Traditionally, investors have focused on building wealth through stocks and bonds. But the financial landscape offers a wider range of opportunities, and commodities can be a compelling alternative investment. Commodities – the raw materials that fuel our world – can be a fascinating and potentially lucrative asset class for investors. From the oil that keeps our cars running to the wheat that fills our breadbaskets, commodities play a fundamental role in the global economy. But how exactly can you invest in these essential materials, and what are the key considerations before taking the plunge? This comprehensive guide dives deep into the world of commodity investing, exploring its potential benefits, risks, and various investment avenues.

Understanding the Commodity Market

Commodities can be broadly categorized into four main groups:

- Energy: This includes crude oil, natural gas, gasoline, and heating oil. Energy prices are highly sensitive to global economic activity, geopolitical tensions, and supply chain disruptions.

- Metals: Precious metals like gold and silver, and industrial metals like copper, iron ore, and aluminum, fall under this category. Their value is influenced by factors like industrial demand, inflation, and the US dollar’s strength.

- Agriculture: This encompasses grains (wheat, corn, soybeans), livestock (cattle, hogs), and soft commodities like coffee, sugar, and cotton. Agricultural prices are driven by factors like weather patterns, global population growth, and government policies.

- Livestock and Meat: The prices of cattle, hogs, and other livestock are influenced by factors such as feed costs, consumer demand, and disease outbreaks.

When there is a plentiful supply of a particular commodity relative to demand, prices tend to fall. Conversely, disruptions to supply or a surge in demand can cause prices to rise significantly.

Supply and Demand

The interplay of supply and demand is fundamental in commodity price formation. When there is a plentiful supply of a particular commodity relative to demand, prices tend to fall. Conversely, disruptions to supply or a surge in demand can cause prices to rise significantly. For example, adverse weather patterns like droughts or floods can significantly impact agricultural yields, leading to higher prices for wheat, corn, and other crops. Similarly, geopolitical tensions in oil-producing regions can disrupt supply chains and push oil prices upwards. By staying informed about factors that can influence supply and demand dynamics, investors can gain valuable insights into potential price movements in the commodity market.

Free Backtesting Spreadsheet

Seasonality in Commodity Prices

Some commodities exhibit predictable price fluctuations throughout the year due to seasonal factors impacting supply and demand. Here’s a brief look at some examples:

Agriculture: Crop prices often peak after harvest seasons due to a temporary surplus in supply. Conversely, prices tend to rise in anticipation of planting seasons due to increased demand for seeds and fertilizer. Weather patterns can significantly disrupt these trends. For instance, droughts or floods can cause shortfalls in crop yields, leading to price spikes even during off-seasons.

Livestock: Livestock prices can be influenced by seasonal variations in feed costs. For example, cattle prices might decrease in the fall when grazing lands are plentiful, leading to lower feed requirements. Holiday seasons can also impact demand for certain meats, like turkeys around Thanksgiving or hams around Easter.

Energy: Heating oil demand typically rises during colder winter months, potentially pushing prices higher. Conversely, demand might soften during the summer. However, seasonal trends in energy prices can also be influenced by broader factors like geopolitical tensions or global economic activity.

You should remember that seasonality is just one factor influencing commodity prices, and unexpected events can disrupt these trends.

Why Invest in Commodities?

There are several compelling reasons to consider incorporating commodities into your investment portfolio.

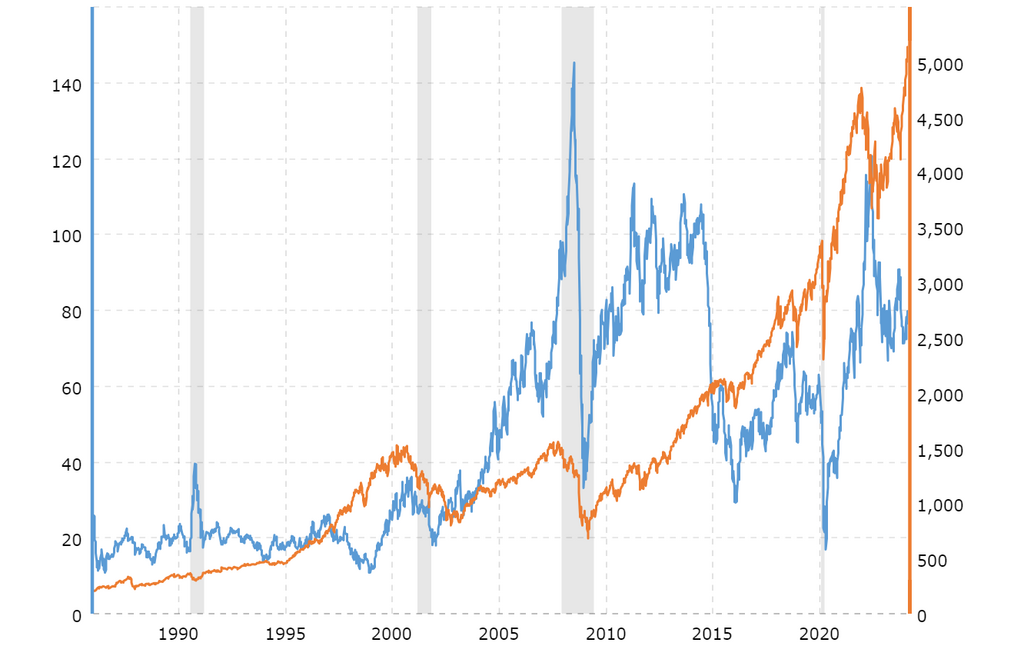

Diversification: Commodities with inelastic demand (energy, food staples) tend to exhibit a low correlation with traditional stocks and bonds. This means that including them in your portfolio can help mitigate risk and smooth out overall returns, especially during periods of market volatility.

Comparison of Crude oil prices (blue) and SP500 index (orange). Grey is recessions. Source: macrotrends.net

Inflation Hedge: Historically, commodity prices have often risen alongside inflation. As the cost-of-living increases, the value of commodities tends to go up as well, offering a potential hedge against inflation’s erosive effects on purchasing power.

Potential for High Returns: Commodity prices can experience significant swings, offering the possibility of substantial returns, particularly for investors with a high-risk tolerance.

Weakening US Dollar: A weakening US dollar can benefit commodity investors. Since many commodities are priced in US dollars, a decline in the dollar’s value makes them cheaper for investors holding foreign currencies. This can lead to increased demand for commodities and potentially drive their prices higher. For example, if the US dollar weakens against the Euro, European investors can purchase oil (priced in USD) at a discount, potentially increasing demand and driving up oil prices.

How to Invest in Commodities

There are several ways to gain exposure to commodities, each with its own advantages and disadvantages.

Physical Commodities

Owning physical commodities like gold or silver can provide a tangible hedge against inflation and economic uncertainty. However, this method comes with drawbacks. Storage costs can erode returns, and security risks are a concern, particularly for precious metals. Furthermore, not all commodities are practical to hold physically (think oil or wheat) and selling them can be time-consuming and involve additional transaction fees.

Futures are a widely chosen method for commodity trading due to their ability to magnify potential returns and their role in price discovery.

Futures Contracts

Futures contracts offer the potential for amplified gains due to leverage, allowing investors to control a larger quantity of a commodity with a smaller initial investment. However, this leverage is a double-edged sword, magnifying losses as readily as profits. Meeting margin calls (additional fund requirements) can be challenging, potentially forcing sales at unfavorable times. Additionally, futures contracts have expiration dates, requiring investors to roll over contracts (closing existing ones and opening new ones) to maintain their position, which incurs additional costs. Despite these risks, futures contracts remain a widely chosen method for commodity trading due to their ability to magnify potential returns and their role in price discovery.

Commodity Options

Compared to futures contracts, options offer greater flexibility. Investors can choose between call options (to profit from rising prices) or put options (to profit from falling prices) without the obligation to buy or sell the underlying commodity. This flexibility allows for targeted speculation or effective hedging strategies. However, option contracts suffer from time decay. Their value deteriorates over time even if the underlying commodity price remains unchanged. Options can also be complex financial instruments, requiring a thorough understanding for successful implementation.

Exchange-Traded Funds (ETFs)

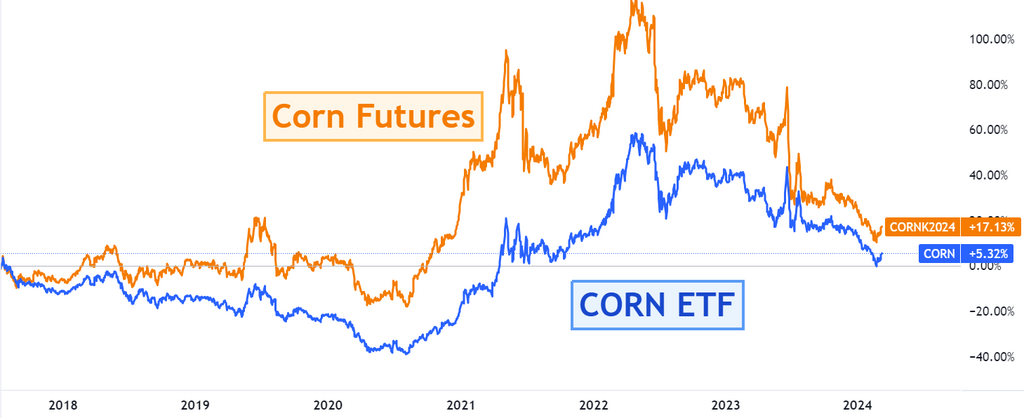

ETFs offer a convenient and cost-effective way to gain diversified exposure to a basket of commodities. They trade like stocks on exchanges, making them easy to buy and sell. However, tracking error (the difference between the ETF’s return and the return of the index it tracks) can prevent the ETF from perfectly mirroring the underlying commodity index performance. Additionally, some commodity ETFs are designed to roll over near-expiring futures contracts, which can result in exposure to contango. Imagine an ETF that holds futures contracts for corn. The current spot price of corn is $4 per bushel. The near-expiring futures contract might be priced at $4.50 per bushel since the market anticipates the price of corn to be higher in the future compared to the present price (contango). When the near-expiring contract nears its expiry date, the ETF sells it at $4.50. However, to maintain its exposure to corn, the ETF needs to buy a new futures contract. But due to contango, the new contract might be priced at $4.75 per bushel. In this scenario, the ETF experiences a loss of $0.25 per bushel even though the actual price of corn might not have changed. This effect can be amplified over multiple rollovers, potentially causing the ETF’s returns to deviate from the underlying commodity’s price movement.

Difference in performance of Teucrium Corn ETF (CORN) and corn futures

Examples of Commodity ETFs

Energy: SPDR S&P Oil & Gas Exploration & Production ETF (XOP), Invesco DB Energy Commodity Index Tracking ETF (DBC)

Metals: SPDR Gold Shares (GLD) is a popular way to gain exposure to gold prices, iShares Silver Trust (SLV) allows investors to invest in silver bullion.

Agriculture: Teucrium Corn ETF (CORN) tracks the price of corn futures contracts, iShares Diversified Agriculture Index ETF (DBA) provides exposure to a basket of agricultural commodities including corn, soybeans, wheat, and cotton.

Stocks of Commodity Producers

Investing in companies that explore, extract, or process commodities offers indirect exposure to the commodity market while potentially benefiting from company growth and dividend payouts. This approach allows investors to focus on specific sectors within the commodity space. However, the stock prices of commodity producers are influenced by factors beyond just the underlying commodity price. Company-specific performance, management decisions, and overall market conditions all play a role. Additionally, these companies may face additional risks like political instability in resource-rich regions or environmental regulations.

Examples of Stocks of Commodity Producers

Energy: Exxon Mobil Corporation (XOM) is one of the world’s largest integrated oil and gas companies. Chevron Corporation (CVX) is another major integrated oil and gas company.

Metals: Freeport-McMoRan Inc. (FCX) is a leading copper mining company. Newmont Corporation (NEM) is a gold and copper mining company.

Agriculture: Archer Daniels Midland Company (ADM) is a major agricultural processing and trading company. Bunge Limited (BG) is another large agricultural processing and trading company.

Livestock: Tyson Foods, Inc. (TSN) is a leading meat processing company. JBS SA (JBSAY) – Brazilian multinational meat processing company.

Futures contracts might be suitable for short-term strategies with high-risk tolerance, while ETFs cater more towards long-term diversification.

What to Choose for Commodity Investing

The best approach to commodity investing depends on your individual risk tolerance, investment goals, and time horizon. Here are some key factors to consider:

- Risk Tolerance: Commodity markets can be highly volatile. If you have a low-risk tolerance, consider investing in broad commodity ETFs to spread the risk.

- Investment Goals: Are you looking for short-term gains or long-term portfolio diversification? Futures contracts and options might be suitable for short-term strategies with high-risk tolerance, while ETFs cater more towards long-term diversification.

- Time Horizon: If you have a short investment horizon, the volatility of commodity markets can be particularly risky. Consider longer timeframes to allow for price fluctuations to even out.

- Investment Knowledge: Futures contracts and options require a deep understanding of derivatives markets and risk management strategies. ETFs offer a more accessible entry point for those with less experience.

- Fees and Expenses: Compare expense ratios for ETFs before investing. Consider the costs associated with storage and insurance if opting for physical commodities.

- Tax Implications: Capital gains taxes on commodity investments can vary depending on the investment vehicle and holding period. Consult a tax advisor for specific details.

The Risks of Commodity Investing

While there are attractive benefits, commodity investing also comes with inherent risks that need careful consideration:

- Volatility: Commodity prices are notoriously volatile, susceptible to fluctuations based on a complex interplay of global events, weather patterns, and supply-demand dynamics. This volatility can lead to significant losses if not managed appropriately.

- Storage Costs: Investing in physical commodities often involves storage costs, which can eat into your returns. Additionally, physical commodities may require specialized storage facilities, adding another layer of complexity.

- Geopolitical Risks: Political instability, wars, and trade disputes in resource-rich regions can significantly disrupt commodity supplies and cause price swings.

- Limited Liquidity: Investing in certain physical commodities or niche derivative contracts may have limited liquidity, making it difficult to enter or exit positions quickly.

Final Thoughts

Commodities can be a valuable addition to a diversified investment portfolio, offering potential benefits like inflation protection and diversification. However, careful consideration of the inherent risks and choosing the appropriate investment vehicle are crucial for success. By understanding the dynamics of the commodity market, aligning your investment strategy with your risk tolerance and goals, and conducting thorough research, you can navigate the exciting, yet challenging, world of commodity investing. It’s important to remember that speculative buying and selling by hedge funds and other market participants can contribute to price volatility, adding another layer of complexity to consider in your investment decisions.

Share on Social Media: