Options trading, while offering a broader range of investment strategies, can feel complex for newcomers. Understanding the two fundamental types, calls and puts, is a crucial first step. This article delves into the world of calls and puts, exploring when to buy and when to sell each to maximize your potential gains while mitigating risks.

Demystifying Calls and Puts: A Fundamental Distinction

Calls

Imagine you see a promising new gadget and are convinced its price will skyrocket. However, you’re hesitant to commit a large sum upfront. A call option grants you the right, but not the obligation, to buy the underlying asset (the gadget in this case) at a predetermined price (strike price) by a specific date (expiration date). It’s like having a reservation at a discounted price, allowing you to capitalize if the price surges but limiting your risk to the premium you paid for the call option.

Puts

Conversely, let’s say you’re concerned about the stock market and believe a specific company’s stock might plummet. A put option grants you the right, but not the obligation, to sell the underlying asset at the strike price by the expiration date. It’s like an insurance policy in case the price crashes. You pay a premium for this protection, but your potential loss is capped at the premium, unlike short-selling, which carries the risk of unlimited losses.

When to Buy Calls

Scenario 1: Anticipated Stock Surge

Your research indicates a company is about to launch a groundbreaking product, potentially driving its stock price significantly higher. Buying a call option allows you to participate in this potential upside without committing the full purchase price upfront. If the price surpasses the strike price by expiration, you can exercise the option, buy the stock at the lower strike price, and sell it at the higher market price, pocketing the difference minus the premium paid. You can choose not to exercise the option and instead sell the call option contract itself in the market.

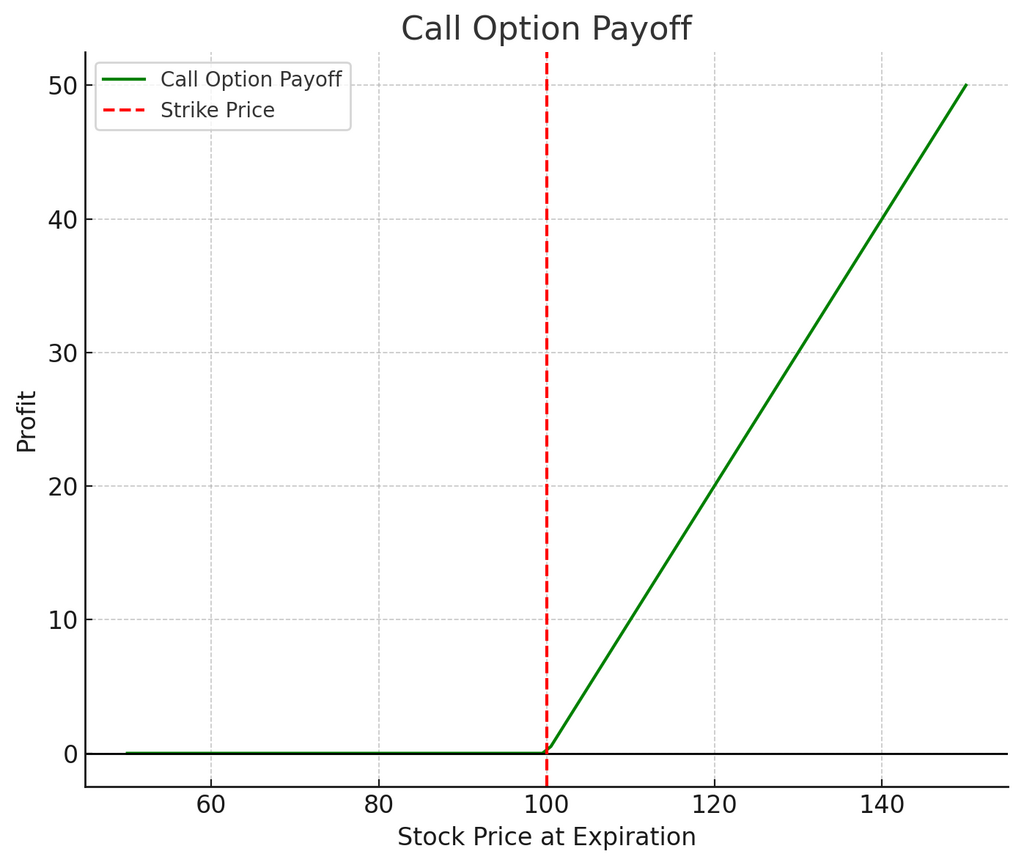

This graph shows that the profit for the call option holder increases as the stock price rises above the strike price (indicated by the red dashed line). If the stock price is below the strike price at expiration, the call option is worthless, and the holder does not exercise the option, resulting in no profit.

Scenario 2: Limited Capital, High Expectations

You’re bullish on a particular stock but have limited capital. Buying a call option, which requires a smaller upfront investment compared to buying the stock outright, allows you to leverage your capital and potentially magnify your gains if the price rises. However, remember that if the stock price remains stagnant or falls below the strike price by expiration, the call option expires worthless, and you lose the premium.

Scenario 3: Income Generation Strategy (Covered Calls)

If you already own a stock and believe its price will remain stable or increase slightly, selling covered calls can generate income. By selling a call option, you collect the premium upfront, essentially receiving income for agreeing to sell your stock at the strike price by expiration. However, if the stock price surges beyond the strike price by expiration, you’ll be obligated to sell your shares at the lower strike price, potentially forgoing the higher market price.

Free Backtesting Spreadsheet

When to Buy Puts

Scenario 1: Bearish Market Outlook

You anticipate a broader market downturn and want to hedge your portfolio. Buying put options on an index fund or ETF tracking a specific market sector can provide downside protection. If the market indeed falls, the put options gain value, potentially offsetting losses in your other holdings. However, if the market remains flat or rises, the put options expire worthless, and you lose the premium paid.

Scenario 2: Short-Term Bearish on a Specific Stock

You believe a particular company might face temporary challenges, potentially causing its stock price to dip in the short term. Buying a put option allows you to profit from this potential decline. If the stock price falls below the strike price by expiration, you can exercise the option, sell the stock at the higher strike price, and repurchase it at the lower market price, pocketing the difference minus the premium paid. You can choose not to exercise the option and instead sell the put option contract itself in the market. This allows you to profit from the decline in the stock price without taking ownership of the underlying stock.

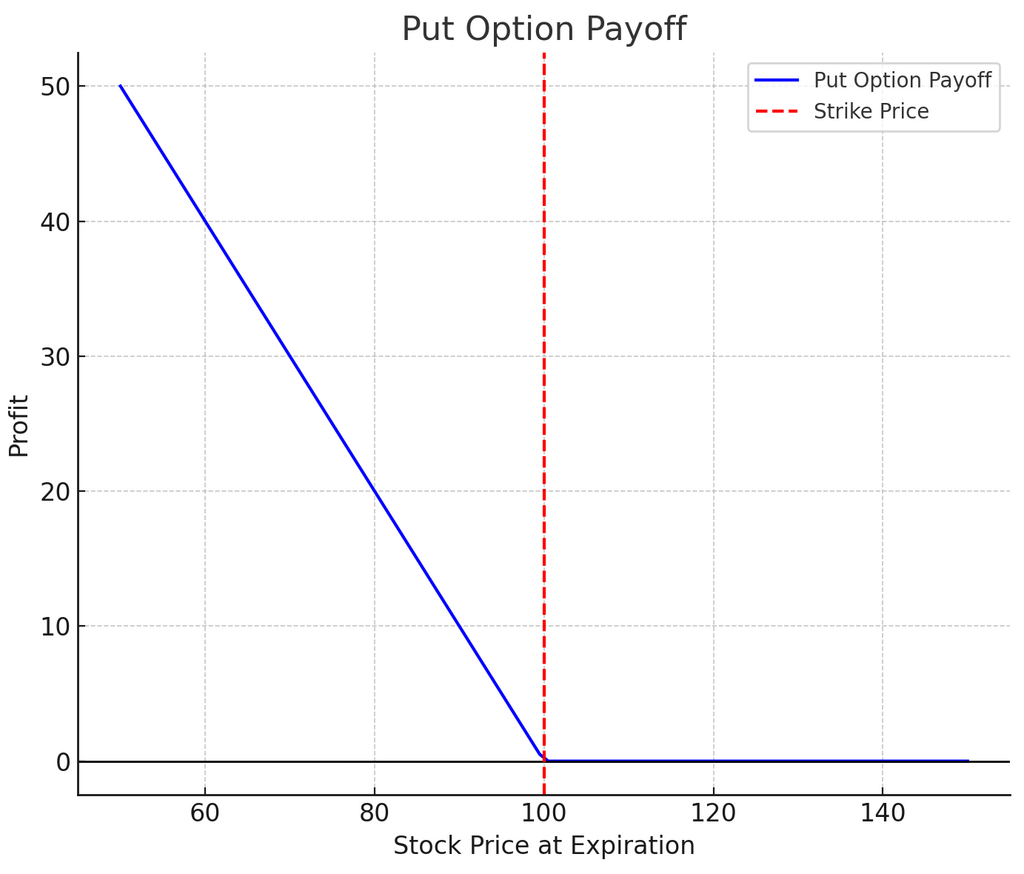

Conversely to the call options, this graph illustrates that the profit for the put option holder increases as the stock price falls below the strike price. If the stock price is above the strike price at expiration, the put option is worthless, and the holder does not exercise the option, leading to no profit.

When to Sell Calls and Puts: Advanced Strategies

Selling options, often referred to as “option writing,” involves different risks and rewards compared to buying them. It’s generally considered an advanced strategy and should be approached with caution, especially by beginners. This section explores various scenarios for selling calls and selling puts, highlighting the potential benefits and risks involved.

Scenario 1: Generating Income with Covered Calls (Selling Calls on Owned Stock)

Situation: You own 100 shares of Company XYZ at $50 per share. You’re moderately bullish on the stock and believe the price may remain stable or rise slightly soon. You’d also like to generate some additional income.

Strategy: Sell 1 call option contract on XYZ with a strike price of $55 and an expiration date 3 months out. You receive a premium, let’s say $2 per share, for a total of $200 (100 shares * $2/share).

Potential Benefits:

- Collect premium: You keep the premium regardless of the stock price movement.

- Limited downside risk: If the stock price stays below $55 by expiration, the option expires worthless, and you retain your shares.

- Potential for upside participation: If the stock price rises moderately above $55, you can still profit by selling your shares at a higher market price before expiration.

Potential Risks:

- Missed opportunity: If the stock price surges significantly beyond $55, you forfeit the potential for higher profits by being obligated to sell at the lower strike price.

Scenario 2: Cash-Secured Puts (Acquiring Stock at a Discount)

Situation: You’re interested in buying shares of Company ABC, currently trading at $40 per share. However, you believe the price may dip soon and want to acquire it at a discount.

Strategy: Sell 1 put option contract on ABC with a strike price of $35 and an expiration date 2 months out. You receive a premium, say $1 per share, for a total of $100 (100 shares * $1/share). You also have the cash available to potentially buy 100 shares of ABC at $35 per share if the option is exercised (assigned) against you.

Potential Benefits:

- Collect premium: You keep the premium regardless of whether you acquire the stock.

- Discounted purchase: If the stock price falls below $35, you are obligated to buy it at the strike price, effectively acquiring it at a discount.

Potential Risks:

- Stock price decline exceeding premium: If the stock price plummets significantly, you’ll be forced to buy it at $35, potentially incurring a loss that exceeds the premium received.

- Capital commitment: You need to have sufficient capital available to potentially purchase the underlying asset at the strike price if assigned. Cash-Secured Put in details.

Scenario 3: Selling Naked Calls

Situation: You’re strongly bearish on a specific stock and believe it will decline significantly in price. You aim to capitalize on this potential decline.

Strategy: Sell 1 naked call option contract on the stock with a strike price above the current market price and an expiration date a few months out. You collect the premium upfront.

Potential Benefits:

- Collect premium: If the stock price falls below the strike price by expiration, the option expires worthless, and you keep the premium as your profit.

Potential Risks:

- Unlimited downside risk: If the stock price surges beyond the strike price, you’ll be obligated to buy it at a higher price to fulfill the contract, potentially incurring significant losses. This risk is much higher compared to other strategies as you don’t own the underlying asset initially.

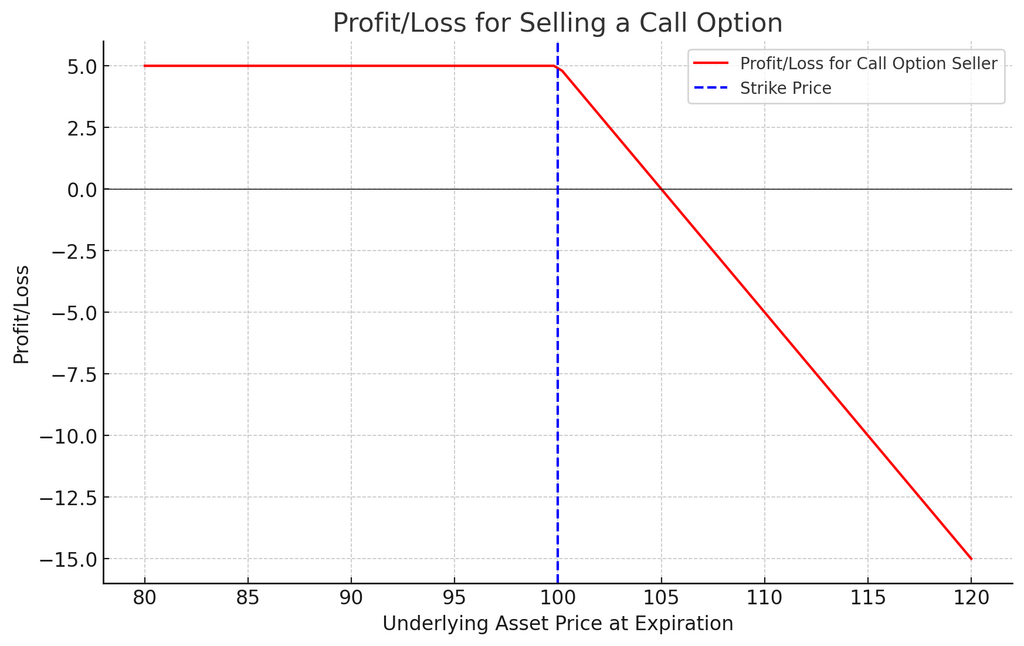

The graph above illustrates the profit or loss for selling a call option based on the underlying asset’s price at expiration. Here’s how to interpret the graph:

Below the Strike Price (Blue Dashed Line): If the underlying asset’s price at expiration is below the strike price of $100, the option is not exercised, and the seller’s profit remains constant at the premium received, which is $5 in this scenario.

Above the Strike Price: As the underlying asset’s price increases above the strike price, the profit for the option seller decreases. The slope of the line indicates that the seller’s profit decreases dollar for dollar with the increase in the asset’s price above the strike price, leading to potential losses if the asset’s price significantly exceeds the strike price.

At and Beyond Breakeven Point: The breakeven point for the option seller is the strike price plus the premium received (not explicitly marked on the graph). Beyond this point, the seller incurs a loss, which can theoretically grow infinitely as the underlying asset’s price increases.

Scenario 4: Selling Naked Puts

Situation: You believe the stock price of a specific company will remain stable or increase, and you’d like to generate income. However, you’re also willing to take on the risk of potentially acquiring the stock at a higher price.

Strategy: Sell 1 naked put option contract on the stock with a strike price below the current market price and an expiration date a few months out. You collect the premium upfront.

Potential Benefits:

- Collect premium: You keep the premium regardless of whether you acquire the stock.

Potential Risks:

- Assignment risk and potential losses: If the stock price falls below the strike price, you’ll be obligated to buy it at the higher strike price, potentially incurring a loss if the price continues to decline. This risk is much higher compared to other strategies as you don’t initially own the underlying asset.

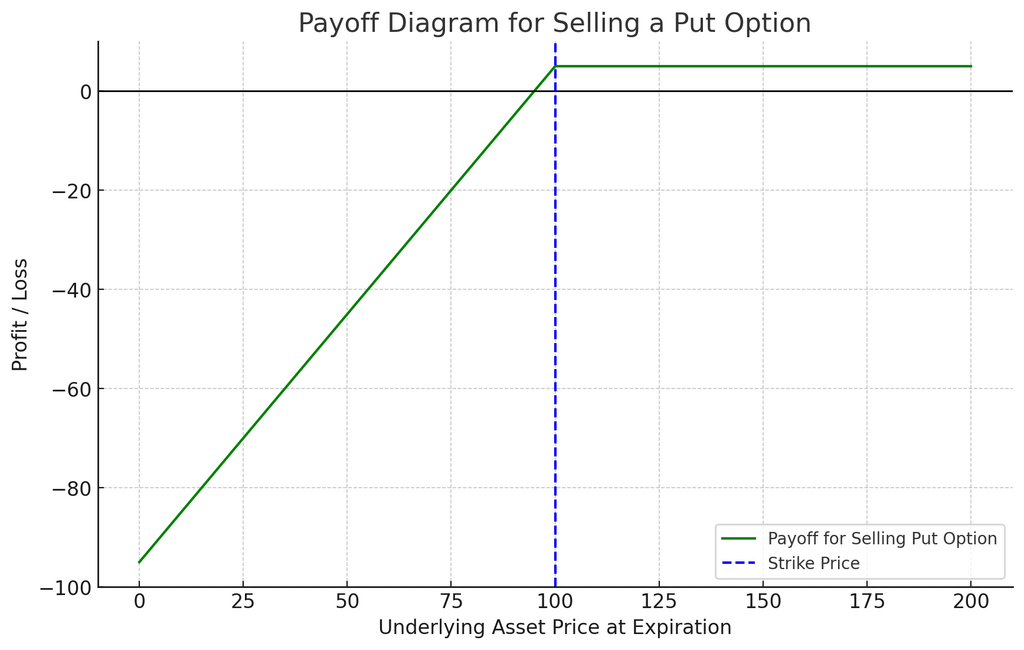

The payoff diagram for selling a put option is illustrated above. The diagram highlights several key aspects:

Flat Line Above Strike Price: When the price of the underlying asset at expiration is above the strike price ($100 in our example), the put option is not exercised by the buyer. The seller’s profit is the premium received ($5), represented by the flat line at the top.

Downward Sloping Line Below Strike Price: If the price of the underlying asset falls below the strike price, the option is likely to be exercised by the buyer. The seller then starts to incur losses. These losses increase as the price of the underlying asset decreases but are initially offset by the premium received. The slope indicates that the seller has to buy the asset at the higher strike price, which could be sold only at the lower market price, resulting in a loss.

Break-even Point: This is the point where the line crosses the X-axis, slightly below the strike price. It is calculated by subtracting the premium received from the strike price ($100 – $5 = $95). If the price of the underlying asset at expiration is exactly $95, the seller breaks even.

Important Considerations:

- Market Volatility: Selling options is generally riskier in volatile markets compared to stable markets. Fluctuations can significantly impact option prices and magnify potential losses.

- Liquidity: Ensure the options contracts you plan to sell have sufficient liquidity to ensure you can easily exit your position if needed.

- Margin Requirements: Selling naked options often requires a margin account, meaning you’ll need to meet specific minimum equity requirements to hold the position.

- Advanced Skills and Risk Management: Selling options, especially naked options, requires advanced skills and a strong understanding of options mechanics, risk management techniques, and emotional discipline to navigate the inherent risks effectively.

Final Thoughts

While selling calls and puts can be powerful tools for generating income and implementing specific investment strategies, the risks involved are significant. These strategies are best suited for experienced options traders with a strong understanding of market dynamics, risk management, and the ability to handle potential losses. For beginners, it’s crucial to start with less risky strategies like buying calls and puts and gradually progress towards more complex strategies with experience and proper education. Remember, consulting with a financial advisor experienced in options trading is highly recommended before venturing into advanced strategies.

Share on Social Media: