Within the intricate web of finance, bonds emerge as foundational pillars of investment, offering stability and opportunity in equal measure. They weave a vital thread in the fabric of global economics, beckoning investors, financial experts, and curious minds alike to unravel their complexities. In this expansive exploration, we embark on a journey into the realm of bonds, deciphering their nuances, classifications, valuation metrics, risks, and their profound impact within the broader financial ecosystem.

What are Bonds?

Bonds, often referred to as fixed-income securities, are debt instruments issued by governments, municipalities, corporations, and other entities to raise capital. When an entity issues a bond, it essentially borrows money from investors, promising to repay the principal amount along with periodic interest payments over a specified period. Bonds are typically issued with a predetermined face value, coupon rate, maturity date, and payment frequency.

When an entity issues a bond, it essentially borrows money from investors, promising to repay the principal amount along with periodic interest payments over a specified period.

The Bonds Market

The bonds market consists of both primary and secondary markets. In the primary market, bonds are issued and sold to investors through public offerings or private placements. In the secondary market, previously issued bonds are bought and sold among investors on stock exchanges or over-the-counter (OTC) platforms. While some bonds are highly liquid and actively traded, others may have limited liquidity, depending on factors such as issuer, maturity, and market demand. The bonds market is enormous and diverse, with a wide range of bond instruments available to investors. These include government bonds, corporate bonds, municipal bonds, agency bonds, mortgage-backed securities (MBS), and asset-backed securities (ABS), among others. Each type of bond has unique characteristics, risk profiles, and investment objectives, catering to different investor preferences and needs.

Types of Bonds

Bonds, with their array of options spanning government-backed securities to corporate debt, offer a spectrum of opportunities tailored to varied risk appetites and investment objectives. From the steadfast security of government bonds to the dynamic potential of corporate debt, each type of bonds presents unique characteristics, risks, and rewards.

Government Bonds

- Treasury Bonds: Issued by governments to finance public spending, these bonds are considered one of the safest investments due to the backing of the issuing government. Treasury bonds typically have longer maturities, ranging from 10 to 30 years, and pay semiannual interest to bondholders.

- Treasury Notes: Like Treasury bonds but with shorter maturities, typically ranging from 2 to 10 years. Treasury notes offer investors a balance between safety and yield, making them popular choices for income-oriented investors.

- Treasury Bills (T-Bills): Short-term debt securities issued by governments with maturities ranging from a few days to one year. T-bills are sold at a discount to face value and do not pay periodic interest; instead, investors earn a return by purchasing them at a discount and receiving the full face value at maturity.

Municipal Bonds

- General Obligation Bonds: Issued by municipalities to finance public projects such as schools, roads, and utilities, general obligation bonds are backed by the full faith and credit of the issuing municipality. These bonds offer tax-exempt income to investors and are considered relatively safe investments.

- Revenue Bonds: Backed by the revenue generated from specific projects or facilities, such as toll roads, airports, or water treatment plants, revenue bonds do not carry the full faith and credit pledge of the issuing municipality. The creditworthiness of revenue bonds depends on the success of the underlying project or facility.

- Municipal Bond Funds: Mutual funds or exchange-traded funds (ETFs) that invest in a diversified portfolio of municipal bonds, offering investors exposure to a broad range of municipal issuers and maturities.

Free Backtesting Spreadsheet

Corporate Bonds

- Investment-Grade Bonds: These bonds are issued by financially robust corporations boasting strong credit ratings, typically falling within the upper tiers of creditworthiness such as AAA, AA, A, or BBB ratings. Such esteemed credit ratings signify a lower risk of default and translate into lower interest rates compared to lower-rated bonds. Investment-grade bonds are often issued by well-established companies with stable cash flows, solid balance sheets, and a history of reliable debt repayment. Investors seeking stability and preservation of capital gravitate towards these bonds, drawn by their perceived safety and predictable income streams.

- High-Yield Bonds (Junk Bonds): In stark contrast, high-yield bonds, colloquially known as “junk bonds,” hail from companies with lower credit ratings or higher perceived risk profiles. These bonds typically carry ratings below investment grade, falling into the BB, B, or even lower categories. The designation as “junk” reflects the heightened risk of default associated with these issuers. To entice investors to shoulder this risk, high-yield bonds offer substantially higher yields than their investment-grade counterparts. While the allure of enhanced returns may be tantalizing, investors must tread cautiously, as high-yield bonds are more susceptible to economic downturns, corporate distress, and market volatility. Despite their elevated risk profile, high-yield bonds can appeal to investors seeking to bolster portfolio returns, provided they are willing to accept heightened credit risk and market fluctuations.

- Corporate Bond ETFs: For investors seeking exposure to corporate bonds without the complexities of individual bond selection, corporate bond exchange-traded funds (ETFs) present a compelling option. These investment vehicles pool investors’ funds to create diversified portfolios of bonds, spanning various issuers, sectors, and credit qualities. Corporate bond ETFs offer the benefits of liquidity, diversification, and professional management, making them accessible and convenient vehicles for gaining exposure to the corporate bond market. Investors can choose from a range of ETFs tailored to their risk tolerance, investment objectives, and desired credit exposure, allowing for flexibility and customization within their investment portfolios.

Bond ETFs pool investors’ funds to create diversified portfolios of bonds, spanning various issuers, sectors, and credit qualities.

International Bonds

- Sovereign Bonds: Issued by foreign governments, sovereign bonds are denominated in the currency of the issuing country and are subject to currency risk and geopolitical factors. These bonds may offer higher yields compared to domestic bonds but also carry higher risks.

- Foreign Corporate Bonds: Issued by international corporations, foreign corporate bonds provide investors with exposure to foreign markets and currencies. These bonds may offer diversification benefits but also expose investors to currency risk and geopolitical uncertainties.

Other Types of Bonds

- Convertible Bonds: Bonds that can be converted into a predetermined number of shares of the issuer’s common stock at the bondholder’s discretion. Convertible bonds offer investors the potential for capital appreciation while providing downside protection through the fixed-income component.

- Callable Bonds: Bonds that can be redeemed by the issuer before the maturity date, typically at a predetermined call price. Callable bonds may offer higher yields to compensate investors for the risk of early redemption but can result in reinvestment risk if interest rates decline after the bond is called.

- Zero-Coupon Bonds: Similarly to Treasury bills zero-coupon bonds do not pay periodic interest but are sold at a deep discount to face value, with the return realized through the appreciation of the bond’s value to par at maturity. The primary distinction lies in their issuers: Treasury bills are issued by governments, while zero-coupon bonds can be issued by governments, corporations, or municipalities and for longer term. Zero-coupon bonds are highly sensitive to changes in interest rates and are often used for long-term savings goals such as retirement planning.

- Agency Bonds: Agency bonds are debt securities issued by government-sponsored enterprises (GSEs) or federal agencies, such as Fannie Mae, Freddie Mac, or the Federal Home Loan Banks. These bonds carry the implicit or explicit backing of the U.S. government, which enhances their credit quality and reduces the risk of default. Agency bonds are commonly used to finance specific sectors such as housing, agriculture, or education.

- Mortgage-Backed Securities (MBS): Mortgage-backed securities (MBS) are bonds that represent ownership interests in a pool of residential mortgage loans. You may heard about it from the movie “The Big Short” (2015) depicting 2008 crisis causes. These loans are typically originated by financial institutions such as banks, mortgage lenders, or government agencies. MBS are structured and sold to investors as securities, with cash flows derived from the principal and interest payments made by homeowners on their mortgage loans. MBS are categorized into different types based on the underlying mortgages, such as agency MBS, non-agency MBS, and commercial MBS.

- Asset-Backed Securities (ABS): Asset-backed securities (ABS) are bonds backed by a pool of underlying assets, such as auto loans, credit card receivables, student loans, or corporate debt. These assets serve as collateral for the securities and provide cash flows to investors based on the performance of the underlying assets. ABS are structured and sold in various tranches, each with different risk profiles and credit ratings.

Characteristics of Bonds

Face Value: The principal amount of the bond, which is repaid to the bondholder at maturity.

Coupon Rate: The annual interest rate paid by the issuer to the bondholder, expressed as a percentage of the face value.

Maturity Date: The date on which the issuer repays the principal amount to the bondholder.

Yield to Maturity (YTM): The total return anticipated on a bond if held until maturity, considering its current market price, coupon payments, and time to maturity.

Valuation of Bonds

Bond valuation involves determining the present value of the bond’s future cash flows, including coupon payments and the principal repayment at maturity. The two primary methods of bond valuation are:

- Discounted Cash Flow (DCF) Analysis: This method discounts the bond’s future cash flows at a specified discount rate to calculate its present value.

- Yield Curve Analysis: This method compares the bond’s yield to maturity with prevailing interest rates to assess its relative value.

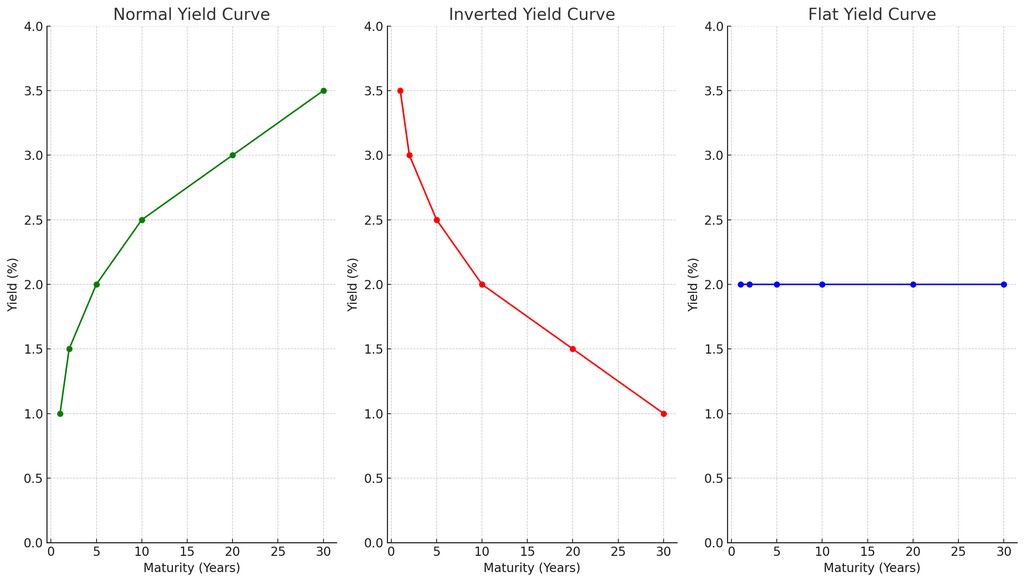

Yield Curve

A yield curve is a graphical representation of the relationship between the yields (interest rates) and maturities of bonds of the same credit quality but different maturities. It provides insights into market expectations regarding future interest rates and economic conditions. The shape of the yield curve can vary, with common patterns including:

- Normal Yield Curve: In a normal yield curve, long-term bonds have higher yields compared to short-term bonds. This indicates that investors expect higher interest rates in the future, reflecting optimism about economic growth.

- Inverted Yield Curve: An inverted yield curve occurs when short-term bonds have higher yields compared to long-term bonds. This phenomenon is often interpreted as a signal of an impending economic recession, as investors anticipate lower interest rates in the future.

- Flat Yield Curve: A flat yield curve occurs when there is little difference between short-term and long-term bond yields. This suggests uncertainty about future interest rates and economic conditions.

The yield curve serves as a tool for understanding bond market sentiment and expectations and forecasting future interest rates and economic conditions. By analyzing the yield curve, investors and policymakers can make informed decisions regarding bond investments, monetary policy, and economic strategies.

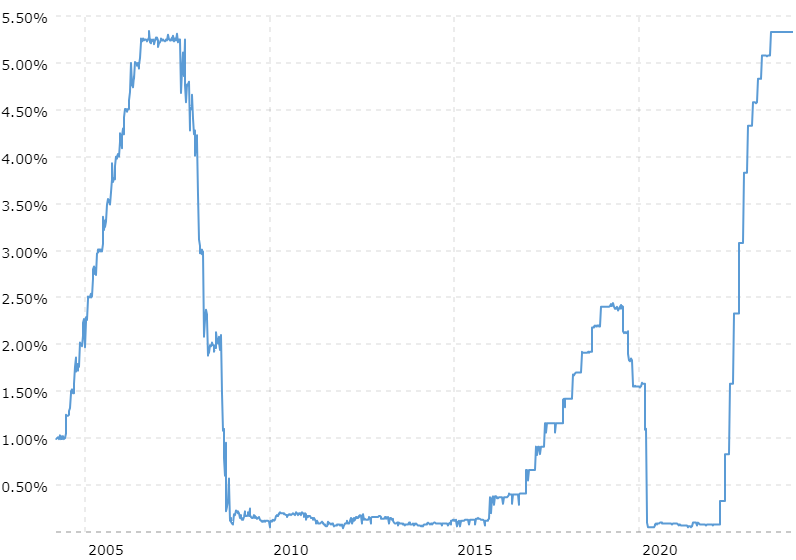

Interaction of Bonds and Interest Rates

Changes in interest rates can significantly impact bond prices and overall portfolio performance. Bonds and interest rates generally have an inverse relationship. When interest rates rise, bond prices typically fall, and vice versa. This inverse relationship is due to the fixed coupon payments provided by bonds. When interest rates rise, newly issued bonds offer higher coupon payments, making existing bonds with lower coupon payments less attractive, leading to a decrease in their prices.

US Interest Rates. Source: macrotrends.net

iShares Core U.S. Aggregate Bond ETF. Source: tradingview.com

Bonds Duration Sensitivity

Duration measures the sensitivity of a bond’s price to changes in interest rates. Bonds with longer durations are more sensitive to changes in interest rates than bonds with shorter durations. This means that as interest rates change, the prices of bonds with longer durations will fluctuate more compared to bonds with shorter durations. Understanding the duration of bonds in a portfolio is essential for managing interest rate risk.

IR Impact on Bonds YTM

Yield to maturity is the total return anticipated on a bond if held until maturity, considering its current market price, coupon payments, and time to maturity. As interest rates change, the YTM of bonds also changes. When interest rates rise, the YTM of existing bonds decreases, making them less attractive to investors. Conversely, when interest rates fall, the YTM of existing bonds increases, making them more attractive.

Reinvestment Risk

Reinvestment risk refers to the risk that future coupon payments or principal repayments may need to be reinvested at lower interest rates. This risk is particularly relevant for investors who rely on income from bond investments. When interest rates decline, reinvesting coupon payments or principal repayments at lower rates may result in lower future income.

Opportunities and Challenges

Changes in interest rates present both opportunities and challenges for bond investors. Falling interest rates can lead to capital appreciation for existing bond holdings, while rising interest rates can result in capital losses. Moreover, investors can capitalize on changes in interest rates by adjusting the duration of their bond portfolios or reallocating capital to bonds with different maturities or credit qualities.

Risks Associated with Bonds

Besides the risk associated with fluctuations in interest rates mentioned in the previous chapter there are other risks require your attention.

Credit Risk: The risk of default by the issuer, which can result in the bondholder not receiving scheduled interest payments or the repayment of principal.

Inflation Risk: The risk that inflation will erode the purchasing power of the bond’s future cash flows, reducing the real return to the bondholder.

Liquidity Risk: The risk of being unable to sell a bond quickly at a fair price due to a lack of market participants or trading volume.

Call Risk: The risk that the issuer will redeem a callable bond before maturity, resulting in the bondholder receiving the call price rather than the full principal amount.

Importance of Bonds in the Financial System

Bonds serve several functions in the financial system, including:

- Providing Financing: Bonds allow governments and corporations to raise capital for various purposes, such as infrastructure projects, expansion initiatives, and debt refinancing.

- Portfolio Diversification: Bonds offer diversification benefits to investors by providing a source of stable income and reducing overall portfolio volatility.

- Benchmarking: Bonds serve as benchmarks for interest rates, influencing borrowing costs for governments, corporations, and consumers.

- Risk Management: Bonds enable investors to manage risk through the selection of bonds with different risk profiles, maturities, and credit qualities.

How to Buy Bonds

Nowadays, many online and discount brokers grant access to bond markets, allowing for a purchase process similar to that of stocks. Here, we outline various methods for buying bonds.

Buy Bonds Through Brokerage Firms

Brokerage firms serve as intermediaries between investors and the bond market, offering access to a wide range of bonds, including government, municipal, corporate, and agency bonds. Investors can open brokerage accounts and utilize online trading platforms or seek assistance from brokers to buy bonds. It’s crucial to consider commission fees or markups charged by brokerage firms when executing bond transactions.

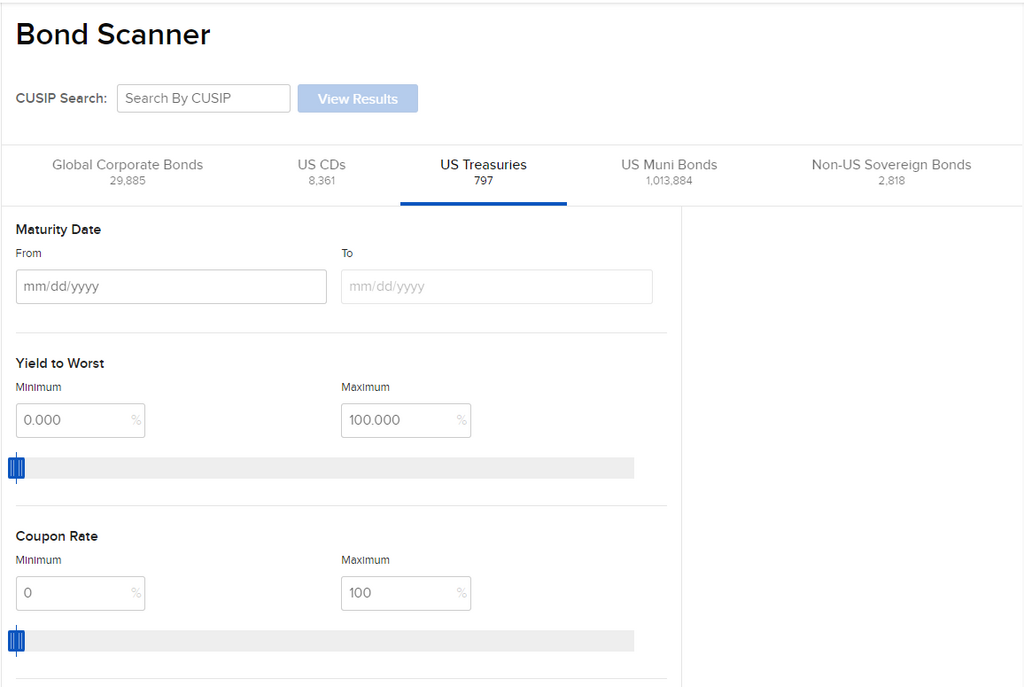

Bond Scanner by Interactive Brokers

Investing in Bonds Online

Dedicated online platforms specialize in bond trading, providing investors with a vast selection of bonds from various issuers. Through these platforms, investors can research different bonds, compare prices, place orders, and manage their bond portfolios online. Online platforms may offer competitive pricing and user-friendly interfaces, enhancing the convenience of buying bonds.

Bond Funds

Bond mutual funds and exchange-traded funds (ETFs) pool investors’ funds to invest in diversified portfolios of bonds. Investors can purchase shares of bond funds through brokerage accounts, retirement accounts, or directly from the fund company. Bond funds offer diversification, professional management, and liquidity, making them suitable for investors seeking exposure to bonds without the need to select individual bonds.

Buy Bond Directly from Issuers

Certain bonds, particularly government and municipal bonds, can be purchased directly from the issuer through auctions or direct purchase programs. For example, U.S. Treasury securities can be bought directly from the U.S. Department of the Treasury through the TreasuryDirect website. Direct purchase programs may offer competitive pricing and minimal fees, although they may have limitations in terms of available bonds and order sizes.

Bond Dealers

Bond dealers, also known as bond brokers or bond traders, facilitate bond transactions between buyers and sellers. Investors can work with bond dealers to buy bonds on the secondary market, where previously issued bonds are traded. Bond dealers offer access to a broad selection of bonds and provide guidance on bond selection and pricing.

Financial Advisors

Financial advisors play a crucial role in assisting investors with bond investments. They can help investors select suitable bonds based on their investment objectives, risk tolerance, and financial situation. Financial advisors provide guidance on creating a bond investment strategy, evaluating bond options, and executing bond transactions. It’s important to clarify the fee structure of financial advisors, as they may charge fees or earn commissions for their services.

Bond Auctions

Some bonds, such as Treasury securities and municipal bonds, are sold through periodic auctions conducted by the issuing authorities. Investors can participate in bond auctions by submitting bids directly to the auction platform or through a broker. Bond auctions enable investors to purchase bonds at the auction-determined yield or price, which may be more favorable than buying bonds on the secondary market.

