The Asian stock market has long been a focal point for investors seeking dynamic growth opportunities. Boasting diverse economies, robust technology sectors, and rapidly expanding consumer markets, Asia offers a rich tapestry of investment prospects. In this comprehensive guide, we delve into the intricacies of the Asian stock market, exploring its key features, historical context, key players, emerging trends, potential future trajectories and investing opportunities.

A Historical Perspective of the Asian Stock Market

The roots of the Asian stock market can be traced back centuries, with early exchanges established in places like Calcutta (now Kolkata) and Hong Kong in the 19th century. However, significant growth occurred in the post-war era, fueled by rapid economic development and liberalization policies in several Asian nations. Japan, for instance, emerged as a global financial powerhouse in the 1980s, followed by the “Asian Tigers” – South Korea, Taiwan, Singapore, and Hong Kong – in the 1990s.

The 1997 Asian financial crisis served as a harsh reminder of the region’s vulnerability to external shocks. However, Asian economies displayed remarkable resilience, undergoing significant reforms and restructuring to strengthen their financial systems. This paved the way for renewed growth and the emergence of new economic giants like China and India.

Key Players of the Asian Stock Market

Chinese Stock Market

As the world’s second-largest economy, China commands significant attention from investors. The Shanghai and Shenzhen stock exchanges are key players, offering exposure to China’s vast manufacturing base, growing consumer market, and expanding tech sector. The Shanghai Composite Index (SSEC) and the CSI 300 Index, which tracks the top 300 stocks traded in Shanghai and Shenzhen, are key benchmarks for assessing the performance of Chinese equities.

Japanese Stock Market

With a rich industrial heritage and a strong tradition of innovation, Japan remains a powerhouse in the Asian stock market. The Tokyo Stock Exchange serves as the primary platform for trading Japanese equities, providing access to leading companies in automotive, electronics, and finance sectors. The Nikkei 225 Index, comprising 225 blue-chip companies listed on the Tokyo Stock Exchange, serves as a widely followed indicator of Japanese market performance.

South Korea’s stock market

South Korea’s stock market, represented by the Korea Exchange (KRX), is renowned for its vibrant technology sector, led by giants such as Samsung Electronics and SK Hynix. Additionally, the country boasts a robust manufacturing base and a thriving export-oriented economy. South Korea’s stock market is represented by the KOSPI Index. The KOSDAQ Index focuses on smaller and more speculative companies, offering additional insights into South Korea’s equity market.

India’s stock market

India’s stock market, dominated by the Bombay Stock Exchange (BSE) with its BSE Sensex index and the National Stock Exchange (NSE) with the Nifty 50 Index, offers exposure to a rapidly growing economy driven by a growing middle class, digital transformation, and ambitious infrastructure projects.

Southeast Asia

Countries such as Singapore, Malaysia, Indonesia, Thailand, and Vietnam collectively form an increasingly important part of the Asian stock market landscape. These economies benefit from strategic geographical locations, growing consumer markets, and government initiatives aimed at attracting foreign investment. The Straits Times Index (STI) in Singapore, the FTSE Bursa Malaysia KLCI in Malaysia, and the SET Index in Thailand are among the notable indices reflecting the performance of their respective markets.

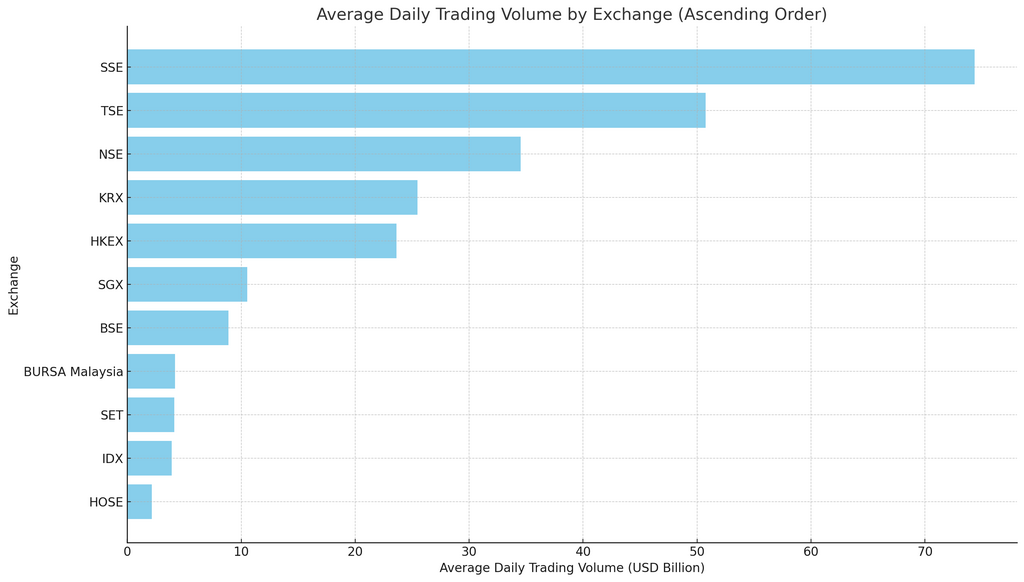

Average daily trading volume for the mentioned stock exchanges as of February 26, 2024:

Daily trading volumes can fluctuate significantly, so these figures represent an average and may not reflect current activity.

Recent Trends and Performance

2023 has been a year of mixed fortunes for Asian markets. While the Nikkei 225 in Japan has reached record highs, other markets like the Hang Seng in Hong Kong have experienced volatility. This disparity reflects the varying economic landscapes across the region.

Factors Driving Performance of the Asian Stock Market

Several factors are shaping the current landscape:

- Economic Growth: The region’s economic growth, while robust, is experiencing a slowdown. China, the economic powerhouse, faces headwinds due to its ongoing property sector woes and COVID-19 concerns. Other countries, like India, are experiencing strong growth but remain susceptible to global economic fluctuations.

- Geopolitical Tensions: The ongoing trade war between the US and China, coupled with regional tensions in the South China Sea and the Korean Peninsula, create uncertainty and can negatively impact investor sentiment.

- Monetary Policy: Central banks across Asia are grappling with the balance of curbing inflation while supporting economic growth. Interest rate hikes, while necessary to combat inflation, can dampen investor activity and slow down market growth.

- Technological Advancements: Asia is at the forefront of technological innovation, particularly in areas like e-commerce, artificial intelligence, and renewable energy. These sectors present exciting investment opportunities but also require careful analysis due to their inherent volatility.

Looking Ahead: Opportunities and Challenges

Despite the challenges, the Asian stock market holds immense potential for investors. Here are some key aspects to consider:

- Technology and Innovation: Asian countries are at the forefront of technological innovation, with thriving ecosystems in areas such as artificial intelligence, e-commerce, fintech, and renewable energy. Companies like Tencent, Alibaba, and TSMC exemplify Asia’s leadership in tech-driven industries.

- Consumer Sector Growth: Rising incomes, urbanization, and changing lifestyles are driving robust demand for consumer goods and services across Asia. From luxury brands to fast-moving consumer goods, companies catering to the Asian consumer market are experiencing significant growth opportunities.

- Infrastructure Development: Many Asian countries are investing heavily in infrastructure projects, including transportation networks, smart cities, and renewable energy initiatives. These developments not only stimulate economic growth but also create opportunities for investors in sectors such as construction, engineering, and utilities.

- Economic Integration: Regional economic integration initiatives, such as the Association of Southeast Asian Nations (ASEAN) Economic Community and China’s Belt and Road Initiative, are fostering greater connectivity and trade among Asian countries. This integration is opening new avenues for cross-border investment and collaboration.

- Environmental, Social, and Governance (ESG) Investing: Increasing awareness of environmental and social issues is driving demand for ESG-compliant investments in the Asian stock market. Companies that prioritize sustainability and corporate responsibility are attracting growing interest from investors focused on long-term value creation.

Free Backtesting Spreadsheet

Investing in the Asian Stock Market

The Asian stock market, with its diverse landscape and potential for growth, presents exciting opportunities for investors seeking to diversify their portfolios. However, successfully navigating this complex market requires careful planning, thorough research, and the adoption of sound investment strategies.

Understanding Investment Vehicles

Investors seeking exposure to the Asian market can utilize various investment vehicles, each with its unique advantages and disadvantages:

- Direct Stock Purchase: Buying individual stocks listed on Asian exchanges offers the potential for high returns. However, it requires extensive research, a deep understanding of the specific company, and a higher tolerance for risk.

- Exchange Traded Funds (ETFs): These are passively managed funds that track a specific index, offering diversified exposure to a basket of Asian stocks. ETFs provide lower risk compared to individual stock picking and are suitable for investors seeking broader market exposure.

- Mutual Funds: Actively managed by fund managers, these funds invest in a selection of Asian stocks based on their specific investment philosophy. Mutual funds offer professional guidance but come with management fees.

- American Depositary Receipts (ADRs): These are US-listed securities representing shares of foreign companies, including those listed on Asian exchanges. ADRs offer convenient access to foreign stocks, but their liquidity and fees can vary.

Beyond Equities: Alternative Investments

While equities are a popular choice, the Asian market offers alternative investment opportunities:

- Real Estate Investment Trusts (REITs): These are companies that own and operate income-generating real estate. They offer exposure to the Asian property market and can provide regular income streams.

- Commodities: Asia is a major producer and consumer of various commodities like oil, metals, and agricultural products. These can be accessed through futures contracts or commodity ETFs. However, commodity prices are highly volatile and require careful risk management.

Essential Factors for Consideration

Before venturing into the Asian stock market, consider these crucial factors:

- Currency Fluctuations: The value of your investment can be affected by fluctuations in currency exchange rates. Consider hedging strategies to mitigate this risk.

- Regulatory Environment: Different countries within Asia have varying regulations and tax regimes for foreign investments. Thoroughly research and understand the specific regulations applicable to your chosen market.

- Liquidity: Some markets, particularly those in developing countries, may have lower liquidity compared to developed markets. This can make it difficult to buy and sell investments quickly.

- Transparency and Information Access: Access to accurate and timely information may be limited in certain markets. Conduct thorough due diligence and ensure reliable sources of information before making investment decisions.

Building a Diversified Portfolio

Diversification is key to mitigating risk and achieving long-term investment success. Consider the following aspects when building your Asian portfolio:

- Sector Allocation: Allocate investments across different sectors, such as consumer staples, technology, financials, and healthcare, to reduce exposure to any single sector’s performance.

- Geographic Diversification: Invest in companies across various Asian countries to spread your risk and tap into different economic growth patterns.

- Asset Class Diversification: Consider combining your Asian investments with other asset classes like bonds, commodities, and real estate to create a more balanced and resilient portfolio.

Prospects of the Asian Stock Market

The Asian stock market is expected to continue playing a pivotal role in the global financial landscape. Key trends shaping the future include:

- Rise of Domestic Investors: With growing wealth in the region, domestic investors are expected to play a larger role, boosting local markets and reducing reliance on foreign investment.

- Emerging Markets Gaining Traction: Markets in Southeast Asia, such as Vietnam and Indonesia, are expected to attract increasing investor interest due to their attractive valuations and growth potential.

- Increased Integration: Technological advancements and regulatory reforms are expected to facilitate greater integration between the various Asian stock exchanges, creating a more unified and competitive regional market.

- Focus on Sustainability: Environmental, social, and governance (ESG) factors are gaining traction in the region, with investors increasingly prioritizing companies that demonstrate sustainable practices.

However, the Asian stock market also faces challenges, including:

- Income Inequality: The persistence of income inequality could hamper domestic investor participation and hinder market growth in some countries.

- Geopolitical Uncertainties: Regional tensions and international conflicts pose a risk to economic stability and investor confidence.

- Regulatory Challenges: Ensuring robust regulatory frameworks across diverse markets will be crucial for maintaining investor trust and fostering healthy market growth.

Final Thoughts

The Asian stock market offers a wealth of opportunities for investors seeking exposure to dynamic economies, innovative companies, and transformative trends. By understanding the historical context, key players, emerging trends, and future trajectories of the Asian stock market, investors can navigate this vibrant and diverse landscape with confidence, unlocking the potential for long-term growth and prosperity. As with any investment, conducting thorough research, diversifying portfolios, and seeking professional advice are essential practices to maximize returns and manage risks in the Asian stock market. With prudent strategies and a keen eye for opportunity, investors can harness the power of Asia’s economic dynamism to achieve their financial goals in the years to come.

Share on Social Media: