In the vast landscape of financial markets, one area that often captures the attention of traders and investors alike is the futures market. Often associated with high risk and high reward, futures trading plays a crucial role in the global economy, providing participants with opportunities to hedge risk, speculate on price movements, and gain exposure to various asset classes. In this comprehensive guide, we will delve into the intricacies of the futures market, exploring its mechanics, participants, strategies, and significance.

What are Futures?

Futures are derivatives or financial contracts that obligate the buyer to purchase (in the case of a long position) or the seller to sell (in the case of a short position) a specific asset at a predetermined price on a specified future date. These assets can include commodities (such as oil, gold, or wheat), financial instruments (like stocks or bonds), or even intangible assets (such as stock market indices or interest rates).

Mechanics of Futures Trading

Futures contracts are standardized agreements traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). Standardization ensures that each contract has uniform terms regarding the quantity, quality, delivery date, and settlement procedures, facilitating liquidity and price discovery.

Upon entering a futures contract, both the buyer (long position) and the seller (short position) are required to post an initial margin, which serves as collateral and ensures performance of the contract. Throughout the duration of the contract, variation margin may be exchanged between the parties to account for changes in the contract’s value.

Let’s illustrate a futures trade with a hypothetical example involving a commodity futures contract.

Example of Futures Trading

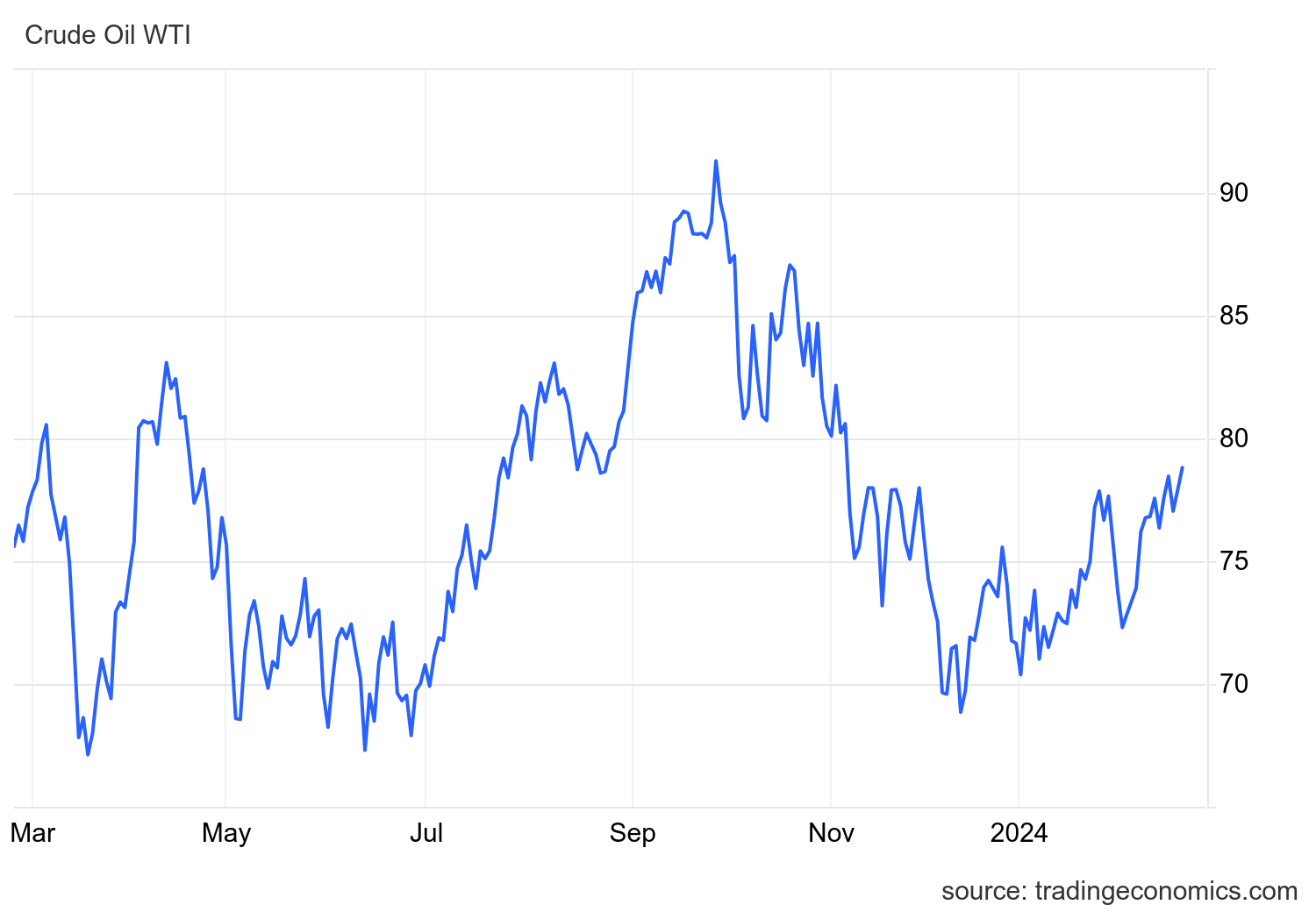

Scenario: Trading Crude Oil Futures

Background: John, a seasoned trader with expertise in commodities, believes that the price of crude oil is poised to increase in the coming months due to geopolitical tensions in oil-producing regions and growing global demand. He decides to capitalize on this outlook by entering a long position in crude oil futures.

Market Analysis: John conducts thorough research on factors influencing the crude oil market, including supply-demand dynamics, geopolitical events, inventory levels, and macroeconomic indicators. Based on his analysis, he concludes that the current market conditions favor a bullish trend in crude oil prices.

Trade Execution:

- Contract Selection: John selects a standard futures contract for West Texas Intermediate (WTI) crude oil, traded on the New York Mercantile Exchange (NYMEX). The contract represents the delivery of 1,000 barrels of crude oil with a specified delivery month.

- Order Placement: John places a buy order for one crude oil futures contract at the prevailing market price, which is $60 per barrel. Since each contract represents 1,000 barrels, the total contract value is $60,000.

- Margin Requirements: Upon entering the trade, John is required to post an initial margin, typically a fraction of the total contract value, as collateral. Let’s assume the initial margin for crude oil futures is 5% of the contract value, amounting to $3,000.

- Trade Confirmation: Once the order is executed, John receives a trade confirmation from his brokerage, detailing the contract specifications, entry price, margin requirements, and any associated fees.

Monitoring and Management:

- Market Dynamics: John closely monitors developments in the crude oil market, including geopolitical tensions, production disruptions, inventory reports, and changes in global economic conditions. He adjusts his trading strategy based on evolving market fundamentals and technical indicators.

- Risk Management: To mitigate potential losses, John sets stop-loss orders to automatically exit the trade if the price moves against his position beyond a predefined threshold. He also considers implementing profit targets to lock in gains as the price appreciates.

- Margin Maintenance: Throughout the duration of the trade, John maintains sufficient margin in his trading account to cover potential losses and margin calls. He monitors margin requirements regularly and adds additional funds if necessary to avoid margin deficits.

Trade Outcome:

- Profit Scenario: If the price of crude oil rises as anticipated, John stands to profit from his long futures position. For example, if the price increases to $70 per barrel by the contract’s expiration date, John’s profit would be $10 per barrel, or $10,000 for the entire contract.

- Loss Scenario: Conversely, if the price of crude oil declines below John’s entry price, he may incur losses on his futures position. However, his losses are limited to the initial margin posted, provided he manages the trade effectively and avoids margin deficits.

This example illustrates a simplified futures trade in the context of trading crude oil futures. Like any trading activity, futures trading involves inherent risks and requires careful analysis, disciplined execution, and effective risk management. By leveraging market insights, employing appropriate trading strategies, and managing risk prudently, traders can seek to capitalize on price movements in the futures market and achieve their financial objectives.

Free Backtesting Spreadsheet

Participants in the Futures Market

The futures market attracts a diverse array of participants, each with distinct objectives and strategies:

- Hedgers: These are typically producers or consumers of the underlying asset seeking to mitigate the risk of adverse price movements. For example, an oil producer may use futures contracts to lock in a favorable price for their future production, while a cereal manufacturer may hedge against rising wheat prices.

- Speculators: Speculators aim to profit from price fluctuations in the futures market without any intention of taking delivery of the underlying asset. They provide liquidity to the market and can amplify price movements through their trading activities.

- Arbitrageurs: Arbitrageurs exploit price differentials between related assets or markets to generate risk-free profits. They play a vital role in ensuring price efficiency and market integration by quickly capitalizing on mispricings.

Key Strategies in Futures Trading

When engaging in futures trading, participants have a plethora of strategies at their disposal to navigate the market’s complexities and capitalize on various opportunities. Let’s delve deeper into some of the key strategies commonly employed by traders:

Long and Short Futures Positions

Traders take a long position by buying a futures contract, anticipating that the price of the underlying asset will increase. If the price rises above the contract’s initial purchase price, the trader can sell the contract at a profit before its expiration date. Conversely, traders take a short position by selling a futures contract, speculating that the price of the underlying asset will decrease. If the price declines below the contract’s initial selling price, the trader can buy back the contract at a lower price, pocketing the price difference.

Spread Futures Trading

Calendar Spreads: Also known as time or horizontal spreads, calendar spreads involve simultaneously buying and selling futures contracts with different delivery months of the same underlying asset. Traders capitalize on price differentials between near-term and distant contracts, aiming to profit from changes in the spread over time.

Inter-commodity Spreads: Inter-commodity spreads involve trading futures contracts of related but different commodities, such as gold and silver or crude oil and natural gas. Traders exploit price relationships between these commodities, leveraging their understanding of supply-demand dynamics and market interrelationships.

Options on Futures

Call options, the same like stock options, give the holder the right, but not the obligation, to buy a futures contract at a predetermined price (strike price) before the option’s expiration date. Traders purchase call options to speculate on rising prices or hedge against potential upside risk. Put options give the holder the right, but not the obligation, to sell a futures contract at a predetermined price (strike price) before the option’s expiration date. Traders buy put options to speculate on falling prices or hedge against potential downside risk.

Option traders can also implement various spread and combination strategies using multiple call and put options simultaneously. These strategies, such as straddles, strangles, and butterflies, allow traders to profit from anticipated changes in volatility, regardless of the direction of price movement.

Trend Following

Moving Averages: Trend followers use moving averages, such as the simple moving average (SMA) or exponential moving average (EMA), to identify trends and potential entry or exit points. When the current price crosses above the moving average, it may signal a bullish trend, while a cross below the moving average may indicate a bearish trend.

Momentum Indicators: Momentum indicators, such as the relative strength index (RSI) or stochastic oscillator, help traders identify overbought or oversold conditions in the market. By entering positions in alignment with momentum signals, traders aim to capitalize on the continuation of existing trends.

Breakout Strategies: Breakout traders seek to profit from significant price movements that occur when the price breaks out of a predefined range or chart pattern, such as triangles, flags, or channels. Breakout strategies often involve placing buy or sell orders above or below key support or resistance levels.

These strategies represent a subset of the diverse approaches employed by traders in the futures market. Successful trading requires a deep understanding of market dynamics, disciplined risk management, and the ability to adapt to changing market conditions. By carefully selecting and implementing appropriate strategies, traders can enhance their chances of achieving their financial objectives while navigating the complexities of the futures market.

Significance of the Futures Market

The futures market serves several vital functions within the global financial system:

- Price Discovery: Futures prices reflect the collective expectations and sentiments of market participants, providing valuable information about the future direction of asset prices. This price discovery mechanism aids producers, consumers, and investors in making informed decisions.

- Risk Management: By offering a means to hedge against price fluctuations, futures contracts enable businesses to manage various types of risk, including commodity price risk, interest rate risk, and currency risk. This risk mitigation fosters stability and resilience in the economy.

- Liquidity and Efficiency: The futures market enhances market liquidity by providing a centralized venue for trading standardized contracts. This liquidity, coupled with the presence of arbitrageurs and speculators, promotes price efficiency and reduces transaction costs.

- Global Integration: Futures markets facilitate cross-border trade and investment by providing mechanisms for hedging currency risk and accessing international markets. This fosters economic interconnectedness and globalization.

Risks and Considerations

Despite its potential benefits, futures trading entails inherent risks that participants must carefully manage:

- Price Volatility: Futures markets can be highly volatile, subject to abrupt price movements driven by various factors such as geopolitical events, economic indicators, and supply-demand dynamics.

- Leverage: Trading futures involves the use of leverage, amplifying both potential gains and losses. While leverage can enhance returns, it also increases the risk of substantial losses, particularly if positions are not managed prudently.

- Counterparty Risk: Although futures exchanges act as intermediaries and guarantee the performance of contracts, there is still a risk of default by counterparties, especially in over-the-counter (OTC) derivatives markets.

- Regulatory and Operational Risks: Participants must adhere to regulatory requirements and maintain robust risk management practices to ensure compliance and safeguard against operational disruptions.

Final Thoughts

The futures market occupies a prominent position in the global financial landscape, offering participants a platform to manage risk, speculate on price movements, and facilitate price discovery. With its diverse array of participants, standardized contracts, and sophisticated trading strategies, the futures market plays a crucial role in fostering liquidity, efficiency, and stability in the broader economy. However, participants must remain vigilant and employ prudent risk management practices to navigate the inherent complexities and uncertainties of futures trading effectively.

Share on Social Media: