The allure of consistent profits in the forex market is undeniable. The 50 pips a day strategy has become a popularized approach, particularly for beginners, promising achievable daily gains. But before diving in, a critical look is essential. This article explores the 50 pips a day strategy, its principles, execution, and practical tips for success.

Understanding the 50 Pips a Day Strategy

First things first, let’s establish some ground rules. Forex, or foreign exchange, is the trading of currencies against each other. A pip, which stands for “percentage in point,” is the smallest unit of measurement for currency exchange rates. The value of a pip depends on the currency pair being traded. For example, one pip in EUR/USD translates to $0.0001, while one pip in USD/JPY translates to ¥1.

The essence of this trading strategy lies in its straightforward objective – to capture a modest yet achievable profit of 50 pips each trading day. Unlike complex trading systems that rely on numerous indicators and analysis, this strategy emphasizes simplicity and discipline. This might seem manageable, but remember, forex is a two-way market. You can either buy (go long) or sell (go short) a currency pair, hoping the price moves in your favor.

Key Components of the Strategy

- Timeframe Selection: The 50 pips a day strategy is often executed on shorter timeframes, such as the 15-minute or 1-hour charts. These timeframes provide sufficient market activity for frequent trading opportunities while allowing traders to capture profits within a single trading session.

- Currency Pairs: While this strategy can be applied to various currency pairs, it is commonly used with major pairs like EUR/USD, GBP/USD, and USD/JPY due to their liquidity and volatility.

- Entry and Exit Rules: Traders employing the 50 pips a day strategy typically enter trades based on clear signals, such as price action patterns or technical indicators like moving averages or support and resistance levels. Once a trade is initiated, they aim to secure a profit of 50 pips before the trading day concludes. To achieve the goal of 50 pips per day, traders set profit targets and stop-loss orders accordingly. Profit targets are placed at the 50-pip mark, while stop-loss orders are typically positioned to limit losses to a predetermined amount, often a fraction of the potential profit.

Example of the 50 Pips a Day Strategy

Let’s walk through an example of how the 50 pips a day forex strategy might be executed.

Suppose you’re trading the EUR/USD pair on a 15-minute timeframe. After conducting your analysis, you notice that the price has been trending upwards but has recently retraced to a key support level around 1.2100. You decide to enter a long position (buy) if the price bounces off the support level and shows signs of continuation. You set a buy order at 1.2110, slightly above the support level to confirm the bullish momentum. To adhere to the 50 pips a day strategy, you set your profit target at 1.2160, 50 pips above your entry point. For risk management, you place a stop-loss order at 1.2080, 30 pips below your entry point, ensuring a favorable risk-to-reward ratio. As the trade unfolds, you monitor the price action closely. If the price moves in your favor and reaches your profit target, you close the position and secure your 50-pip profit. If the price starts to move against you and reaches your stop-loss level, you exit the trade to limit losses.

By following this example trade, you’ve successfully achieved the goal of 50 pips for the day using the 50 pips a day Forex strategy. It’s important to note that not every trade will be a winner, and losses are inevitable in trading.

Free Backtesting Spreadsheet

Critical Look at the 50 Pips a Day Strategy

The 50 pips a day strategy beckons beginner forex traders with the promise of simplicity and achievable daily gains. However, a closer look reveals some significant shortcomings that can hinder your long-term success in the market. Here’s a breakdown of why this strategy might not be the magic bullet it appears to be.

Absence of Real Edge Seeking

The 50 pips a day approach prioritizes risk management through pre-defined profit targets and stop-loss orders. While commendable, effective risk management is just one piece of the puzzle. The strategy itself lacks clear explanation of entry and exit signals. Without a well-defined method to identify trading opportunities, achieving consistent profits becomes a matter of chance, not skill. Imagine entering a casino and placing random bets, hoping to win a specific amount each day. The 50 pips strategy can fall into this trap of lacking a statistically significant advantage (edge) over the market.

Ignoring Volatility

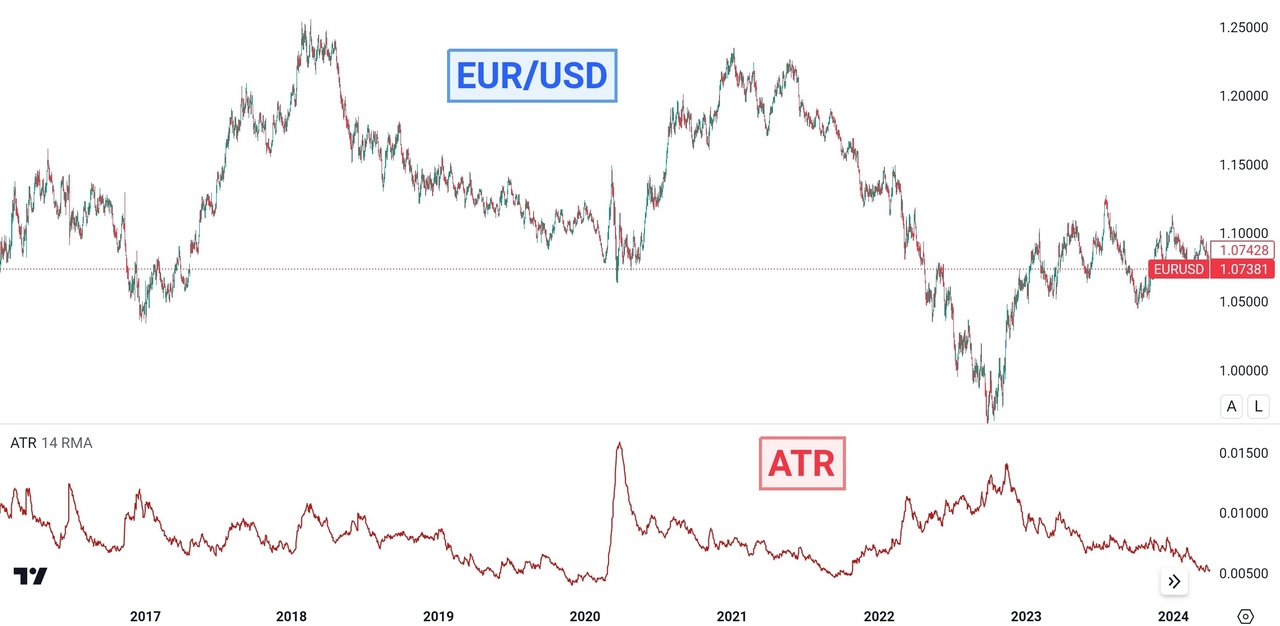

The arbitrary 50 pip target fails to consider crucial factors that drive price movements. Forex is a dynamic environment influenced by factors like economic data releases, central bank decisions, and global events. These factors can cause volatility to fluctuate, impacting the feasibility of achieving a fixed pip target each day. For instance, during periods of high volatility, a 50 pips target might be easily attainable. However, during low volatility periods, the market might meander within a tight range, making it challenging to reach the target without taking on excessive risk.

The chart shows significant fluctuations in EUR/USD daily ATR over the last 8 years, suggesting periods of high and low volatility.

Source: TradingView

The 50 pips a day strategy can be a starting point to spark interest in forex trading. However, for long-term success, aspiring traders should prioritize developing a well-rounded skillset.

- Learn to identify trends, analyze economic data, and assess volatility to make informed trading decisions.

- Master both fundamental and technical analysis for a comprehensive understanding of price movements

- Formulate a strategy with clear entry and exit signals based on your analysis and risk tolerance.

- Before deploying the 50 pips a day strategy in live trading, it’s crucial to backtest it rigorously using historical data. This allows traders to assess its performance under various market conditions and identify any potential weaknesses or areas for improvement.

Final Thoughts

The foreign exchange market offers vast potential for profit, but it also demands discipline, dedication, and a realistic understanding of market dynamics. While the 50 pips a day strategy might seem like a straightforward path to consistent gains, its limitations become evident upon closer examination. Remember, forex trading is a marathon, not a sprint. Consistent profitability takes time, discipline, and a commitment to continuous learning. By prioritizing skill development, adapting to market conditions, and employing a well-defined strategy, you can increase your chances of success in the exciting world of forex trading. The 50 pips a day strategy might serve as a basic introduction, but don’t let it be your final destination. Embrace the challenge, hone your skills, and embark on a forex trading journey built on a solid foundation of knowledge and a realistic perspective.

Share on Social Media:

Leave a Reply