Options trading provides numerous strategies and offers investors opportunities to generate income or hedge against risk. One such strategy is the covered call option strategy. This strategy is popular among investors seeking to enhance their portfolio returns while managing risk effectively. In this article, you will find detailed explanation of the covered call option strategy with examples, its mechanics, benefits, and risks.

What is Covered Call?

A covered call option strategy involves the combination of holding a long position in an underlying asset, typically stocks, and writing (selling) call options on that same asset. This strategy generates income for the investor in the form of premiums received from selling the call options. The investor, in return for receiving the premium, assumes the obligation to sell the underlying asset at a predetermined price (strike price) within a specified time frame (expiration date), should the buyer of the call option choose to exercise it.

How Does Covered Call Work?

To implement a covered call option strategy, an investor must follow these steps:

- Selecting the Underlying Asset. The investor begins by selecting an underlying asset that they own or intend to purchase. Typically, investors choose stocks with stable price movements and a bullish outlook.

- Determining the Strike Price and Expiration Date. Once the underlying asset is selected, the investor must decide on the strike price at which they are willing to sell the asset if the call option is exercised. Additionally, they choose an expiration date, which represents the duration of the option contract.

- Selling Call Options. With the strike price and expiration date in mind, the investor sells call options against the underlying asset in their portfolio. Each call option corresponds to 100 shares of the underlying asset. By selling call options, the investor collects premiums, which serve as immediate income.

- Monitoring and Managing Positions. Throughout the life of the options contract, the investor monitors the performance of the underlying asset and the options market. Depending on market conditions and their outlook, the investor may choose to buy back the call options, let them expire worthless, or allow them to be exercised, resulting in the sale of the underlying asset at the predetermined strike price.

Example and Risk Profile

Let’s consider an example of covered call. We’ll assume the following for simplicity:

- You bought the stock at $100.

- You sell a call option with a strike price of $110 and receive a $5 premium for it.

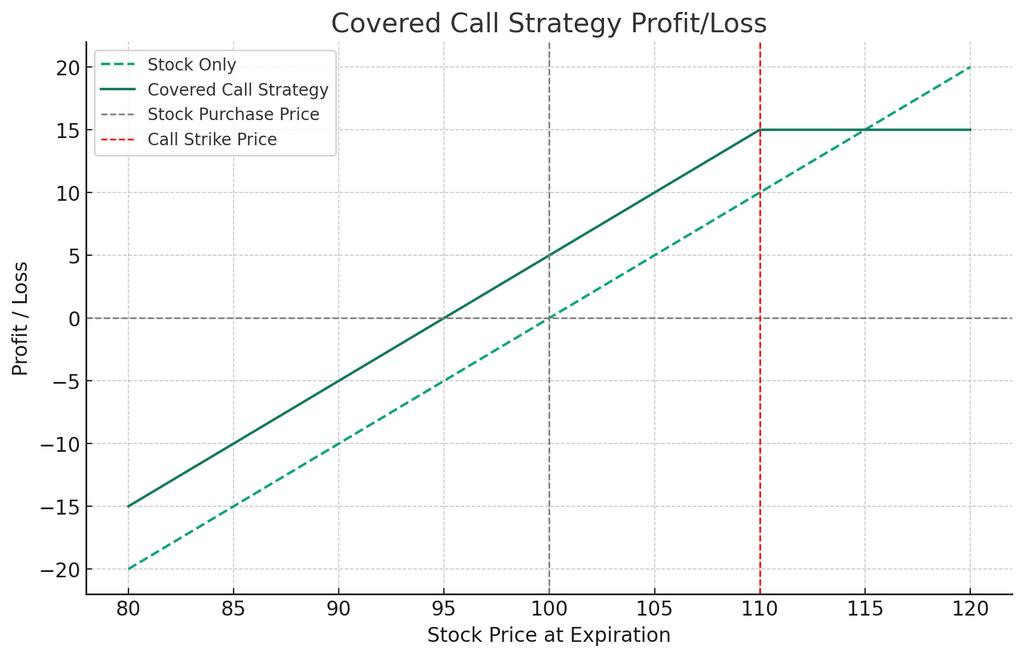

We’ll plot the profit/loss profile from a stock price of $80 to $120 to show how the covered call strategy performs across different stock price scenarios at option expiration.

The chart illustrates the profit/loss profile for both owning the stock alone (dashed line) and implementing a covered call strategy (solid line), given our assumptions:

- The vertical grey dashed line represents the stock’s purchase price ($100). To the right, you profit from owning the stock; to the left, you incur losses.

- The vertical red dashed line indicates the call option’s strike price ($110). This is where the profit from the covered call strategy caps out because you are obligated to sell the stock at this price if the stock price exceeds it at expiration.

- The covered call strategy curve shows that you start with a higher profit at lower stock prices compared to just owning the stock, thanks to the option premium collected. This provides a cushion against losses if the stock price falls.

- However, the profit potential is capped. Even if the stock price goes above the strike price ($110), your profit does not increase because you must sell the stock at the strike price due to the call option.

- The break-even point for the covered call strategy is lower than the stock’s purchase price due to the option premium received, offering a slight advantage if the stock price declines.

Free Backtesting Spreadsheet

Benefits of the Covered Call Option Strategy

The covered call option strategy offers 6 valuable advantages to investors.

#1. Income Generation

The primary benefit of the covered call strategy lies in its ability to generate income for investors. By selling call options on underlying assets they already own, investors receive premiums upfront. These premiums serve as immediate income, which can supplement existing cash flows or provide regular income streams. The income generated from selling call options can significantly enhance the overall returns of an investor’s portfolio, particularly in sideways or mildly bullish market conditions. This consistent income stream can be particularly appealing for retirees or investors seeking to diversify their income sources.

#2. Portfolio Hedging

Another significant advantage of the covered call strategy is its potential to serve as a form of portfolio insurance. During periods of market uncertainty or volatility, investors may seek ways to protect their portfolios against potential losses. The covered call strategy offers a means of downside protection by providing a cushion against declines in the value of the underlying asset. By receiving premiums from selling call options, investors can offset some of the losses incurred during market downturns. This hedging mechanism helps investors mitigate risk and preserve capital, thereby enhancing the overall resilience of their portfolios.

#3. Flexibility and Customization

One notable aspect of the covered call strategy is its flexibility and adaptability to different market conditions and investor preferences. Investors have the flexibility to customize their covered call positions by adjusting factors such as the strike price, expiration date, and the number of call options sold. This customization allows investors to tailor their strategies based on their outlook for the underlying asset and their risk tolerance. For example, selling options with higher strike price reduces the probability of assignment but decreases the premium received. Additionally, the covered call strategy can be combined with other options or stock positions to create more complex strategies, providing further flexibility in portfolio management.

#4. Risk Management

One of the key features of the covered call strategy is its emphasis on risk management. Since investors already own the underlying asset, the risk associated with the covered call strategy is considered lower compared to strategies like naked call writing. By holding the underlying asset, investors have built-in downside protection, as they can always sell the asset at its current market value if necessary.

#5. Diversification Benefits

Options, as derivatives, can serve as valuable components of a diversified investment portfolio. By incorporating options into their investment approach, investors can effectively diversify their risk exposure and potentially reduce overall portfolio volatility. Furthermore, the income generated from selling call options can complement returns from other asset classes, such as stocks or bonds, further enhancing portfolio diversification. Diversification is a fundamental principle of risk management that aims to spread investment risk across different assets to achieve more stable long-term returns while minimizing the impact of market fluctuations. By integrating options into a diversified portfolio, investors can benefit from the unique risk-return characteristics that derivatives offer, contributing to a well-rounded investment strategy.

#6. Profit Potential in Neutral or Slightly Bullish Markets

The covered call strategy has profit potential in neutral or slightly bullish market conditions. In such market environments, where the underlying asset’s price remains relatively stable or experiences modest increases, the covered call strategy can outperform traditional buy-and-hold strategies. By capturing premium income through selling call options, investors retain ownership of the underlying asset, with the potential obligation to sell it at the strike price if the call option is exercised. However, if the asset’s price rises above the strike price, the investor may still benefit from the premium income received and the difference between the strike price and the current market price of the asset. In such cases, the investor may miss out on potential future gains if the asset’s price continues to rise and the option is exercised, resulting in the sale of the asset at the predetermined strike price. This dual income and capital appreciation potential make the covered call strategy well-suited for investors seeking to maximize returns while managing risk effectively. But as we mentioned, these benefits come with some risks. So, let’s uncover details of these risks.

Risks Associated with the Covered Call

While the covered call option strategy offers various benefits, it also comes with certain risks:

- Limited Upside Potential. One of the main drawbacks of the covered call strategy is the limited upside potential. Since the investor is obligated to sell the underlying asset at the strike price if the call option is exercised, they may miss out on significant profits if the asset’s price experiences a substantial increase.

- Assignment Risk. There is always the possibility that the call options sold by the investor will be exercised by the buyer, resulting in the sale of the underlying asset at the predetermined strike price. This can occur if the price of the underlying asset rises above the strike price before the expiration date. In such cases, the investor may miss out on potential future gains if the asset’s price continues to rise.

- Market Risk. As with any investment strategy, the covered call option strategy is subject to market risk. Fluctuations in the price of the underlying asset, changes in market conditions, and unforeseen events can impact the performance of the strategy.

- Opportunity Cost. By selling call options against their holdings, investors limit their ability to participate fully in any substantial upside movement in the price of the underlying asset. This opportunity cost can be significant, especially in strongly bullish market environments.

Final Thoughts

The covered call option strategy offers investors a versatile tool for income generation, risk management, and enhancing portfolio returns. By combining the benefits of owning the underlying asset with the income generated from selling call options, investors can effectively navigate various market conditions while minimizing risks. However, it is essential for investors to understand the mechanics of the strategy, assess its risks, and align it with their investment objectives and risk tolerance. With careful planning and prudent execution, the covered call option strategy can be a valuable addition to any investor’s toolkit.

Share on Social Media: