the most reliable setup.

By running these setups in simulated environment, you can detect if alerts are delayed, if orders aren’t executing correctly, or if there’s any lag impacting trade timing.

These are crucial issues to iron out before letting your system operate in a live market. Simulated trading lets you refine this complex automation process, ensuring smooth execution when real money is on the line.

Reason #4. Build Discipline Through Consistent Record-Keeping

Many traders skip record-keeping in paper trading, seeing it as “just practice.” But if you treat it seriously and log every trade, every metric, and every note, it builds discipline. You’re not only tracking the results but also forming habits that carry over to live trading.

Consistent logging shows you’re ready for real trading. If you can stay disciplined in a simulated environment, it’s a good sign. But if you’re sloppy here — skipping trades or forgetting notes — it’s a red flag. Simulated trading gives you a risk-free environment to build these good habits.

Reason #5. Understand Your Emotional Reactions to Trading

There’s no true substitute for the psychological impact of real money on the line. Nevertheless, paper trading is a low-stakes way to see how trading might affect you mentally. Do you feel anxious about an open position? Do you want to abandon the strategy if a trade goes against you?

If you notice emotional patterns like impatience, fear, or overconfidence in simulated trading, it’s a wake-up call. Real trading can amplify these feelings. That is why handling them in a simulated setup prepares you for the bigger emotional challenges of live trading.

How Long to Paper Trade Before Going Live?

Don’t stay in simulated mode for too long. Ten to twenty trades should be enough to catch any obvious issues.

Treat this as a first trial phase — its purpose is just to test the waters. It’s generally better to start live trading sooner, using a small portion of your intended account. This way, you get to experience real trading conditions, such as actual slippage and market impact, with minimal risk.

Live Testing With Tiny Amounts

Live testing with tiny amounts is often more useful than extended simulated trading because it’s the real deal, just on a smaller scale. To truly understand your strategy’s viability, aim to extend these live tests over a longer period, like a year.

Gradually increase your portfolio exposure as you gain confidence in it. If your goal is to trade this strategy for the long term — say, a decade or more — starting with a portion of your portfolio and avoiding leverage for the first year or two is no big deal.

This approach allows time for new insights and gives you room to refine how you evaluate the strategy. By easing into it, you’re less likely to form an emotional attachment. It lets you focus on uncovering and understanding the strategy’s true edge.

Final Thoughts

Paper trading is the real first step toward going live. While backtesting is great for initial insights, trading in simulated mode lets you see how your strategy actually handles itself in the market.

By using this phase to spot problems, make adjustments, and build confidence, you’re setting yourself up for a much smoother transition to real trading.

Think of simulated trading as a tool you can keep using whenever you want to test new ideas, helping you trade smarter and more effectively as you go.

Share on Social Media:

FAQ

Can You Make Money Paper Trading?

Not directly, since paper trading uses virtual funds, so there’s no real profit or loss. However, some platforms, like TradingView, regularly hold simulated trading competitions where traders can win prizes based on their performance.

Can I Do Paper Trading For Free?

Most major trading platforms and brokers offer free paper trading accounts, so you can start practicing and refining your strategy without spending anything.

What Is The Difference Between Physical Trading and Paper Trading?

Physical (or live) trading involves using real money in actual market conditions, meaning you experience both gains and losses directly. Paper trading, on the other hand, is a simulated environment using virtual funds, so there’s no financial risk.

Is Paper Trading Good For Beginners?

Paper trading is a great way for beginners to learn the ropes, get comfortable with trading tools, and develop basic skills before risking real money.

Leave a Reply