One of the most significant developments in recent decades is the rise of algorithmic trading. Also known as algo trading, automated trading or black-box trading, this method relies on automatic execution of trades at speeds and frequencies beyond human capabilities. Algorithmic trading has become a dominant force in global markets, reshaping how assets are bought and sold. In this article, we will explore its mechanisms, impact, challenges, and future prospects. And the most important for our readers – how individual traders can implement these automation tools.

Understanding Algorithmic Trading

Algorithmic trading is the process of executing buy and sell orders using automated pre-programmed trading instructions. These instructions, based on various parameters such as price, time, and volume, are formulated into algorithms that enable rapid and precise trade execution. Unlike traditional manual trading, where human judgment plays a central role, algo trading relies on mathematical models and statistical analysis to make trading decisions.

The Key Components of Algorithmic Trading

Data Collection and Analysis

Algorithmic trading relies on robust data collection and analysis processes to make informed trading decisions. In this phase, algorithms gather vast amounts of market data in real-time, encompassing price quotes, trade volumes, order book dynamics, economic indicators, and even sentiment data from social media platforms. This data is sourced from various exchanges, trading venues, and news feeds, providing a comprehensive view of market activity.

Once collected, the data undergoes sophisticated analysis using advanced statistical techniques, machine learning algorithms, and quantitative models. These analytical tools identify patterns, trends, and anomalies within the data that may present profitable trading opportunities. For instance, algorithms may detect price movements correlated with specific events, such as earnings announcements or macroeconomic indicators, enabling traders to capitalize on predictable market reactions.

Moreover, sentiment analysis algorithms scour news headlines, social media posts, and other textual data to gauge market sentiment and investor psychology. By incorporating sentiment analysis into their trading strategies, algorithms can anticipate market movements driven by collective investor sentiment, adding another dimension to their decision-making process.

Strategy Formulation

Traders or quantitative analysts develop trading strategies based on their understanding of market dynamics and risk-return objectives. These strategies encompass a wide range of approaches, from trend-following and mean-reversion strategies to statistical arbitrage and machine learning-driven models.

Traders use their domain expertise and market insights to devise trading strategies that exploit inefficiencies or mispricings in the market. For instance, a trend-following strategy may seek to capitalize on momentum trends by buying assets that are exhibiting upward price momentum and selling short those experiencing downward momentum.

Quantitative analysts, on the other hand, employ mathematical models and statistical techniques to develop algo trading strategies. These models may incorporate factors such as historical price data, volatility, trading volumes, and market microstructure characteristics to identify profitable trading opportunities.

Once formulated, trading strategies are translated into algorithmic code, defining precise rules for when to enter or exit trades, position sizing, and risk management parameters. These algorithms are rigorously backtested using historical data to assess their performance under various market conditions and refine their parameters for optimal execution.

Free Backtesting Spreadsheet

Trade Execution

Execution is the phase where algorithmic trading strategies are translated into action, with algorithms swiftly executing trades across various financial instruments such as stocks, bonds, commodities, or currencies. This phase requires seamless connectivity to trading venues, low-latency infrastructure, and robust order routing mechanisms to ensure timely and efficient trade execution.

Upon receiving a trading signal generated by the algorithm, the execution algorithm calculates the optimal order parameters, including order type, quantity, and price limits, based on the trading strategy’s parameters and prevailing market conditions. These orders are then routed to the appropriate trading venues or liquidity pools for execution.

In high-frequency trading (HFT), where trades are executed at lightning speed, algorithms use co-location services and direct market access (DMA) to minimize latency and gain a competitive edge. Co-location services enable algorithms to be physically located in close proximity to exchange servers, reducing transmission delays and ensuring faster order execution.

Throughout the execution process, algorithms continuously monitor market conditions and adjust their trading strategies dynamically to adapt to changing circumstances. This adaptive approach enables algorithms to capitalize on fleeting market opportunities while managing execution risk and market impact.

Risk Management

Algorithms incorporate various risk controls and stop-loss mechanisms to protect against adverse market movements and limit downside risk. Risk management algorithms monitor a range of risk factors, including market risk, liquidity risk, and operational risk, to assess the overall risk exposure of the trading strategy. These algorithms calculate measures such as value at risk (VaR), expected shortfall, and maximum drawdown to quantify the potential losses under different scenarios.

Moreover, algorithms dynamically adjust their trading parameters, such as position size and leverage, based on prevailing market conditions and risk metrics. For instance, during periods of heightened volatility or uncertainty, algorithms may reduce position sizes or increase risk controls to minimize exposure to adverse market movements.

Stop-loss mechanisms are another critical component of risk management in algo trading. These mechanisms automatically trigger the liquidation of positions or suspension of trading activity when predefined loss thresholds are breached. By enforcing discipline and limiting losses, stop-loss mechanisms help safeguard capital and prevent catastrophic drawdowns.

Algorithmic Trading for Retail Traders

While algorithmic trading has historically been associated with institutional traders due to their access to advanced technology and resources, the democratization of finance has opened doors for individual traders to participate in algo trading as well. Individual traders, often operating with limited resources compared to institutional counterparts, can still use automated trading strategies through several avenues.

Algorithmic Trading Platforms and Third-Party Providers

There are now numerous algorithmic trading platforms and software tools tailored specifically for individual traders. These platforms offer user-friendly interfaces and pre-built algorithms that allow retail traders to automate their trading strategies without requiring extensive programming knowledge. Individual traders can access a wide range of strategies, including trend-following, mean-reversion, and momentum strategies, and customize them to suit their preferences and risk tolerance.

Free Backtesting Spreadsheet

Backtesting with Excel and historical price data: Individual traders can utilize Excel and historical price data to conduct backtesting of their trading strategies. Backtesting involves simulating trading strategies using historical market data to evaluate their performance and profitability over a specific time period. Traders can import historical price data into Excel and develop simple trading models or rules-based strategies based on technical indicators, such as moving averages or relative strength index (RSI). By applying these strategies to historical data, traders can assess their effectiveness, identify potential flaws, and optimize parameters for improved performance.

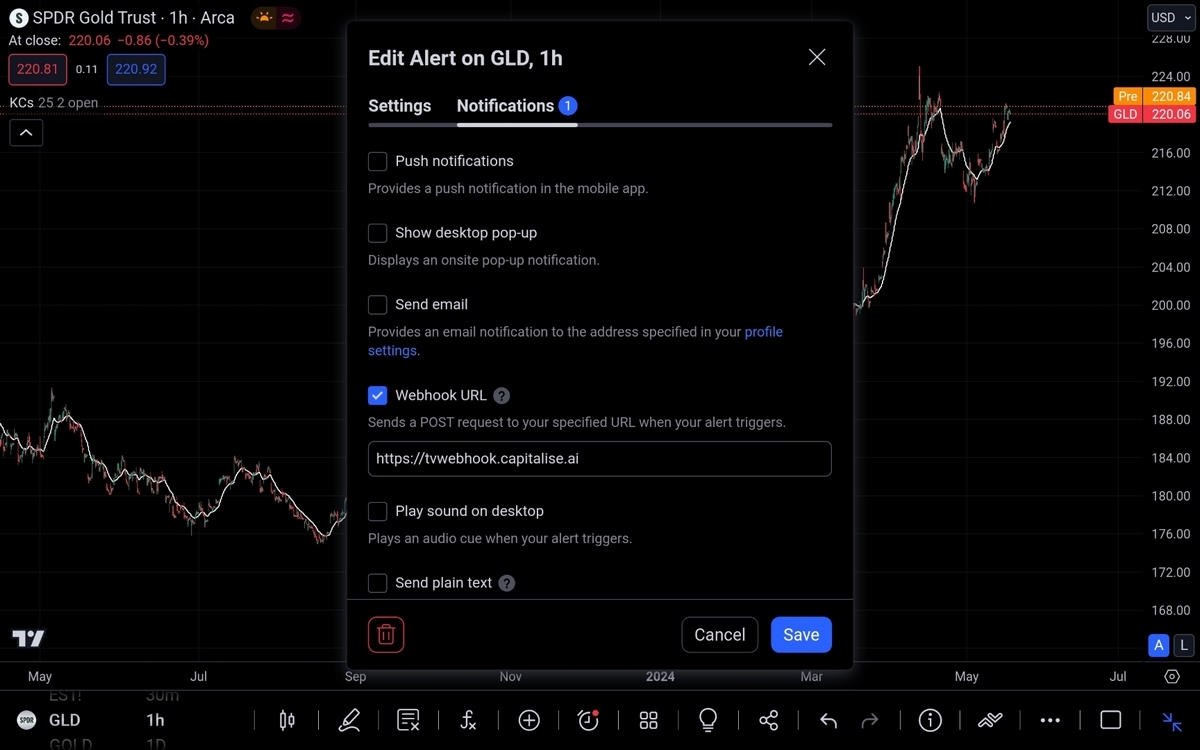

Generate signals with TradingView alerts and webhooks: TradingView, a popular charting platform among individual traders, offers the ability to generate trading signals based on developed in backtesting stage strategy. Traders can create custom indicators or use built-in indicators on TradingView to generate buy or sell signals based on specific criteria, such as crossover of moving averages or breakouts from chart patterns. These signals can then be sent to external applications or services (for example, Capitalise.ai) via alerts with webhooks.

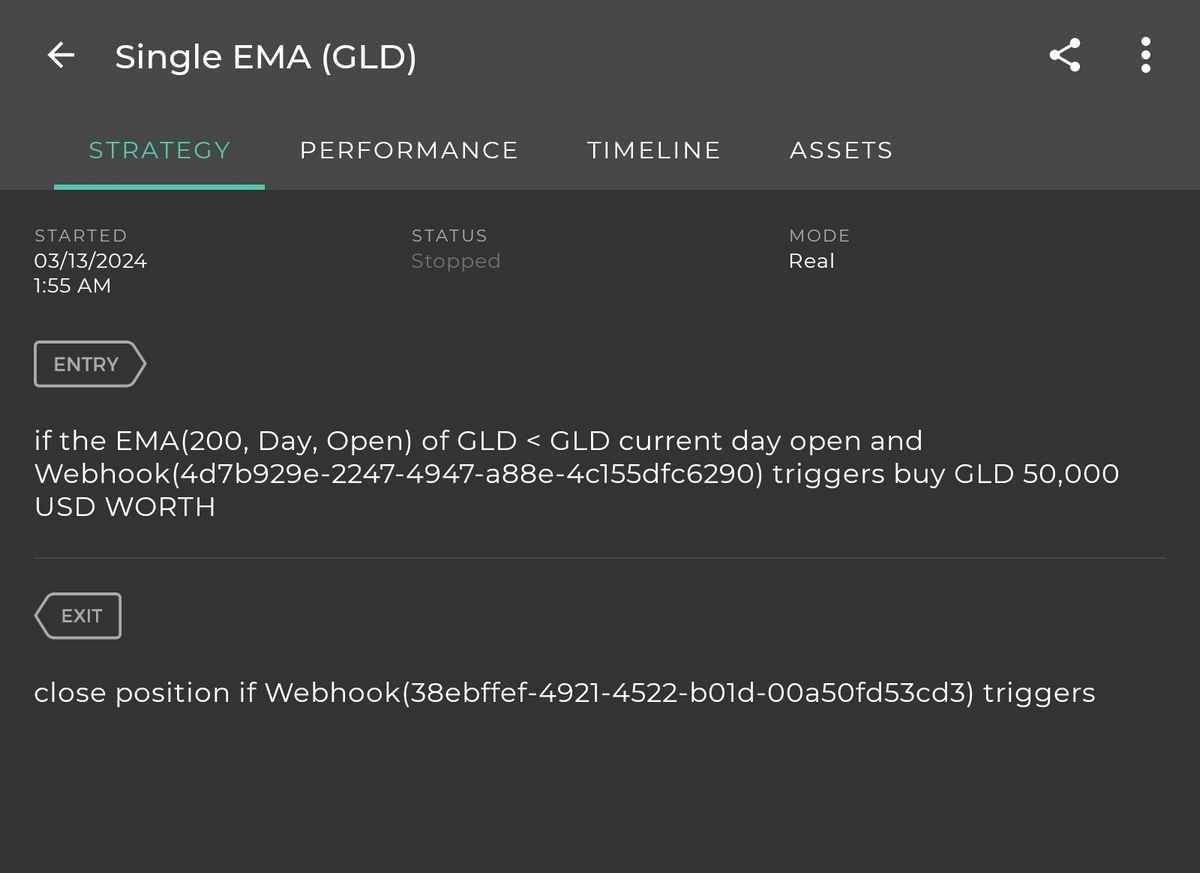

Execute trade automatically with Capitalise.ai service connected to brokerage account: Capitalise.ai is a platform that allows individual traders to create and deploy trading strategies using natural language processing and without the need for coding skills. Traders can define their trading rules and conditions using plain English sentences, and Capitalise.ai platform translates these instructions into executable trading strategies. Once a strategy is defined, traders can connect their brokerage accounts to Capitalise.ai, enabling the platform to execute trades automatically based on the specified criteria. Using Capitalise.ai intuitive interface and seamless integration with brokerage accounts, traders can access advanced algorithmic trading capabilities without the complexities of traditional programming or development.

Open-Source Libraries and Communities

Traders with programming skills can take advantage of open-source libraries and communities dedicated to algorithmic trading. Platforms such as QuantConnect, Quantopian, and MetaTrader provide access to a wealth of educational resources and code libraries that enable traders to develop, test, and deploy their algorithms. Engaging with these communities allows traders to collaborate with like-minded individuals, share ideas, and use collective expertise to improve their trading strategies.

Education and Training

There are numerous online courses, tutorials, and books available that cover topics such as quantitative finance, algorithmic trading strategies, and programming languages, such as Python and R. By investing time and effort in learning the fundamentals of automated trading, traders can gain the knowledge and skills necessary to develop and deploy their strategies effectively.

Benefits of Algorithmic Trading

Algorithms can execute trades in milliseconds, enabling traders to seize fleeting market opportunities and react to rapid price movements in real-time. By the use of advanced technology and high-speed connectivity, algorithmic trading ensures that traders can execute their strategies with minimal latency, enhancing their ability to capitalize on market inefficiencies and price discrepancies.

Moreover, one of the primary benefits of automated trading is its ability to remove human emotion and error from the trading process. Traders may be influenced by fear, greed, or cognitive biases, while algorithms execute trades based solely on predefined criteria. This objective approach reduces the risk of costly mistakes caused by emotional decision-making.

Free Backtesting Spreadsheet

Risks and Challenges

- Technical Failures: Despite their speed and efficiency, algorithms are susceptible to technical glitches, software bugs, and connectivity issues that can disrupt trading operations. A malfunctioning algorithm can lead to erroneous trades, order routing errors, or system downtime, resulting in financial losses for traders.

- Overfitting: Optimizing algorithms based on historical data carries the risk of overfitting, where the strategy performs well in backtests but fails to generalize to unseen market conditions. Overfitting occurs when algorithms are excessively tuned to historical data patterns, capturing noise rather than genuine market signals. As a result, the algorithm may perform poorly in live markets, leading to disappointing trading results and potential losses. To avoid overfitting, traders must strike a balance between model complexity and generalization ability, use out-of-sample testing to validate their strategies.

- Market Impact: Large-scale algorithmic trading can influence market dynamics, leading to increased volatility and potential market manipulation. HFT algorithms, in particular, can exacerbate market fluctuations by executing a large number of trades within short timeframes. Moreover, automated trading strategies that rely on similar signals or patterns may amplify market movements, creating feedback loops and systemic risks. Regulators and market participants closely monitor algorithmic trading activities to ensure market integrity and stability.

- Competition: The proliferation of algorithmic trading has intensified competition among traders and firms, making it challenging to maintain a competitive edge in the market. Traders face increased competition for alpha, liquidity, and market access.

Future Trends and Innovations

Looking ahead, several trends and innovations are poised to shape the future of algorithmic trading:

- Artificial Intelligence and Machine Learning: The integration of artificial intelligence (AI) and machine learning (ML) techniques is expected to enhance the capabilities of algorithmic trading algorithms. AI-driven algorithms can adapt to changing market conditions, learn from past experiences, and uncover new patterns.

- Quantum Computing: The advent of quantum computing holds the promise of revolutionizing automated trading. Quantum algorithms can process vast amounts of data and perform complex calculations at unprecedented speeds, enabling more sophisticated trading strategies and risk analytics.

- Regulatory Evolution: Regulators are likely to implement stricter rules to address the risks associated with automated trading. Greater transparency, surveillance, and accountability measures may be introduced to safeguard market integrity and stability.

- Crypto and DeFi Markets: Algorithmic trading is increasingly penetrating emerging markets such as cryptocurrencies and decentralized finance (DeFi). The decentralized nature of these markets presents unique opportunities and challenges for algo trading, as traditional regulatory frameworks may not fully apply.

Final Thoughts

Algorithmic trading provides individual traders with the ability to automate their strategies. From automated trading platforms to open-source libraries and educational communities, a wealth of resources is available to support traders in their endeavors. With dedication and a commitment to continuous learning, individual traders can unlock the full potential of algorithmic trading.

Share on Social Media:

FAQ

Is algorithmic trading really profitable?

Algorithmic trading can be profitable for traders who have developed effective strategies, manage risk appropriately, and adapt to changing market conditions. While algo trading offers potential for profit, it also carries risks, and success is not guaranteed.

What is algorithmic trading?

Algorithmic trading, also known as algo trading, automated trading, or black-box trading, is the process of using computer algorithms to execute trading orders automatically. Algo trading aims to remove human emotion and subjectivity from the trading process, enabling faster, more efficient, and systematic trading.

Is algo trading illegal?

Algo trading itself is not illegal. However, certain practices associated with algorithmic trading, such as market manipulation or insider trading, are illegal and subject to regulatory scrutiny and enforcement.

How can I start algorithmic trading?

Begin learning the nuances of trading principles and strategies. Next, select a suitable algorithmic trading platform or software. With a platform in hand, design algorithms that reflect your stategy rules. Utilize historical market data to backtest your strategies rigorously, evaluating their performance and potential profitability. Once you’ve refined your strategies through backtesting, cautiously transition to live markets. Start with modest capital and gradually increase exposure as you gain confidence in your algorithms.

Is algo trading easy?

Algo trading can be complex and challenging, especially for beginners. It requires a solid understanding of financial markets, quantitative analysis, programming skills, and risk management principles. While algorithmic trading platforms and tools have made it more accessible to individual traders, success in algo trading requires dedication, perseverance, and a willingness to continuously learn and adapt to changing market dynamics.