Traditional investments like stocks and bonds have long been the cornerstone of investment portfolios. However, as financial markets evolve and investors seek to diversify their holdings, alternative investments have gained traction. Alternative investments encompass a wide range of assets beyond stocks and bonds, offering unique opportunities for returns and portfolio diversification. In this article, we’ll delve into the world of alternative investments, exploring different types, their benefits, risks, and how they can complement traditional investment strategies.

- #1. Real Estate as an Alternative Investment

- #2. Farmland as an Alternative Investment

- #3. Cryptocurrencies as Alternative Investments

- #4. Commodities

- #5. Derivatives as Alternative Investments

- #6. Structured Products

- #7. Private Equity

- #8. Peer-to-Peer Lending

- #9. Hedge Funds

- #10. Closed-Ended Funds

- #11. Investing in Collectibles

- #12. Royalty Income Streams

- Benefits of Alternative Investments

- Accessibility of Alternative Investments for Retail Investors

- Risks Associated with Alternative Investments

- Tax Considerations in Alternative Investments

- Integration with Traditional Investment Strategies

Alternative investments are non-traditional assets that don’t fall under the category of stocks, bonds, or cash equivalents.

Alternative investments are non-traditional assets that don’t fall under the category of stocks, bonds, or cash equivalents. These assets often have low correlation with traditional markets, providing an avenue for diversification and potentially higher returns. Here is a list of 12 of the most interesting alternative investments.

Oleg Gapeenko/Vecteezy

#1. Real Estate as an Alternative Investment

Real estate investment involves owning physical properties, either directly or through vehicles like Real Estate Investment Trusts (REITs). When considering real estate investments, investors must assess key factors such as property type (residential, commercial, industrial), location, rental income potential, and appreciation prospects.

One of the primary attractions of real estate investments is the potential for generating steady rental income. Residential properties offer recurring rental payments from tenants, while commercial properties, such as office buildings, retail centers, and industrial warehouses, can provide higher rental yields. Moreover, real estate investments offer various tax advantages that can enhance overall returns. Investors can benefit from depreciation deductions, mortgage interest deductions, and potential tax deferral through like-kind exchanges (1031 exchanges) when selling properties.

Despite the potential rewards, real estate investments also entail risks that investors must consider. Property vacancies can lead to income disruptions, maintenance costs are ongoing expenses, and liquidity constraints can hinder the ability to quickly sell properties. Additionally, real estate values are subject to market fluctuations influenced by factors like interest rates and economic conditions.

#2. Farmland as an Alternative Investment

Farmland also can be considered as an alternative investment that involves owning agricultural land used for crop cultivation, livestock farming, or forestry. Farmland provides opportunities for rental income, crop proceeds, and land appreciation. Key considerations include soil quality, climate suitability, water access, and local market dynamics. Farmland investments offer inflation protection, portfolio diversification, and potential tax benefits (e.g., agricultural exemptions). However, they require ongoing management, monitoring of agricultural trends, and exposure to environmental risks (e.g., droughts, pests).

Naratrip Boonroung/Vecteezy

#3. Cryptocurrencies as Alternative Investments

Cryptocurrencies have emerged as a unique alternative investment class, representing digital or virtual currencies secured by cryptography and decentralized ledger technology, commonly known as blockchain. Prominent examples include Bitcoin, Ethereum, and a myriad of other digital assets that have gained widespread attention and adoption in recent years. The appeal of cryptocurrencies as alternative investments stems from several key factors. Firstly, cryptocurrencies offer the potential for high returns, with some investors experiencing substantial gains during periods of rapid price appreciation. The decentralized nature of blockchain technology, which underpins cryptocurrencies, provides transparency and security, fostering trust among users and investors.

Furthermore, cryptocurrencies offer diversification from traditional asset classes like stocks and bonds. Unlike traditional financial assets, cryptocurrencies operate independently of central banks and governments, making them immune to macroeconomic factors such as interest rate changes or political instability. This independence allows cryptocurrencies to potentially act as a hedge against systemic risks inherent in traditional financial systems. Moreover, the global nature of cryptocurrencies enables investors to access new markets and investment opportunities with ease. The proliferation of cryptocurrency exchanges and trading platforms has democratized access to digital assets, allowing investors of all sizes to participate in this burgeoning market.

Cryptocurrencies offer diversification from traditional assets and potential for portfolio growth, but they also pose risks like extreme volatility, regulatory uncertainty, cybersecurity threats, and technological innovation challenges.

Commodities by Pixabay

#4. Commodities

Commodities encompass physical goods like precious metals (gold, silver), energy (oil, natural gas), agricultural products (corn, wheat), and industrial metals (copper, aluminum). Investors can access commodities through derivatives such as futures contracts or physical ownership. Commodities serve as a hedge against inflation, geopolitical risks, and currency depreciation, making them attractive diversifiers in investment portfolios. They offer non-correlation with traditional assets, helping investors mitigate overall portfolio risk. However, commodities also entail risks such as volatility, storage costs, and regulatory changes, requiring careful consideration and risk management strategies.

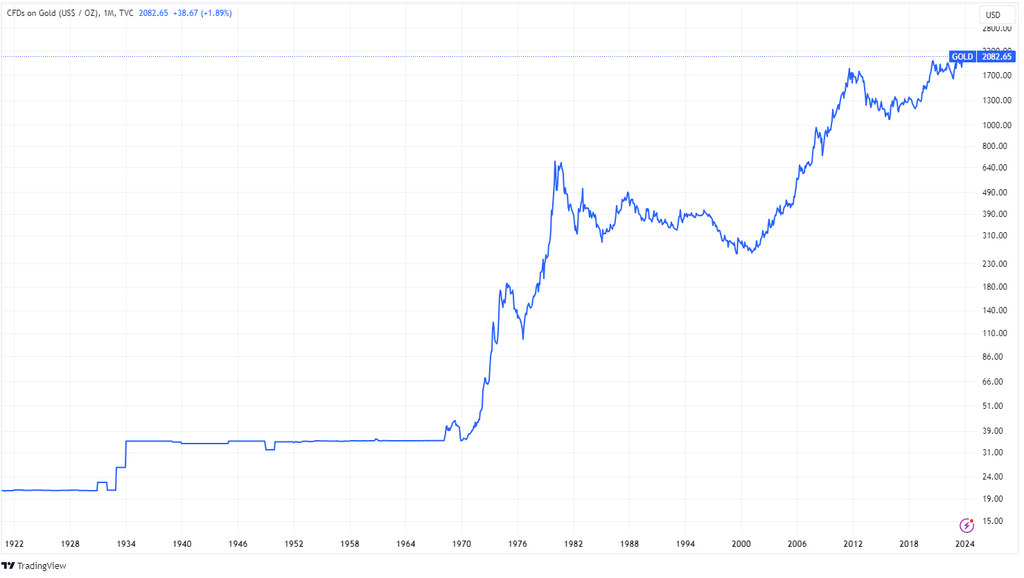

Gold as an Alternative Investment

Gold is a popular alternative investment that has been valued for its intrinsic properties and perceived store of value for centuries. As an alternative investment, gold offers several unique characteristics and benefits to investors:

- Store of Value: Gold has long been considered a reliable store of value, preserving wealth over time. Unlike fiat currencies, which can be subject to inflationary pressures and devaluation, gold maintains its purchasing power over the long term. This makes gold an attractive hedge against currency depreciation and inflationary risks.

- Safe-Haven Asset: Gold is widely regarded as a safe-haven asset during times of geopolitical instability, financial crises, or market turmoil. Investors tend to flock to gold as a hedge against systemic risks and as a refuge from market uncertainties. The perceived stability and liquidity of gold make it an attractive asset for investors seeking to preserve capital during turbulent times.

- Positive Bias: Gold benefits from a positive bias among investors, rooted in its historical performance as a wealth preserver and hedge against economic instability. This positive bias is reinforced by cultural and psychological factors that ascribe enduring value to gold, regardless of prevailing market conditions. As a result, gold tends to enjoy consistent demand and price appreciation over the long term, providing investors with a reliable source of capital preservation and portfolio insurance.

- Liquidity: Gold is highly liquid and can be easily bought, sold, and traded in global markets. It is traded on various exchanges worldwide, and there are numerous investment vehicles available for gaining exposure to gold, including physical bullion, gold exchange-traded funds (ETFs), gold futures contracts, and gold mining stocks. This liquidity ensures that investors can enter and exit positions in gold quickly and efficiently.

Gold prices chart (logarithmic) last 100 years/TradingView

Despite these benefits, it’s essential to recognize that gold also carries certain risks and considerations. The price of gold can be influenced by various factors, including macroeconomic indicators, central bank policies, geopolitical tensions, and investor sentiment. Additionally, gold does not generate income like dividend-paying stocks or interest-bearing bonds, so its value relies solely on price appreciation.

#5. Derivatives as Alternative Investments

Derivatives are financial contracts whose value derives from an underlying asset (e.g., stocks, bonds, commodities) or index. Investors often turn to derivatives as alternative investments to diversify their portfolios, manage risk exposures, and potentially enhance returns. Derivatives offer leverage (which also leads to increased risk), allowing investors to control larger positions with a smaller initial investment, and liquidity, enabling easy trading in various market conditions. Common derivatives include options, futures, swaps, and forwards.

Futures

Futures contracts are standardized agreements (obligation) to buy or sell an asset at a predetermined price and date. They are widely used for hedging and speculation in commodities, currencies, and financial instruments. Futures contracts offer leverage and liquidity, enabling investors to gain exposure to underlying assets with minimal upfront capital. However, they carry risks such as margin calls, price volatility, and the potential for substantial losses.

Options

Options provide the buyer with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price within a predetermined timeframe. Options offer flexibility and limited downside risk, making them popular for hedging and speculative strategies. However, they involve premium payments, time decay, and the risk of losing the entire investment if the option expires worthless.

Fragment of option chain representing options daily price change

Credit Default Swaps

Swaps are derivative contracts that involve the exchange of cash flows between two parties based on predetermined terms. Common types of swaps include interest rate swaps, currency swaps, and credit default swaps (CDS). Credit default swaps (CDS) provide insurance-like protection against default on debt obligations, such as bonds or loans. CDS buyers pay premiums to CDS sellers in exchange for compensation if the reference entity defaults. While swaps offer opportunities for portfolio hedging, risk mitigation, and speculative trading, they also entail counterparty risk, basis risk, and regulatory scrutiny.

#6. Structured Products

Structured products are hybrid financial instruments that combine traditional securities (e.g., stocks, bonds) with derivatives (e.g., options, swaps) to offer customized risk-return profiles. Examples include structured notes (for example, equity-linked notes), principal-protected products, and leveraged or inverse ETFs. Structured products provide exposure to specific market factors (e.g., interest rates, volatility, currencies) or investment themes (e.g., environmental, social, governance) while offering downside protection or enhanced returns. However, they involve complexity, issuer credit risk, liquidity constraints, and potential for adverse tax treatment.

#7. Private Equity

Private equity involves investing in privately held companies, often with the aim of restructuring, growing, or eventually selling them for a profit. Private equity funds may target various stages of company development (venture capital for startups, growth equity for expanding companies, buyouts for mature businesses). Private equity investments offer potential for high returns, active involvement in company operations, and diversification from public markets. Such alternative investments, especially venture capital investments, offer the potential for significant returns if successful companies achieve rapid growth or are acquired. However, they involve high risk due to the high failure rate of startups and long investment horizons before exits (e.g., IPOs, acquisitions).

Khunkorn Laowisit/Vecteezy

#8. Peer-to-Peer Lending

Peer-to-Peer (P2P) lending is an alternative investment tool that allows individuals to lend money directly to other individuals or businesses through online platforms (for example, Funding Circle), bypassing traditional financial institutions like banks. In P2P lending, borrowers are matched with lenders through online platforms, which facilitate the loan origination, servicing, and repayment process. Investors can earn interest income by funding consumer, small business, or real estate loans.

P2P lending offers several benefits to both borrowers and lenders. For borrowers, P2P lending provides access to financing that may be more flexible and accessible compared to traditional bank loans. For lenders, P2P lending offers the opportunity to earn attractive returns by investing in a diversified portfolio of loans. Lenders can choose to invest in individual loans or spread their investment across multiple loans to minimize risk. P2P lending platforms typically provide tools and metrics to help lenders assess the creditworthiness of borrowers and make informed investment decisions.

However, it’s important to recognize that P2P lending carries risks as well. These risks include the possibility of borrower default, economic downturns impacting borrowers’ ability to repay loans, and platform-specific risks such as platform insolvency or fraud. Additionally, P2P lending investments may lack liquidity, as loans typically have fixed terms and may not be easily sold or traded on secondary markets.

Citadel Headquarters. Image by Felix Lipov/Vecteezy

#9. Hedge Funds

Hedge funds are actively managed investment pools that employ various strategies (e.g., long-short equity, global macro, event-driven) to generate returns. These funds often pursue absolute returns and may use leverage and derivatives for risk management and alpha generation. Hedge funds offer potential for alpha, diversification, and downside protection during market downturns. However, they typically require high investment minimums, charge performance fees, and may lack transparency and liquidity.

#10. Closed-Ended Funds

Closed-ended funds are pooled investment vehicles with a fixed number of shares that trade on secondary markets. These funds invest in diverse assets like equities, fixed income, real estate, or private equity. Closed-ended funds offer professional management, diversification, and potential for capital appreciation. However, they may trade at discounts or premiums to net asset value, incur higher fees, and have limited liquidity compared to open-ended funds.

Karl Oss Von Eeja/Pixabay

#11. Investing in Collectibles

Investing in tangible objects like art, antiques, or rare coins is a unique alternative investment avenue. This niche asset class requires specialized knowledge and involves significant risk due to the subjective nature of valuation and limited liquidity. Examples include investing in fine art through auction houses, acquiring rare sports memorabilia, or collecting vintage coins. Factors influencing art value include artist reputation, artwork rarity, provenance, historical significance, and market demand trends. Art investments offer potential for capital appreciation, aesthetic enjoyment, and portfolio diversification. However, they involve subjective valuation, illiquidity, high transaction costs (e.g., commissions, insurance, storage), and risks like forgery, damage, and shifts in art market preferences. Wine, too, falls under this category, as investors purchase bottles or cases of fine or rare wines with the expectation of appreciation. Factors affecting wine value include producer reputation, vintage quality, provenance, rarity, and storage conditions. Wine investments offer potential for capital growth, diversification, and tax advantages (e.g., capital gains treatment). However, like other collectibles, they require expertise in selection, proper storage facilities, and monitoring market trends to optimize returns and avoid counterfeit risks.

Free Backtesting Spreadsheet

#12. Royalty Income Streams

Royalty income streams involve investing in intellectual property rights (e.g., music royalties, patent royalties, mineral rights) to receive ongoing payments from licensing agreements or usage rights. Royalty investments offer potential for passive income, diversification from traditional assets, and inflation protection. However, they require due diligence on intellectual property quality, monitoring of royalty collection processes, and exposure to legal and market risks (e.g., copyright infringement, technological disruption).

Benefits of Alternative Investments

Diversification: Alternative investments have low correlation with traditional assets like stocks and bonds, helping to reduce portfolio volatility and enhance risk-adjusted returns.

Potential for Higher Returns: Alternative investments often have higher return potentials compared to traditional assets, especially in niche markets or during periods of market distress.

Inflation Hedge: Assets like real estate, commodities, and infrastructure can serve as a hedge against inflation, preserving purchasing power over the long term.

Access to Unique Opportunities: Alternative investments provide access to markets and asset classes not typically available through traditional investments.

Portfolio Customization: Investors can tailor their alternative investment allocations to meet specific objectives, whether it’s capital preservation, income generation, or long-term growth.

Advancements in technology and regulatory changes have democratized access to alternative investments, making them more accessible to retail investors.

Accessibility of Alternative Investments for Retail Investors

One of the primary challenges retail investors face in accessing alternative investments is the traditionally exclusive nature of these asset classes. Historically, alternative investments like private equity, hedge funds, and venture capital were reserved for institutional investors and high-net-worth individuals due to regulatory restrictions and high investment minimums. However, advancements in technology and regulatory changes have democratized access to alternative investments, making them more accessible to retail investors. Online investment platforms and marketplaces, such as crowdfunding platforms, peer-to-peer lending platforms (examples were provided in dedicated chapter above), and digital asset exchanges, have emerged as accessible avenues for retail investors to participate in alternative investments. These platforms offer a wide range of alternative assets, streamlined investment processes, and lower investment minimums, allowing retail investors to diversify their portfolios with ease.

Crowdfunding Platforms

Platforms like Kickstarter, Indiegogo, and SeedInvest allow retail investors to participate in crowdfunding campaigns for startups, small businesses, and real estate projects. Retail investors can contribute funds to projects they believe in and receive rewards, equity, or debt-based returns depending on the crowdfunding model.

Example: RealtyShares is a crowdfunding platform that enables retail investors to invest in real estate projects, including residential and commercial properties. Investors can browse through a variety of investment opportunities, review project details and financial projections, and invest in properties with as little as $5,000.

Digital Asset Exchanges

Cryptocurrency exchanges like Coinbase, Binance, and Kraken provide retail investors with access to digital assets such as cryptocurrencies, tokens, and digital securities. These exchanges offer trading services, wallet storage, and educational resources to help investors navigate the digital asset market. These platforms offer a user-friendly interface, secure storage solutions, and educational materials to help investors understand the cryptocurrency market.

Exchange-Traded Funds (ETFs) and Mutual Funds

ETFs and mutual funds provide retail investors with access to alternative investment strategies and asset classes through liquid and transparent investment vehicles. Alternative investment ETFs and mutual funds may focus on specific sectors (e.g., real estate, commodities), investment styles (e.g., value, growth), or alternative strategies (e.g., long-short equity, managed futures), offering retail investors diversified exposure to alternative investments without the need for direct ownership.

Robo-Advisors and Managed Portfolios

Robo-advisors and managed portfolio services leverage algorithms and technology to offer retail investors customized investment portfolios that may include alternative assets alongside traditional investments. These automated investment platforms provide convenient access to alternative investments, personalized asset allocation, and ongoing portfolio monitoring, making it easier for retail investors to incorporate alternative assets into their investment strategies. Here are some examples of robo-advisors and managed portfolio services: Wealthfront, Betterment, Schwab Intelligent Portfolios.

Alternative assets often involve unique risks, valuation methodologies, and regulatory considerations that require specialized knowledge and expertise.

Education in Alternative Investments

In addition to accessibility, education is crucial for retail investors to make informed decisions and navigate the complexities of alternative investments effectively. Alternative assets often involve unique risks, valuation methodologies, and regulatory considerations that require specialized knowledge and expertise. Here are some strategies for retail investors to enhance their understanding of alternative investments:

- Research and Due Diligence: Conduct thorough research and due diligence on alternative investments before committing capital. This includes analyzing historical performance, understanding investment strategies, evaluating fund managers’ track records, and assessing underlying asset characteristics. Retail investors should leverage resources such as investment prospectuses, offering documents, financial statements, and independent research reports to gain insights into alternative investment opportunities.

- Professional Networking and Mentorship: Network with industry professionals, experienced investors, and financial advisors to gain valuable insights and mentorship in alternative investments. Joining industry associations, attending conferences, and participating in networking events can help retail investors expand their knowledge base, build relationships, and access investment opportunities not readily available to the public.

- Simulation and Practice: Practice investing in alternative assets through simulation platforms, virtual trading accounts, or paper trading exercises to gain hands-on experience without risking real capital. Simulation tools allow retail investors to test different investment strategies, analyze performance metrics, and hone their decision-making skills in a risk-free environment before deploying capital into actual alternative investments. Read more about simulated trading.

Risks Associated with Alternative Investments

Illiquidity: Many alternative investments, such as real estate and private equity, lack liquidity and may require a long holding period before realizing returns.

Higher Volatility: Alternative investments, such as cryptocurrencies or options, often exhibit higher volatility compared to traditional assets, leading to potential fluctuations in portfolio value.

Complex Structures: Hedge funds, private equity, and certain alternative investments often involve complex structures and strategies, which can be difficult for investors to understand fully.

Regulatory Risks: Some alternative investments, like cryptocurrencies and certain hedge fund strategies, face regulatory uncertainty, which can impact their legality and valuation.

Managerial Risks: Investments in hedge funds, private equity, and venture capital are often managed by fund managers whose skills and decisions can significantly impact investment performance.

Concentration Risk: Investing in a single alternative asset or strategy can expose investors to concentration risk, especially if the asset class experiences adverse developments.

Investors in real estate should leverage depreciation deductions to maximize tax efficiency and enhance overall investment returns.

Tax Considerations in Alternative Investments

Understanding the tax treatment associated with different alternative assets is essential for investors to optimize their after-tax returns and comply with relevant tax regulations. Here are some key tax considerations to keep in mind when investing in alternative assets:

Capital Gains Tax: Most alternative investments, including real estate, private equity, and collectibles, are subject to capital gains tax on the profit generated from the sale or disposition of the asset. The capital gains tax rate typically depends on the holding period of the investment, with long-term gains taxed at lower rates than short-term gains. Investors should be aware of the tax implications of realizing capital gains and plan their investment exits accordingly to minimize tax liabilities.

Depreciation Deductions: Real estate investments offer unique tax advantages, including depreciation deductions that can offset taxable rental income. Depreciation allows investors to deduct a portion of the property’s value over time, reducing taxable income and providing cash flow benefits. Investors in real estate should leverage depreciation deductions to maximize tax efficiency and enhance overall investment returns.

Pass-Through Entities: Many alternative investments, such as partnerships, limited liability companies (LLCs), and real estate investment trusts (REITs), are structured as pass-through entities for tax purposes. Pass-through entities do not pay taxes at the entity level; instead, profits and losses flow through to the individual investors, who report them on their personal tax returns. Investors should understand the tax implications of pass-through entities, including the treatment of income, deductions, and distributions, when evaluating alternative investment opportunities.

Qualified Opportunity Zones (QOZs): Qualified Opportunity Zones are designated economically distressed areas where investors can receive preferential tax treatment for investing in eligible projects. Investments in QOZs offer potential tax deferral on capital gains, reduction of capital gains tax liability, and tax-free appreciation of investment gains if certain conditions are met. Investors interested in real estate development or business ventures in QOZs should explore the tax benefits and compliance requirements associated with these investments.

Tax-Advantaged Accounts: Certain alternative investments may be eligible for inclusion in tax-advantaged accounts such as self-directed individual retirement accounts (IRAs) or Health Savings Accounts (HSAs). Investing in alternative assets through tax-advantaged accounts can provide tax-deferred or tax-free growth, allowing investors to compound their returns more efficiently over time. However, investors should be mindful of contribution limits, distribution rules, and prohibited transactions associated with tax-advantaged accounts to avoid penalties and compliance issues.

State and Local Taxes: In addition to federal taxes, investors in alternative investments may be subject to state and local taxes based on their residency and the location of the investment assets. State tax laws vary widely, and investors should consult with tax professionals to understand the state-specific tax implications of their alternative investment activities. State taxes may include income taxes, property taxes, and sales taxes that can affect investment returns and cash flow.

Tax Reporting and Compliance: Alternative investments often involve complex tax reporting requirements, including the filing of specialized tax forms and disclosures related to partnership income, foreign investments, and passive activity losses. Investors should maintain accurate records of their alternative investment transactions, income, and expenses to comply with tax laws and regulations. Working with qualified tax advisors and accountants can help investors navigate the intricacies of tax reporting and ensure compliance with applicable tax rules.

Integration with Traditional Investment Strategies

While alternative investments offer diversification benefits and potential for higher returns, they should be integrated thoughtfully into an overall investment strategy. Here are some considerations for incorporating alternative investments into a portfolio:

Risk Appetite: Assess your risk tolerance and investment objectives before allocating to alternative investments. These assets often carry higher risks and may not be suitable for all investors.

Asset Allocation: Determine the appropriate allocation to alternative investments based on your investment horizon, liquidity needs, and diversification goals. A diversified portfolio typically includes a mix of traditional and alternative assets.

Due Diligence: Conduct thorough due diligence on alternative investments, including analyzing historical performance, fund managers’ track records, and underlying asset characteristics.

Monitoring and Rebalancing: Regularly monitor the performance of alternative investments and rebalance the portfolio as needed to maintain target allocations and risk profiles.

Professional Advice: Consider seeking advice from financial advisors or investment professionals with expertise in alternative investments to help navigate the complexities of these asset classes.

Final Thoughts

Alternative investments offer a diverse array of opportunities beyond traditional stocks and bonds, ranging from real estate and private equity to commodities, cryptocurrencies, and specialized financial instruments. While these investments can enhance portfolio diversification and potentially boost returns, they also entail unique risks, complexities, and due diligence requirements. Investors should carefully evaluate each alternative investment option based on their risk tolerance, investment objectives, and time horizon. By incorporating a well-diversified mix of traditional and alternative investments into their portfolios, investors can optimize risk-adjusted returns and pursue their financial goals effectively. Consulting with financial professionals and conducting thorough research are essential steps in navigating the complex landscape of alternative investments.

Share on Social Media: