Backtesting

Backtesting refers to the process of testing a trading strategy using historical data to evaluate its performance before applying it in live trading. By simulating trades based on past price movements, traders can gain insights into how a strategy would have performed, identify potential flaws, and make necessary adjustments. Effective backtesting involves careful selection of data, proper handling of biases, and the use of performance metrics to ensure reliable results. It allows traders to refine strategies, manage risks, and improve their decision-making before committing real capital.

-

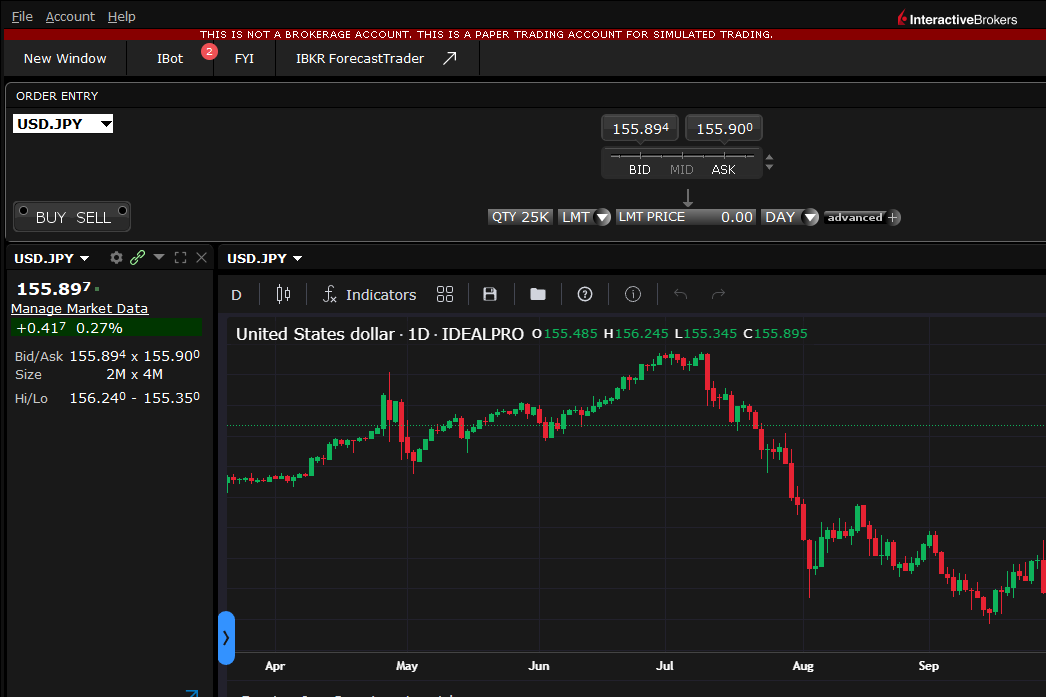

5 Strong Reasons to Use Paper Trading After Backtesting

5 compelling reasons why paper trading is a smart next step after backtesting. Plus, we’ll cover some free paper trading websites to help you get started.

-

Maximum Drawdown in Backtesting: Formula of Your Losses Limit

What drawdown limits famous traders have. How to Prepare Yourself for a Deep Drawdown. Learn how to calculate maximum drawdown and drawdown duration in Excel.

-

The Sharpe Ratio in Backtesting: What Value is Good?

Explore how Sharpe ratio helps assess risk-adjusted returns in backtesting trading strategies. What Sharpe ratio is good? 1, 2, 3 or even 0.5? Let`s find out!

-

Historical Price Data for Backtesting: Sources, Quality, Preparation

Explore various sources of historical price data, ohlc data — both free and paid. Tips on evaluating its quality. Real example of preparation and cleaning.

-

7 Steps to Backtesting Trading Strategies: A Complete Guide

This guide will walk you through the entire backtesting process, from defining your trading strategy to optimization analysis and validating your results.