The world of investing can feel overwhelming, especially for beginners. Deciding where to put your hard-earned money involves navigating a multitude of options, each with its own set of advantages and drawbacks. Two popular choices for investors are exchange-traded funds (ETFs) and individual stocks. While they share some similarities, understanding the key differences between these two investment vehicles is crucial for making informed financial decisions.

What Are ETFs and Stocks?

Exchange-Traded Funds (ETFs): ETFs are investment funds that trade on stock exchanges, like individual stocks. They pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, commodities, or a combination thereof. ETFs are designed to track the performance of a specific index, sector, or asset class.

Individual Stocks: Stocks, on the other hand, represent ownership in individual companies. When an investor buys shares of a company’s stock, they become partial owners of that company, entitling them to a portion of its profits and voting rights at shareholder meetings.

9 Key Differences of ETFs and Stocks

#1. Accessibility and Ease of Use

ETFs offer accessibility to a wide range of investors, including beginners, due to their simplicity and ease of use. Investors can purchase ETF shares through brokerage accounts just like individual stocks, without the need for extensive knowledge or experience in stock selection. Individual stocks may require a deeper understanding of financial markets, company fundamentals, and valuation techniques. While some investors enjoy the process of analyzing and selecting individual stocks, others may find it daunting or time-consuming.

#2. ETFs vs Stocks: Diversification

ETFs typically offer broad diversification since they hold a basket of securities. This diversification helps spread risk across multiple assets, reducing the impact of any single security’s poor performance on the overall investment. In contrast, investing in individual stocks exposes investors to company-specific risks. A well-diversified portfolio of stocks requires significant research and monitoring.

#3. Risk and Volatility

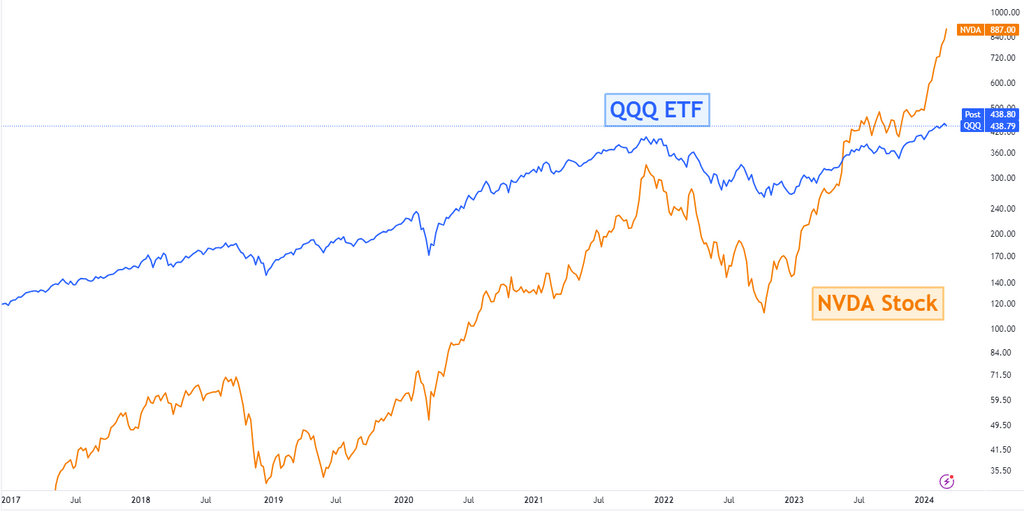

Due to their diversified nature, ETFs generally exhibit lower volatility compared to individual stocks. The risk of significant losses from a single security’s decline is mitigated in ETFs. However, this also means that ETFs may not experience the same potential for high returns as individual stocks, which can be more volatile but offer greater upside potential.

Comparison of Invesco QQQ Trust ETF and Nvidia stock prices (logarithmic)/TradingView

#4. Management and Expenses

ETFs are passively managed funds, meaning they aim to replicate the performance of an underlying index or asset class rather than actively selecting securities. As a result, ETFs typically have lower management fees. On the other hand, investing in individual stocks requires active management, research, and monitoring, which can incur higher costs and time commitment.

#5. Liquidity and Trading

ETFs trade on stock exchanges throughout the trading day, offering liquidity and flexibility to buy or sell shares at market prices. This liquidity makes ETFs suitable for short-term trading strategies. Individual stocks also trade on exchanges, but their liquidity may vary depending on factors such as company size, trading volume, and market conditions.

#6. Market Exposure and Strategy

ETFs provide exposure to specific market segments, sectors, or asset classes, allowing investors to implement various investment strategies. For instance, investors can gain exposure to broad market indices, such as the S&P 500, or focus on specific sectors like technology or healthcare. Conversely, investing in individual stocks enables investors to capitalize on the potential growth of particular companies or industries, but it requires diligent research and analysis.

#7. Long-Term vs. Short-Term Investing

ETFs are well-suited for long-term investors seeking stable, diversified exposure to the broader market or specific sectors. Holding ETFs over the long term can help mitigate short-term market volatility and provide consistent returns over time. Individual stocks may be favored by investors with a shorter time horizon or those seeking to capitalize on short-term market opportunities or specific company events. However, short-term trading in individual stocks can be speculative and subject to higher transaction costs and tax implications.

Free Backtesting Spreadsheet

#8. Dividends and Corporate Actions

When investing in individual stocks, investors may receive dividends and participate in corporate actions such as stock splits, mergers, or acquisitions. These events can impact the overall return and composition of the investor’s portfolio. ETFs also distribute dividends from the underlying assets, but the frequency and amount may vary depending on the fund’s structure and investment strategy.

#9. Tax Efficiency of ETF and Stock investments

ETFs are generally considered tax-efficient investment vehicles compared to individual stocks. Since ETFs typically have low turnover and do not require frequent buying and selling of securities, they generate fewer capital gains distributions, resulting in potential tax savings for investors.

Making Informed Investment Decisions

- Understand Your Investment Goals and Risk Tolerance: Before choosing between ETFs and individual stocks, it’s essential to clarify your investment objectives, time horizon, and risk tolerance. ETFs may be suitable for long-term investors seeking diversified exposure to various market segments with lower risk, while individual stocks may appeal to those comfortable with higher volatility and willing to conduct thorough research.

- Conduct Research and Due Diligence: Regardless of the investment vehicle chosen, conducting research and due diligence is crucial. For ETF investors, this involves understanding the fund’s underlying assets, expense ratio, tracking error, and performance relative to its benchmark. For stock investors, researching company fundamentals, financials, industry trends, and competitive positioning is essential.

- Consider Portfolio Diversification: Diversification is key to managing risk in any investment portfolio. While individual stocks offer the potential for outsized returns, they also carry higher company-specific risk. Combining both ETFs and individual stocks in a portfolio can provide a balanced approach, benefiting from the diversification of ETFs and the growth potential of individual stocks.

- Monitor and Rebalance Your Portfolio: Regularly monitor your investment portfolio to ensure it remains aligned with your investment goals and risk tolerance. Rebalancing may be necessary to adjust asset allocations and maintain diversification. Additionally, staying informed about market developments, economic indicators, and geopolitical events can help guide investment decisions.

Final Thoughts

ETFs and individual stocks are two popular investment vehicles offering distinct advantages and disadvantages. ETFs provide diversification, lower volatility, and cost-effective exposure to various market segments, while individual stocks offer the potential for higher returns but require active management and research. Ultimately, the choice between ETFs and stocks depends on individual preferences, investment goals, and risk tolerance.

Share on Social Media: