In the realm of investments, the allure of gold has endured across centuries and cultures. While stocks and bonds dominate mainstream investment portfolios, gold shines as an alternative asset with unique qualities that attract investors seeking diversification and stability. This article delves into the multifaceted appeal of buying gold as an alternative investment, exploring its historical significance, intrinsic value, role in portfolio diversification, and its relevance in contemporary investment strategies.

Historical Significance of Gold

Gold’s allure as a store of value and medium of exchange dates back to ancient civilizations. Its rarity, durability, and aesthetic appeal made it highly coveted for adornment, trade, and as a symbol of wealth and power. From the ancient Egyptians to the Roman Empire and beyond, gold played a central role in economic systems and monetary policies.

Throughout history, gold has maintained its purchasing power, serving as a hedge against inflation, currency devaluation, and geopolitical uncertainties. The allure of gold endured during times of economic turmoil, wars, and financial crises, as investors sought refuge in its intrinsic value and stability.

Intrinsic Value of Gold

Unlike fiat currencies that can be printed at will, gold possesses intrinsic value derived from its scarcity and unique physical properties. Gold is chemically inert, resistant to corrosion, and rare enough to maintain its value over time. Its tangible nature provides a sense of security that paper assets often lack.

Moreover, gold has diverse industrial applications, from electronics to healthcare, further underpinning its intrinsic value. The demand for gold extends beyond mere investment purposes, contributing to its resilience in the face of economic fluctuations.

Buying Gold for Portfolio Diversification

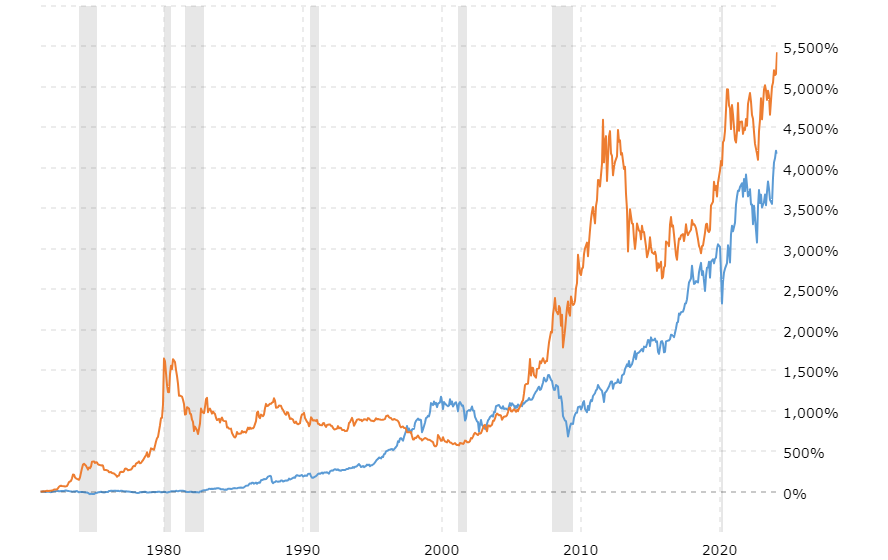

Gold’s role as a diversification tool is well recognized among investors and financial experts. Correlation analysis reveals that gold often exhibits low or negative correlations with traditional asset classes such as stocks and bonds. This inverse relationship can mitigate portfolio volatility and enhance risk-adjusted returns, particularly during periods of market turbulence.

Historical percentage return for the Dow Jones Industrial Average (blue) against the return for gold prices (orange) over the last 50 years. Gray is periods of recessions. Source: macrotrends.net

Buying gold for diversification of investment portfolio can improve its overall risk-return profile by providing a hedge against systemic risks and currency devaluation. Gold’s ability to preserve wealth over the long term makes it an attractive option for investors seeking stability amidst market uncertainties.

Buying Physical Gold as an Alternative Investment

Investors interested in owning physical gold have several options to consider, each with its own advantages and trade-offs. Gold coins, such as the American Eagle, Canadian Maple Leaf, or South African Krugerrand, offer liquidity, divisibility, and aesthetic appeal for investors seeking a tangible store of value. These government-issued coins are recognized globally and carry a nominal face value, providing additional legal tender status.

Alternatively, gold bars or bullion offer higher purity and lower premiums compared to coins, making them an attractive option for investors seeking maximum value per ounce. Gold bars typically come in various sizes, ranging from small ingots to larger kilo bars, catering to diverse investment budgets and preferences.

Storage and security are paramount considerations for investors holding physical gold. While some investors opt for home storage or safe deposit boxes, others prefer professional vaulting services offered by reputable custodians and bullion dealers. These secure storage facilities provide insurance, audit trails, and peace of mind for investors safeguarding their precious metal holdings.

Free Backtesting Spreadsheet

Market Liquidity of Gold

One of the key advantages of investing in physical gold is its high liquidity, which refers to the ease with which an asset can be bought or sold without significantly impacting its price. Gold’s liquidity stems from its universal acceptance and recognition as a store of value, making it readily tradable in various markets around the world.

When considering the liquidity of physical gold, investors should consider factors such as the availability of buyers and sellers, transaction costs, and the time it takes to complete a transaction. In general, gold coins and bars of standard sizes, such as one ounce or smaller, tend to be more liquid than larger or non-standard denominations.

Where to Buy Gold

- Local Dealers and Coin Shops: Local dealers and coin shops offer a convenient and accessible option for purchasing physical gold. These establishments typically carry a range of gold coins and bars, allowing investors to inspect the products in person before making a purchase. However, prices at local dealers may vary, and investors should be mindful of any premiums or fees associated with their purchases.

- Online Bullion Dealers: Online bullion dealers (APMEX, JM Bullion, Provident Metals) provide a wide selection of gold products and offer competitive pricing compared to local dealers. Investors can browse through various bullion products, including coins, bars, and rounds, and place orders conveniently from the comfort of their homes. When buying gold online, investors should ensure they are dealing with reputable dealers with a track record of reliability and security.

- Auctions: Auctions (Heritage Auctions, Stack’s Bowers Galleries) can be another avenue for purchasing physical gold, offering the opportunity to acquire rare or collectible coins and bars. While auctions may present the possibility of obtaining unique pieces at attractive prices, investors should exercise caution and thoroughly research the authenticity and provenance of the items being auctioned.

Gold Bullion Issuers

Gold bullion can be issued by a wide range of entities, including government mints, private mints, banks. Investors interested in purchasing gold bullion should carefully consider factors such as purity, authenticity, and reputation when selecting products from different issuers.

- Government mints are official institutions authorized by sovereign governments to produce and distribute coins and bullion. These mints typically produce legal tender coins with a specified face value and purity. Examples of government mints that issue gold bullion coins include the United States Mint (producer of the American Gold Eagle), the Royal Canadian Mint (producer of the Canadian Gold Maple Leaf), and the Perth Mint in Australia (producer of the Australian Gold Kangaroo).

- Private mints are independent facilities that specialize in the production of bullion bars, rounds, and other precious metal products. While they do not have the authority to issue legal tender coins, private mints often produce bullion products with high levels of purity and quality. Some well-known private mints that issue gold bullion bars and rounds include PAMP Suisse, Valcambi Suisse, and Sunshine Minting Inc.

- Some banks and financial institutions offer gold bullion products to their customers as part of their investment or wealth management services. These institutions may partner with refineries or mints to produce branded bullion products or offer allocated and unallocated gold accounts. Examples of banks that offer gold bullion products include Swiss banks like UBS and Credit Suisse, which offer gold bars and coins to investors through their precious metals divisions.

These are respectful issuers of gold bullion. When purchasing gold bullion, it’s crucial to consider the implications of buying from sanctioned entities and the risks involved in selling it internationally. Consulting with legal and financial advisors is advisable to understand applicable sanctions regulations and assess the feasibility and potential risks of the transaction. Since the perceived risk associated with assets from sanctioned entities may impact the liquidity and price of the gold bullion, making it more challenging to sell at favorable terms. Conducting thorough due diligence on the legal and regulatory landscape of the countries involved can help mitigate risks and ensure compliance with sanctions regulations.

Contemporary Investment Strategies

While physical ownership is one avenue, it’s not the only option to invest in gold. Exchange-traded funds (ETF), futures contracts, and gold mining stocks offer investors various avenues to gain exposure to the precious metal without the need for physical ownership.

Gold ETFs, such as SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), provide convenient and cost-effective access to gold bullion prices, allowing investors to buy and sell shares through brokerage accounts. Futures contracts enable investors to speculate on gold prices or hedge against market risks, albeit with higher volatility and leverage.

Performance (2006-2024) of Gold ETF and Gold. Factors such as transaction costs, management fees, and portfolio rebalancing can contribute to tracking error of ETFs over time. Chart source: TradingView

Gold mining stocks represent another avenue for investors to capitalize on the potential upside of gold prices while gaining exposure to the operational performance of mining companies. However, mining stocks may entail additional risks related to operational, geopolitical, and regulatory factors.

Risk Factors and Considerations

While gold offers diversification benefits and a hedge against economic uncertainties, it is not immune to risks and challenges. Like any investment, gold prices are subject to market forces, supply-demand dynamics, and geopolitical events. Fluctuations in interest rates, inflation expectations, and currency movements can influence investor sentiment towards gold.

Moreover, gold does not generate income or dividends like stocks or bonds, making it less appealing in environments characterized by strong economic growth and rising interest rates. Furthermore, the opportunity cost of holding gold must be considered, especially in periods of bullish equity markets or rising bond yields. Investors must weigh the trade-offs between potential capital appreciation and foregone returns from alternative investments.

Final Thoughts

The multifaceted appeal of buying gold as an alternative investment stems from its historical significance, intrinsic value, and role in portfolio diversification. As a tangible asset with intrinsic worth, gold serves as a hedge against inflation, currency devaluation, and geopolitical uncertainties. In today’s interconnected financial markets, gold continues to hold relevance as a diversification tool and store of value. Whether through physical ownership, ETFs, futures contracts, or mining stocks, investors have numerous avenues to incorporate gold into their investment portfolios.

However, investors must carefully consider the risk-return trade-offs, opportunity costs, and their individual investment objectives before allocating capital to gold. While gold may not be suitable for every investor or investment strategy, its unique qualities and historical track record make it a compelling option for those seeking to enhance portfolio resilience and preserve wealth over the long term.

Share on Social Media: