Arbitrage represents a financial practice where traders exploit price discrepancies in various markets to secure risk-free profits. The concept, deeply rooted in the efficient market hypothesis, suggests that assets’ prices reflect all available information. However, in reality, markets are not always perfectly efficient, leaving room for arbitrageurs to capitalize on temporary price discrepancies. In this article we will uncover 7 widely used arbitrage strategies and explain the opportunities and limitations associated with arbitrage.

Definition of Arbitrage

At its core, arbitrage trading involves simultaneous buying and selling of assets or securities in different markets to profit from price differentials. Arbitrage opportunities also arise when related assets are mispriced relative to each other. These disparities can occur due to factors such as inefficiencies, market frictions, information asymmetries, or behavioral biases. In such cases arbitrageurs swiftly execute trades to capitalize on the price differentials before the market corrects itself. Arbitrage strategies often intersect with algorithmic trading due to the need for rapid execution and sophisticated analysis of market data. Successful arbitrage hinges on minimizing or eliminating risks associated with market movements, transaction costs, counterparty risks, and regulatory constraints.

Arbitrage Strategies

Arbitrage manifests in various forms across financial markets, each offering distinct opportunities and challenges.

#1. Inter-Exchange Arbitrage

Inter-exchange arbitrage entails exploiting price differences of the same asset across different exchanges. With the advent of electronic trading and globalization, opportunities for inter-exchange arbitrage have increased significantly. Arbitrageurs can buy an asset on one exchange where it’s priced lower and simultaneously sell it on another exchange where it commands a higher price, profiting from the price differential. This type of arbitrage trading relies heavily on fast execution and efficient order routing systems to capitalize on fleeting pricing disparities between exchanges.

Free Backtesting Spreadsheet

#2. Temporal Arbitrage

Temporal arbitrage focuses on exploiting price differences of an asset over time. This could involve trading futures contracts against underlying assets or capitalizing on divergences between spot and forward prices. Arbitrageurs seek to profit from discrepancies between current prices and future expectations, leveraging derivatives markets and interest rate differentials to capture risk-free returns over time.

#3. Statistical Arbitrage

Statistical arbitrage trading utilizes quantitative models and statistical analysis to identify mispricings among correlated securities. Arbitrageurs leverage sophisticated algorithms to exploit short-term deviations from expected price relationships, such as pairs trading or relative value strategies. This strategy relies on historical data analysis and advanced mathematical techniques to identify patterns and anomalies in market behavior, enabling traders to profit from inefficiencies before they are corrected by the broader market.

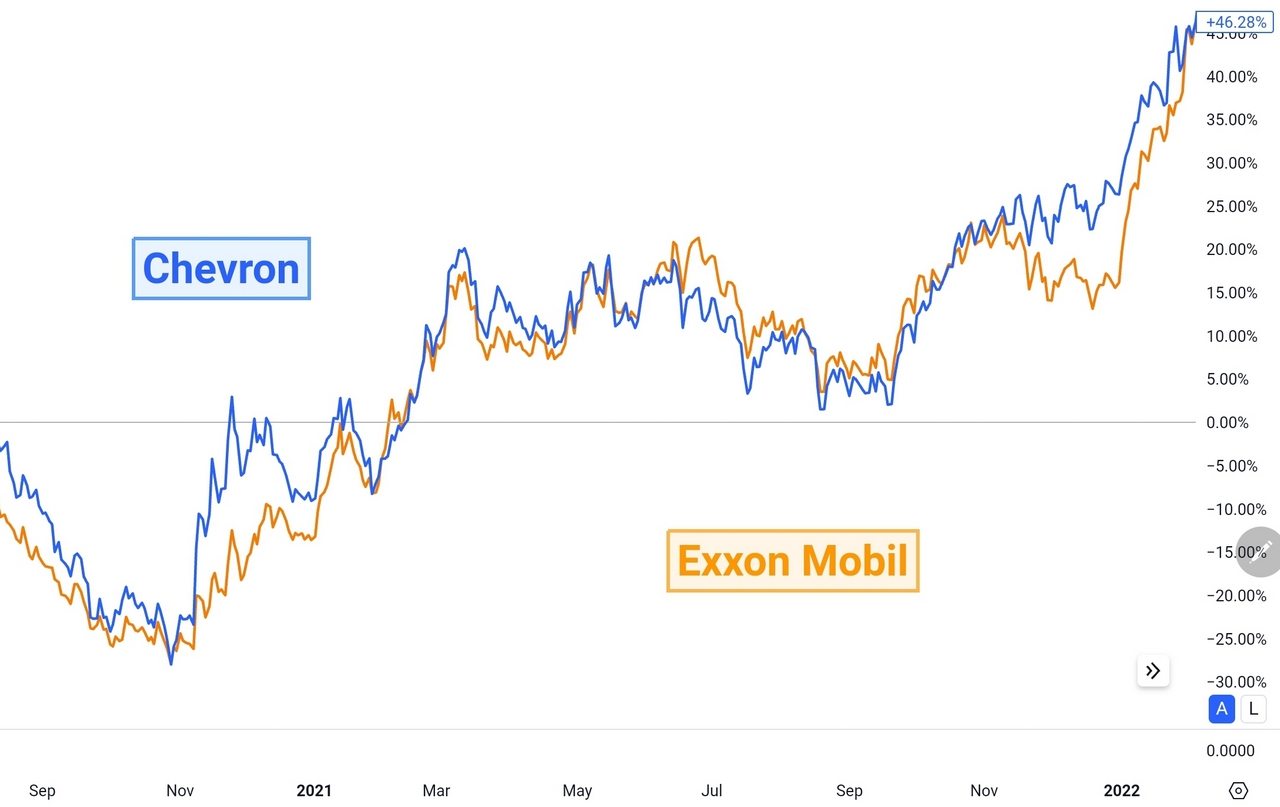

Chevron and Exxon Mobile stocks have strong correlation in their price movements that can be applied in statistical arbitrage/TradingView

Example of Statistical Arbitrage

Suppose an arbitrageur identifies two stocks, Company X and Company Y, that historically exhibit a strong correlation in their price movements. However, due to temporary market factors, Company X experiences a sudden price increase, while Company Y’s price remains relatively unchanged.

The arbitrageur employs quantitative models to analyze historical price data and identify deviations from the normal relationship between Company X and Company Y. Based on this analysis, the arbitrageur derives trading signals indicating that Company X is overvalued relative to Company Y. Often sophisticated trading algorithms are employed to execute statistical arbitrage trades rapidly and efficiently. These algorithms automatically place buy orders for Company Y and sell orders for Company X to capitalize on the pricing discrepancy. Once the price relationship between Company X and Company Y begins to revert to its historical norm, the arbitrageur closes out the positions, realizing profits from the price convergence.

#4. Triangular Arbitrage

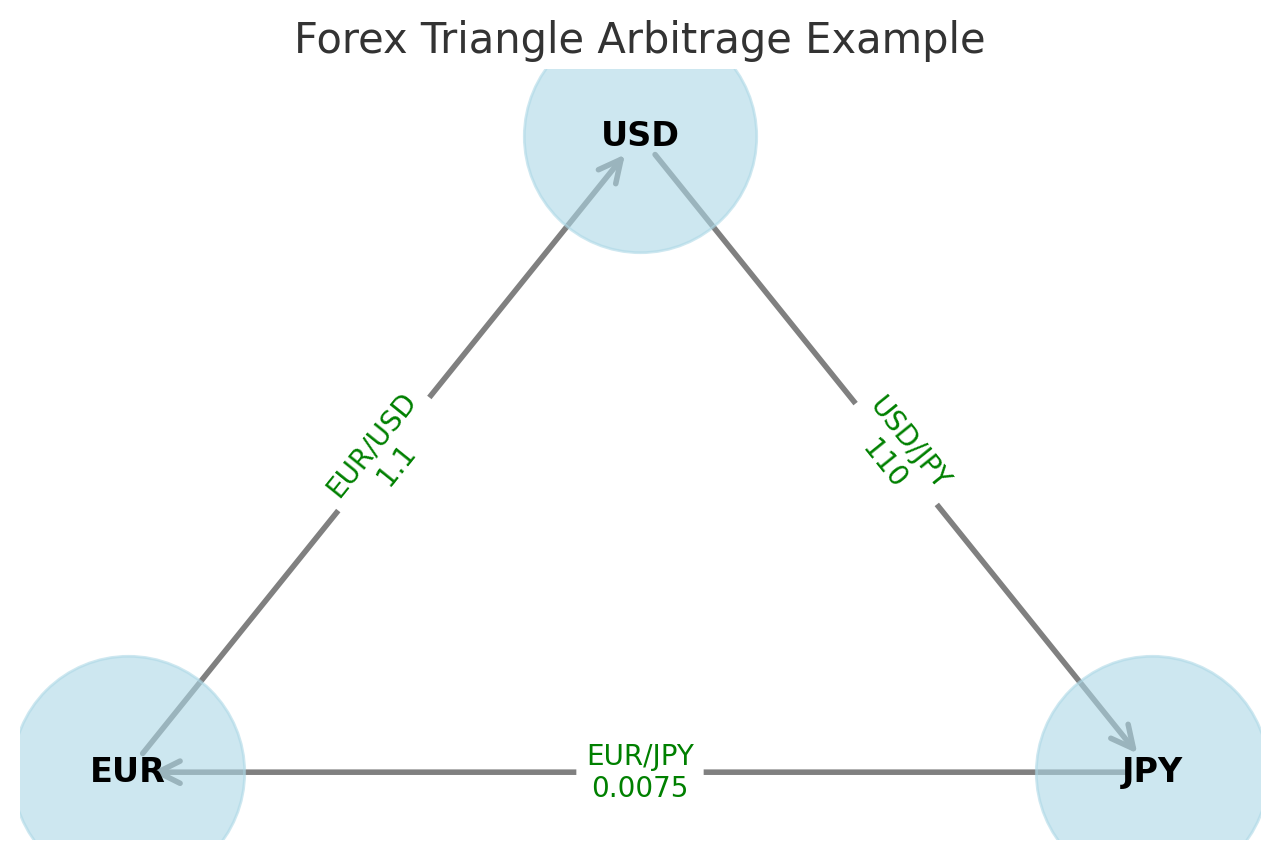

In the foreign exchange (FX or Forex) market, triangular arbitrage involves exploiting discrepancies in exchange rates between three currency pairs to lock in profits. Traders execute a series of transactions to capitalize on pricing inefficiencies and restore equilibrium. By simultaneously buying and selling multiple currency pairs, arbitrageurs aim to exploit temporary mispricings in the FX market, profiting from differences in exchange rates across various currency pairs.

Forex triangle arbitrage scheme. Assume you start with EUR, convert it to USD, then convert those USD to JPY, and finally convert those JPY back to EUR, completing the arbitrage loop.

#5. Merger Arbitrage

Merger arbitrage involves capitalizing on price differentials between a target company’s stock and the offer price during mergers and acquisitions. Arbitrageurs assess deal probabilities, regulatory approvals, and timing to profit from the convergence of prices. This strategy requires in-depth analysis of deal terms, market sentiment, and regulatory considerations to accurately assess the risk and potential returns associated with merger transactions.

#6. Convertible Arbitrage

Convertible arbitrage involves exploiting price differentials between a convertible bond and its underlying stock. Arbitrageurs may simultaneously buy the convertible bond and short sell the underlying stock to profit from valuation disparities and volatility changes. This strategy relies on understanding the complex relationship between the convertible security and its underlying equity, as well as managing risks associated with interest rates, credit quality, and market volatility.

#7. Volatility Arbitrage

Volatility arbitrage seeks to profit from discrepancies in the implied volatility of options relative to their historical volatility. Arbitrageurs may buy undervalued options and sell overvalued options to exploit mispricings in the options market. This strategy relies on complex mathematical models to assess volatility levels and identify mispriced options. Volatility arbitrage aims to capture changes in market volatility and option prices, hedging against directional market movements while profiting from changes in volatility levels. However, this strategy carries risks related to model assumptions, parameter estimation errors, and sudden shifts in market sentiment or volatility regimes.

Opportunities and Limitations

Arbitrage presents lucrative opportunities for traders and investors, offering the potential for consistent, risk-adjusted returns. Some of the key advantages include:

Profit Potential: Arbitrageurs can earn profits without taking directional market bets, thereby diversifying their portfolios and generating consistent returns regardless of market conditions.

Efficiency Enhancement: By exploiting price inefficiencies, arbitrageurs contribute to market efficiency by narrowing spreads and aligning prices across different markets, thus enhancing liquidity and reducing information asymmetries.

Risk Diversification: Arbitrage strategies often exhibit low correlation with traditional asset classes, providing diversification benefits and serving as a hedge against market volatility and systematic risks.

However, arbitrage also entails several challenges and limitations:

Execution Risks: Rapid market movements, liquidity constraints, and technological glitches can impede timely execution, leading to missed opportunities or losses.

Regulatory Constraints: Arbitrage strategies are subject to regulatory scrutiny, particularly in highly regulated markets, where authorities impose restrictions on short-selling, leverage, and speculative activities.

Market Dynamics: As arbitrage opportunities become more widely known and exploited, competition intensifies, leading to diminishing profit margins and shorter windows of opportunity.

Model Risks: Quantitative models used in arbitrage strategies are susceptible to model risk, parameter estimation errors, and regime changes, potentially undermining the effectiveness of trading strategies.

Final Thoughts

Arbitrage plays a crucial role in maintaining market efficiency by exploiting pricing disparities and restoring equilibrium. However, successful arbitrage requires a deep understanding of market dynamics, sophisticated analytical tools, and the ability to manage associated risks effectively. By leveraging arbitrage strategies judiciously, investors can potentially generate consistent profits while contributing to market efficiency and liquidity. Nonetheless, it’s essential to recognize that arbitrage is not a risk-free endeavor and requires careful consideration of risks and rewards. As financial markets continue to evolve, arbitrage will remain a cornerstone of trading strategies, offering opportunities for those adept at navigating its complexities.

Share on Social Media:

FAQ

Is arbitrage good or bad?

Arbitrage is neither inherently good nor bad. It’s a financial strategy used to exploit market inefficiencies. While it can contribute to price discovery and efficiency, it also poses risks and ethical considerations.

Can you make money with arbitrage?

Arbitrage can be profitable under certain conditions. It involves capitalizing on price differences between assets or markets. Success requires careful analysis, quick execution, and effective risk management.

Is arbitrage risk-free?

Arbitrage is often considered low-risk but not entirely risk-free. Factors like market changes, execution delays, liquidity issues, and regulatory constraints can impact profitability.

Why is arbitrage difficult?

Arbitrage is challenging due to the need for sophisticated analysis, fast decision-making, competition, and regulatory complexities. Opportunities may be short-lived, and market conditions constantly change.

Do brokers allow arbitrage?

Broker policies vary. Some may prohibit certain forms of arbitrage or impose restrictions, while others may allow it under specific conditions. Traders should review broker policies and seek legal advice for compliance.