Exchange-traded funds (ETFs) have emerged as a popular investment vehicle, offering a blend of features from both stocks and mutual funds. Understanding their intricacies and functionalities can equip investors with a valuable tool for navigating the financial landscape. This article delves into the world of ETFs, exploring their fundamentals, benefits, drawbacks, and various investment strategies.

What are ETFs?

An ETF is a type of investment fund that tracks a basket of underlying assets, such as stocks, bonds, commodities, or a combination thereof. These assets are held by the fund, and ownership is divided into shares that investors can buy and sell on stock exchanges throughout the trading day, like individual stocks.

Unlike mutual funds, which only trade once at the end of the day, ETFs offer intraday trading flexibility, allowing investors to react to market movements and adjust their positions as needed. This characteristic makes them suitable for investors seeking more active portfolio management.

The value of an ETF’s shares is based on the net asset value (NAV) of its underlying assets. Authorized Participants (APs) help maintain the ETF’s price close to its NAV by engaging in arbitrage. If the ETF’s market price deviates from its NAV, APs can create or redeem shares to bring them back in line.

How to Buy ETFs

Buying ETFs is like buying individual stocks. Investors can purchase shares of an ETF through a brokerage account. They can place orders to buy or sell ETF shares during market hours. It’s essential to research the ETF’s objectives, holdings, and performance before investing.

Investors have the option to buy ETF shares through a variety of order types, including market orders, limit orders, and stop orders. Market orders execute at the prevailing market price, while limit orders allow investors to specify a maximum purchase price. Stop orders trigger a purchase when the ETF’s price reaches a certain level.

Image by Statista

Popularity of ETFs

ETFs have witnessed explosive growth in popularity over the past few decades. According to data from the Investment Company Institute (ICI), global ETF assets surpassed $7 trillion in 2021. This exponential growth can be attributed to several factors:

Diversification: ETFs offer investors exposure to a diversified portfolio of assets within a single investment, reducing individual security risk.

Low Costs: ETFs typically have lower expense ratios compared to mutual funds, making them an attractive option for cost-conscious investors.

Liquidity: ETFs trade on major stock exchanges, providing investors with liquidity and flexibility to buy or sell shares throughout the trading day.

Transparency: Most ETFs disclose their holdings daily, allowing investors to monitor the fund’s portfolio and performance.

Free Backtesting Spreadsheet

Types of ETFs

The market of ETFs encompasses a wide range of investment strategies and asset classes, catering to diverse investor preferences and objectives. Here is the major types of ETFs:

Stock ETFs

Stock ETFs, also known as equity ETFs, invest primarily in stocks or equity securities, providing investors with exposure to broad market indices, specific sectors, or individual countries or regions. Stock ETFs offer investors a convenient way to gain diversified exposure to the equity markets without the need to pick individual stocks or actively manage a portfolio.

- Broad Market Indices: These ETFs track broad market indices such as the S&P 500, Dow Jones Industrial Average, or Russell 2000, providing investors with exposure to large-cap, mid-cap, or small-cap stocks across various sectors of the economy. Example: SPDR S&P 500 ETF (SPY)

- Sector-Specific ETFs: Sector ETFs focus on specific sectors or industries of the economy, such as technology, healthcare, financials, or consumer discretionary. These ETFs allow investors to overweight or underweight sectors based on their views on sector-specific trends, opportunities, or risks. Example: Technology Select Sector SPDR Fund (XLK)

- International ETFs: International ETFs provide investors with exposure to foreign markets, allowing them to diversify their portfolios geographically and capitalize on growth opportunities in international economies. These ETFs may track broad international indices or focus on specific regions or countries, such as emerging markets or developed markets outside the United States. Example: Vanguard FTSE Developed Markets ETF (VEA)

Bond ETFs

Bond ETFs invest in a diversified portfolio of fixed-income securities, including government bonds, corporate bonds, municipal bonds, and high-yield bonds. Bond ETFs offer investors exposure to the bond market with the liquidity and transparency of exchange-traded securities, making them an attractive option for investors seeking fixed income and portfolio diversification.

- Government Bond ETFs: These ETFs invest in government-issued bonds, including U.S. Treasury bonds, agency bonds, and government-sponsored enterprise bonds. Government bond ETFs are considered relatively low-risk investments, as they are backed by the full faith and credit of the issuing government. Example: iShares 20+ Year Treasury Bond ETF (TLT)

- Corporate Bond ETFs: Corporate bond ETFs invest in bonds issued by corporations, including investment-grade and high-yield corporate bonds. These ETFs offer investors exposure to the corporate bond market, allowing them to diversify their fixed-income holdings and potentially earn higher yields compared to government bonds. Example: iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- Municipal Bond ETFs: Municipal bond ETFs invest in bonds issued by state and local governments to finance public infrastructure projects, such as schools, roads, and utilities. Municipal bond ETFs offer tax advantages to investors, as interest income from municipal bonds is generally exempt from federal income taxes and may be exempt from state and local taxes for investors residing in the issuing state. Example: Vanguard Tax-Exempt Bond ETF (VTEB)

Commodity ETFs

Commodity ETFs track the prices of physical commodities, such as precious metals, energy products, agricultural products, and industrial metals. Commodity ETFs offer investors exposure to the commodity markets without the need to invest directly in physical commodities or futures contracts, providing liquidity, transparency, and ease of access to commodity investments.

- Precious Metals ETFs: Precious metals ETFs invest in physical precious metals, such as gold, silver, platinum, and palladium. These ETFs allow investors to gain exposure to precious metals as a store of value, inflation hedge, or portfolio diversifier, without the logistical challenges of owning physical bullion. Example: SPDR Gold Shares (GLD)

- Energy ETFs: Energy ETFs invest in energy-related commodities, such as crude oil, natural gas, gasoline, and heating oil. These ETFs offer investors exposure to the energy sector, allowing them to capitalize on trends in global energy markets, geopolitical developments, and supply-demand dynamics. Example: Energy Select Sector SPDR Fund (XLE)

- Agricultural ETFs: Agricultural ETFs invest in agricultural commodities, such as corn, wheat, soybeans, sugar, and coffee. These ETFs provide investors with exposure to the agricultural sector, allowing them to diversify their portfolios and potentially profit from trends in global food consumption, weather patterns, and crop yields. Example: Invesco DB Agriculture Fund (DBA)

Inverse ETFs

Inverse ETFs, also known as short ETFs or bear ETFs, seek to deliver the opposite return of an underlying index or asset class, providing investors with a hedge against declining markets or the ability to profit from downside movements. Inverse ETFs use derivatives, such as futures contracts or options, to achieve inverse exposure to the underlying index or asset class, making them suitable for investors seeking to hedge against market downturns or implement contrarian strategies.

- Inverse Equity ETFs: These ETFs aim to deliver the inverse return of a specific stock market index, such as the S&P 500 or Nasdaq-100. Inverse equity ETFs are designed for investors seeking to hedge against market declines or profit from bearish market trends, allowing them to offset losses in their equity portfolios during market downturns. Example: ProShares Short S&P 500 (SH)

- Inverse Bond ETFs: These ETFs seek to deliver the inverse return of a specific bond index or fixed-income asset class, such as U.S. Treasuries or investment-grade corporate bonds. Inverse bond ETFs are designed for investors seeking to hedge against rising interest rates or credit spreads, allowing them to profit from declines in bond prices or increases in bond yields. Example: ProShares UltraShort 20+ Year Treasury (TBT)

- Inverse Commodity ETFs: These ETFs aim to deliver the inverse return of a specific commodity index or commodity futures contract, such as crude oil, natural gas, or gold. Inverse commodity ETFs are designed for investors seeking to hedge against declines in commodity prices or profit from bearish trends in commodity markets, allowing them to offset losses in their commodity portfolios during periods of falling prices. Example: ProShares Short Gold (DGZ)

Leveraged and Inversed ETFs by Direxion

Leveraged ETFs

Leveraged ETFs seek to amplify the returns, both positive and negative, of an underlying index or asset class, using financial derivatives, such as futures contracts or swaps, to achieve leveraged exposure to the underlying index or asset class. Leveraged ETFs are designed for sophisticated investors with a high risk tolerance and short-term investment horizon, as they can magnify both gains and losses compared to traditional ETFs.

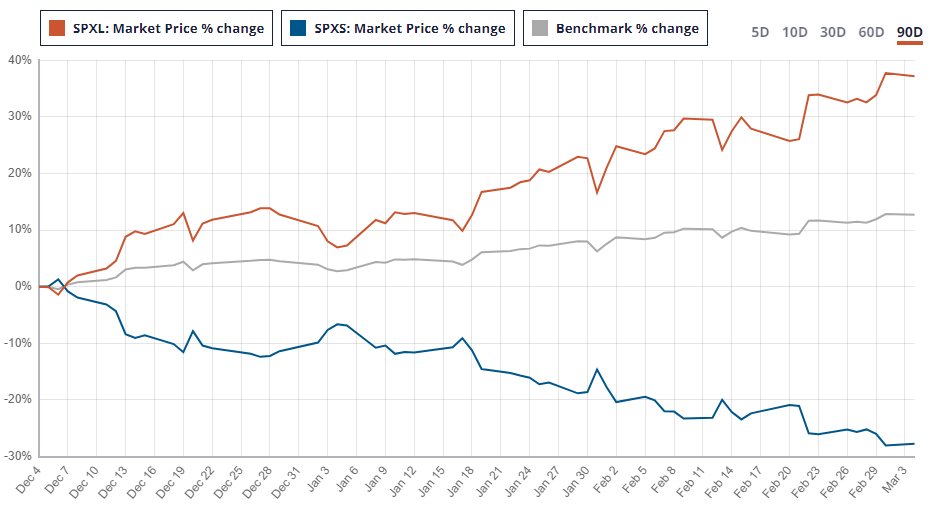

- 3x Leveraged ETFs: These ETFs seek to deliver three times the daily return of an underlying index or asset class, providing triple the exposure to market movements compared to traditional ETFs. 3x leveraged ETFs are designed for aggressive traders and speculators who want to amplify their potential returns but should be used cautiously due to their significant risk and potential for losses. Example: Direxion Daily S&P 500 Bull 3X Shares (SPXL)

- Inverse Leveraged ETFs: These ETFs aim to deliver leveraged inverse exposure to an underlying index or asset class, providing double or triple the inverse return of the underlying index. Inverse leveraged ETFs are designed for sophisticated investors seeking to hedge against declines in the market or profit from bearish trends, but they carry heightened risk and volatility compared to traditional ETFs. Example: Direxion Daily S&P 500 Bear 3X Shares ETF (SPXS)

Bitcoin ETFs

Bitcoin ETFs, which began trading in early 2024, are a new type of investment vehicle that directly invests in Bitcoin, the world’s first and largest cryptocurrency by market capitalization. They offer investors a convenient way to gain exposure to Bitcoin’s price movements without the need to set up a cryptocurrency wallet or exchange account. Example: iShares Bitcoin Trust (IBIT)

Integration of ETFs into Investment Portfolios

When incorporating ETFs into an investment portfolio, investors should consider their investment objectives, risk tolerance, time horizon, and asset allocation preferences. Here are some strategies for integrating ETFs into a diversified portfolio:

Core-Satellite Approach

In core-satellite approach, investors use a core portfolio of low-cost, broad-based ETFs to provide foundational exposure to major asset classes such as stocks and bonds. Satellite ETFs can then be added to the portfolio to provide targeted exposure to specific sectors, themes, or investment strategies.

Asset Allocation

ETFs can be used to implement strategic asset allocation strategies based on an investor’s risk profile and investment horizon. By allocating assets across different asset classes such as equities, fixed income, and commodities, investors can build a well-diversified portfolio that balances risk and return potential.

Tactical Allocation

ETFs can be used for tactical asset allocation, where investors adjust their portfolio allocations in response to changing market conditions or economic trends. By overweighting or underweighting specific sectors, regions, or asset classes, investors can capitalize on short-term opportunities and manage risk effectively.

Risk Management

ETFs can be used for risk management purposes, such as hedging against downside risk or reducing portfolio volatility. Investors can use inverse ETFs or defensive sectors ETFs to mitigate the impact of market downturns or unexpected events on their investment portfolios.

Income Generation

Fixed-income ETFs can be used to generate regular income in a portfolio through dividends or interest payments. By selecting high-quality bond ETFs with attractive yields and manageable credit risk, investors can enhance the income-generating potential of their investment portfolios.

Difference in performance (2006-2024) of Gold ETF and Gold/TradingView

Disadvantages of ETFs: Considerations for Investors

While ETFs offer numerous benefits, they also come with certain drawbacks that investors should consider:

- Tracking Error: Despite their best efforts, ETFs may experience tracking error, which refers to the discrepancy between the performance of the ETF and its underlying index. Factors such as transaction costs, management fees, and portfolio rebalancing can contribute to tracking error over time.

- Concentration Risk: Some ETFs may have concentrated exposure to specific sectors, industries, or regions, which can increase the risk of losses if those segments underperform or face adverse market conditions.

- Market Complexity: With thousands of ETFs available in the market, selecting the right ETFs for a diversified portfolio can be a daunting task for investors. Conducting thorough research and understanding the underlying assets, investment objectives, and risks of each ETF is essential for making informed investment decisions.

- High Expense Ratio: While many ETFs boast low expense ratios, some, particularly actively managed ETFs, or those targeting niche markets, may have higher expense ratios compared to other index funds or even investing directly in individual stocks. These fees can eat into your returns over time, so it’s crucial to compare expense ratios before investing in any ETF.

- Potential for Leveraged and Inverse ETFs: Leveraged and inverse ETFs use financial derivatives to amplify the returns or provide inverse exposure to an underlying index or asset. While these ETFs can be useful for short-term trading or hedging purposes, they are not suitable for long-term investors due to their complex nature and higher risk profile.

Final Thoughts

Exchange-Traded Funds (ETFs) have revolutionized the way investors access and manage their investment portfolios, offering unparalleled convenience, diversification, and flexibility. By understanding the structure, mechanics, advantages, and disadvantages of ETFs, investors can make informed decisions about incorporating these versatile investment vehicles into their portfolios. Whether used as core building blocks or tactical tools, ETFs can play a valuable role in helping investors achieve their financial goals and navigate the complexities of today’s global financial markets.

Share on Social Media: