Investing

Investing involves purchasing assets with the expectation of generating long-term returns, typically through capital appreciation, dividends, or interest payments. It focuses on building wealth over time by holding assets for an extended period, often years or decades.

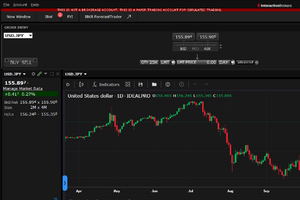

If compare to trading, investing emphasizes long-term wealth accumulation through a buy-and-hold approach, while trading focuses on short-term profit generation by actively buying and selling assets based on market fluctuations. Both approaches have their merits and risks, and individuals should choose the one that aligns with their financial goals, risk tolerance, and time horizon.

-

What are Derivatives. The 4 Most Used Types

Explore derivatives and their top types with examples. Understand their mechanics, risks, and applications for managing risk, speculation, and diversification.

-

Equity-Linked Notes (ELNs): Definition and Examples

Equity-Linked Notes are hybrid investments blending fixed-income features with equity exposure, offering potential returns based on underlying asset performance

-

Yield curve. Forecasting Recesions

Explore the dynamics of yield curve and its impact on economic forecasts, investment strategies, and market sentiment. Inverse yield curve and recessions

-

A Deep Dive into Commodity Investing

Master the commodity market: Discover how to invest in energy, metals, agriculture & more! Discover risks, rewards & how to choose the right strategy for you.

-

Buying Gold as an Alternative Investment

Diving Deep into the Multifaceted Appeal: A Comprehensive Guide to Buying Gold as an Alternative Investment in Today’s Financial Landscape.

-

ETFs vs. Stocks: 9 Key Differences and What to Choose

ETFs vs Stocks: Understand the key differences & choose the right investment for you. Explore diversification, risk, management styles & more!

-

What are ETFs: Definition & Investment Guide

A Comprehensive Guide to Exchange-Traded Funds explains the ins and outs of ETFs, offering clarity on their benefits, drawbacks, and various types.

-

The Stock Market: Basics and Secrets

Discover the stock market secrets—from basics to advanced strategies. Explore investor psychology and global finance for financial success

-

12 Alternative Investments You Should Know

Dive into diverse alternative investments: real estate, cryptocurrencies, commodities, P2P lending, hedge funds, and more for robust portfolio diversification.

-

Bonds: An In-Depth Guide to Fixed-Income Securities

Discover the world of bonds – essential instruments in investment portfolios, encompassing government securities, corporate debt, and more.