Before buying bonds, investors should conduct thorough research and consider factors such as the bond’s credit quality, maturity, yield, liquidity, and tax implications. Seeking professional advice and understanding the costs associated with bond transactions are essential steps to make informed decisions when buying bonds.

Strategies for Investing in Bonds

Investing in bonds presents a plethora of strategies, each tailored to cater to specific investor objectives, risk appetites, and prevailing market conditions. These strategies, whether traditional or innovative, offer investors a roadmap to optimize their bond portfolios and navigate the complexities of fixed-income markets.

Buy and Hold Strategy

The buy and hold strategy represents a foundational approach wherein investors acquire bonds with the intention of retaining them until maturity. By holding bonds to maturity, investors ensure a predictable income stream through periodic coupon payments and the eventual repayment of the principal amount. This strategy is particularly appealing to risk-averse investors seeking stable returns and capital preservation, as it mitigates the impact of interest rate fluctuations and market volatility.

Bond Laddering

Bond laddering involves diversifying bond holdings across a spectrum of maturities, creating a staggered portfolio structure reminiscent of a ladder. Investors allocate funds to bonds with varying maturity dates, such as short-term, intermediate-term, and long-term bonds. This strategy effectively mitigates reinvestment risk while ensuring a consistent income stream. By staggering maturities, investors maintain flexibility to capitalize on changes in interest rates and market conditions, optimizing portfolio performance over time.

Sector Rotation

Sector rotation entails adjusting bond allocations based on evolving economic trends and sector-specific outlooks. Investors strategically allocate capital across different bond sectors, including government bonds, corporate bonds, municipal bonds, and international bonds, based on relative attractiveness and prevailing market conditions. This dynamic strategy enables investors to capitalize on sector-specific opportunities while managing risks through diversification. Active monitoring of economic indicators, interest rate trends, and geopolitical events is essential for making informed sector allocation decisions.

Bonds Duration Management

Duration management focuses on adjusting the duration of bond portfolios to manage interest rate risk and capitalize on changes in yield curve dynamics. Duration measures the sensitivity of bond prices to changes in interest rates. Investors employ various strategies, such as barbells, bullets, and barwires, to adjust portfolio duration based on their interest rate outlook. By actively managing duration exposure, investors can hedge against interest rate fluctuations and optimize portfolio returns in different market environments.

Quality-Based Allocation

Quality-based allocation involves allocating capital based on the credit quality ratings of bonds. Investors allocate a larger proportion of their portfolio to investment-grade bonds, characterized by lower default risk and higher credit ratings. Conversely, a smaller portion is allocated to high-yield bonds, which offer higher returns but carry elevated credit risk. This strategy allows investors to balance risk and return objectives by diversifying across different credit qualities, optimizing portfolio risk-adjusted returns.

Tax-Efficient Bond Investing

Tax-efficient bond investing focuses on maximizing after-tax returns by investing in tax-advantaged bonds or utilizing tax-efficient investment accounts. Municipal bonds, offering tax-exempt income at the federal, state, and local levels, are particularly attractive for investors in higher tax brackets. Tax-efficient asset location strategies involve strategically placing tax-inefficient bond investments in tax-deferred accounts and tax-efficient equity investments in taxable accounts, optimizing overall tax efficiency.

Active vs. Passive Bond Investing

Investors face the choice between actively managed bond funds and passive bond index funds. Actively managed bond funds aim to outperform the bond market by selecting individual bonds and adjusting portfolio allocations based on market conditions. In contrast, passive bond index funds replicate the performance of a bond index, such as the Bloomberg U.S. Aggregate Bond Index, by holding a diversified portfolio of bonds in proportion to their weights in the index. The choice between active and passive investing hinges on investor preferences, risk tolerance, and views on market efficiency.

Final Thoughts

In the grand tapestry of finance, bonds stand as enduring symbols of stability and resilience, offering investors a sanctuary amidst the ebb and flow of market tumult. Their significance reverberates through the corridors of economic activity, shaping portfolios, influencing policies, and fostering growth. As investors navigate the ever-changing landscape of financial markets, the wisdom gleaned from understanding bonds serves as a beacon, guiding them towards informed decisions and prosperous outcomes.

Share on Social Media: