In the wild west of cryptocurrency, where fortunes are made and lost with dizzying speed, a single word reigns supreme: HODL. More than just a misspelled version of “hold,” HODL has become a battle cry, a badge of honor, and a core tenet of crypto investing. But what exactly does HODL mean, and where did this internet meme turned investment strategy originate? This article will explain it in details: the fascinating history and multifaceted world of HODLing, exploring its potential benefits, drawbacks, and its place in the ever-evolving crypto landscape.

Birth of a Meme: The “I AM HODLING” Post

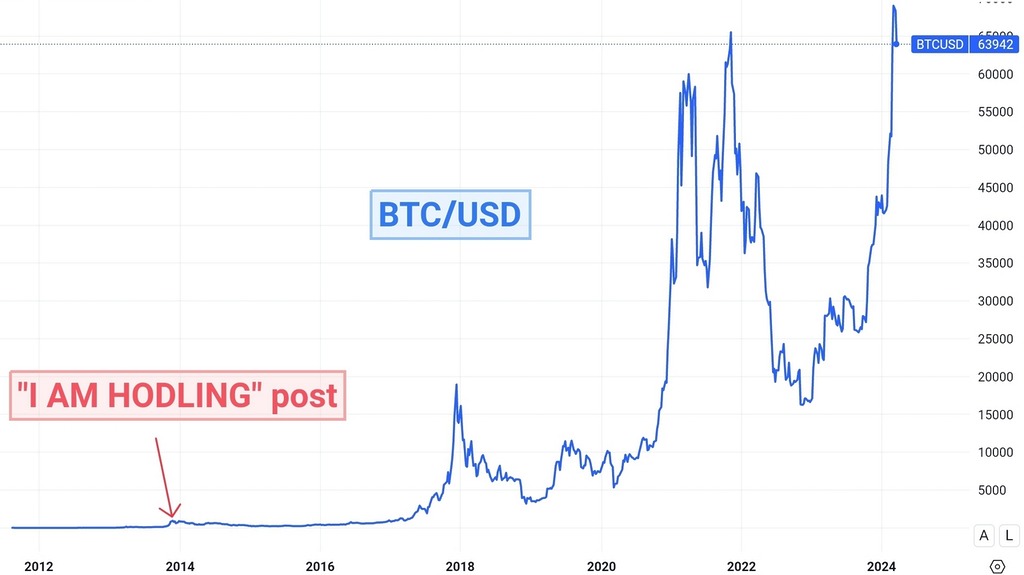

The year was 2013, and Bitcoin, the nascent digital currency, was experiencing a period of intense volatility. Prices were swinging wildly, and fear gripped many early investors. It was amidst this turmoil that a now-legendary post appeared on the Bitcointalk forum, a popular haunt for crypto enthusiasts. The user, known only by the pseudonym GameKyuubi, titled their post in all caps: “I AM HODLING.”

The body of the post, riddled with typos and grammatical errors, detailed GameKyuubi’s struggle to hold onto their Bitcoin despite the plummeting price. What was intended as a lament quickly took on a life of its own. The misspelling of “holding” as “hodling” became an instant meme, capturing the emotional rollercoaster of being a crypto investor. The internet, with its characteristic humor, ran wild. Backronyms were invented, with the most popular being “Hold On for Dear Life.” HODL perfectly encapsulated the white-knuckled determination needed to weather the storms of the crypto market.

HODL has transcended its original forum post and evolved into a full-fledged crypto culture. Merchandise emblazoned with the word HODL is a popular sight at crypto conferences. Online forums and social media are filled with HODLer memes and inspirational quotes urging investors to hold on. This cultural phenomenon reflects the strong sense of community and shared belief among cryptocurrency enthusiasts.

Bitcoin price chart 2011-2024. Gain since “I AM HODLING” post/TradingView

From Meme to Strategy

While born from a moment of despair, HODL soon transcended its meme status. It resonated with a growing community of crypto believers who saw beyond the short-term price fluctuations. They envisioned a future where Bitcoin and other cryptocurrencies would revolutionize the financial system. Proponents of the HODL strategy view short-term price movements as noise, focusing instead on the underlying technology and its disruptive capabilities. HODLers often believe that blockchain technology, the distributed ledger system underpinning cryptocurrencies, has the potential to transform various industries. They see cryptocurrencies as more than just speculative investments but as catalysts for a new financial paradigm. HODLers discount short-term price volatility, confident that the value of cryptocurrencies will increase over time as adoption grows and their utility expands. This strategy prioritizes long-term growth over short-term gains.

This buy-and-hold approach is not unique to crypto. Value investors in traditional markets have long advocated for a similar strategy, focusing on the underlying value of an asset rather than short-term price movements. However, the inherently volatile nature of cryptocurrency lends a new dimension to the HODL strategy. It requires a strong stomach, unwavering belief in the technology, and the ability to tune out the noise of a constantly chattering crypto world.

The Psychology of HODL

The psychology behind HODLing is complex and multifaceted. It requires a combination of patience, discipline, and conviction to withstand the emotional rollercoaster of crypto investing.

One of the key psychological drivers of HODLing is the fear of missing out (FOMO). In a market characterized by rapid price movements, investors may be tempted to chase short-term gains, fearing that they will miss out on opportunities for profit. HODLers, however, are immune to FOMO, as they are committed to their long-term investment strategy regardless of short-term fluctuations.

Additionally, the HODL strategy requires a strong belief in the underlying technology and principles of cryptocurrencies. Many HODLers are not just investors; they are enthusiasts who see themselves as part of a larger movement towards financial sovereignty and empowerment. This sense of community and shared purpose can help bolster resolve during periods of market turbulence.

However, HODLing is not without its psychological challenges. The fear of loss (FOL) can be particularly acute during bear markets, when the value of investments may plummet. Maintaining confidence in the face of adversity requires a deep-seated belief in the long-term viability of cryptocurrencies and a willingness to weather short-term storms.

Free Backtesting Spreadsheet

The Practicality of HODL

The practical implications of this strategy cannot be overlooked. The HODL requires careful portfolio management and risk assessment to ensure that investments are diversified and resilient to market fluctuations.

One practical consideration for HODLers is the choice of assets to hold. While Bitcoin is often touted as the flagship cryptocurrency, many HODLers diversify their portfolios to include a range of digital assets with varying risk profiles. This diversification helps mitigate risk and can increase the potential for long-term gains.

Furthermore, HODLers must stay informed about developments within the cryptocurrency ecosystem to make informed decisions about when to buy, sell, or hold their investments. This requires ongoing research into market trends, technological advancements, regulatory developments, and other factors that may impact the value of cryptocurrencies.

Another practical aspect of the HODL strategy is the importance of secure storage solutions. With the rising threat of hacking and theft, safeguarding cryptocurrency holdings is essential. HODLers often utilize hardware wallets, paper wallets, or secure digital vaults to protect their assets from unauthorized access.

Risks and Challenges of HODLing

While HODLing offers enticing benefits, it’s not without its risks. Understanding these challenges is crucial for investors looking to adopt this strategy.

Missed Opportunities

Cryptocurrencies are a dynamic asset class, characterized by rapid price movements and volatile market conditions. HODLing, by its nature, involves holding onto assets for the long term, potentially missing out on profitable short-term trades. For traders adept at timing the market, this could mean sacrificing opportunities for quick gains.

Impermanent Loss

In the realm of decentralized finance (DeFi), the HODL strategy can lead to impermanent loss, a situation where investors lose out on potential gains due to price fluctuations. This phenomenon occurs when providing liquidity to liquidity pools or yield farming platforms. Despite earning rewards, the value of the assets may not reflect their potential if held individually, resulting in a loss relative to holding them.

Technological Disruption

The crypto landscape is constantly evolving, with new technologies and regulations shaping its trajectory. A rigid HODL strategy may not adapt well to such disruptions. Emerging technologies or regulatory changes could render some existing cryptocurrencies obsolete, leading to significant losses for HODLers who fail to adjust their portfolios accordingly.

Total Loss

The cryptocurrency market is inherently risky, with numerous projects failing to gain traction or facing regulatory scrutiny. HODLing carries the risk of total loss if invested in projects that ultimately fail or turn out to be fraudulent. While diversification can mitigate this risk to some extent, investors must remain vigilant and conduct thorough research before committing to long-term HODL strategies.

The debate between HODLing and actively trading is a constant hum in the cryptosphere.

HODL vs. Trading

The debate between HODLing and actively trading is a constant hum in the cryptosphere. Finding the right balance between these approaches depends on various factors.

Risk Tolerance: Investors with a lower risk tolerance may be better suited for a more balanced approach, combining HODLing with some strategic trading. By diversifying their strategies, investors can capitalize on short-term opportunities while maintaining a long-term investment horizon.

Investment Horizon: Those with a long-term investment horizon are more likely to benefit from the HODL strategy, allowing them to ride out market volatility and capitalize on the potential long-term appreciation of their assets. However, it’s essential to remain flexible and adjust strategies as market conditions evolve.

Market Conditions: Market conditions play a significant role in determining the optimal strategy. During periods of rapid price appreciation, active trading may offer opportunities for short-term gains. Conversely, HODL may be a safer strategy during market downturns, helping investors avoid panic selling and capitalize on eventual market recovery.

Diversification: Regardless of the chosen approach, diversification is key to managing risk effectively. Investors can HODL a core set of established cryptocurrencies while allocating a smaller portion for active trading of potentially high-growth assets. This balanced approach helps mitigate risk while maximizing potential returns.

The Evolution of HODLing

The concept of HODLing has evolved beyond simply buying and holding. Here are some additional strategies that fall under the HODL umbrella:

HODL with Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy helps average out the purchase price and reduces the risk of buying at a peak, making it particularly suitable for long-term HODLers looking to accumulate assets gradually.

Staking

Staking allows investors to earn rewards on certain cryptocurrencies by locking them up for a specific period. This incentivizes the HODL strategy and provides additional passive income, making it an attractive option for investors seeking to generate returns while holding onto their assets.

Yield Farming

Yield farming is a DeFi strategy that involves depositing crypto assets into liquidity pools and earning rewards for providing liquidity. While offering potentially high yields, it also comes with greater risk due to the complexity and volatility of DeFi protocols. HODLers interested in yield farming should conduct thorough research and exercise caution before participating in such activities.

If cryptocurrencies become widely accepted as a means of payment and store of value, HODLing could become a mainstream investment strategy.

HODL and the Future of Crypto

The future of HODLing remains intertwined with the evolution of the cryptocurrency market. If cryptocurrencies become widely accepted as a means of payment and store of value, HODLing could become a mainstream investment strategy. As more individuals and institutions embrace cryptocurrencies, long-term HODLing may gain broader acceptance as a viable wealth-building strategy.

Increased regulations could bring stability to the market, making the HODL strategy a more attractive option for risk-averse investors. Clear regulatory frameworks and compliance standards could help alleviate concerns about fraud and manipulation, fostering greater confidence in long-term investment strategies like HODLing.

Additionally, technological advancements and new use cases for cryptocurrencies could further strengthen the case for HODLing specific assets with strong project fundamentals. As blockchain technology continues to evolve and mature, innovative projects may emerge that offer compelling opportunities for long-term growth and value creation.

Final Thoughts

HODLing represents more than just a misspelled word on a Bitcoin forum; it embodies a philosophy, psychology, and practical approach to cryptocurrency investing. It is a testament to the resilience and determination of those who believe in the transformative power of blockchain technology and the potential for cryptocurrencies to revolutionize finance.

While the HODL strategy is not without its challenges, it offers a compelling alternative to the frenetic pace of day trading and speculation. By adopting a long-term mindset and staying true to their convictions, HODLers have the opportunity to ride the waves of volatility and emerge stronger on the other side.

As the cryptocurrency market continues to evolve and mature, HODLing may remain a steadfast strategy for those seeking to build wealth and participate in the digital economy of the future. In a world of uncertainty and flux, HODLing provides a beacon of stability and hope for a better tomorrow.

Share on Social Media: