The US stock market stands as a symbol of economic vitality and innovation, representing the heartbeat of global finance. As one of the largest and most influential stock markets in the world, it plays a pivotal role in shaping investment strategies, driving economic growth, and reflecting broader socioeconomic trends. With its intricate web of companies, investors, regulations, and technologies, the US stock market presents a dynamic and multifaceted landscape worthy of exploration.

- Historical Overview of the US Stock Market

- Market Structure

- Major Indices of the US Stock Market

- Trading Volume of the US Stock Market

- Market Participants

- US Stock Market Dynamics

- Investment Strategies

- Challenges and Risks

- US Stock Market Regulation

- Market Trends and Innovations

- US Stock Market Access and Participation

Historical Overview of the US Stock Market

The historical overview of the US stock market is a journey through centuries of economic development, financial innovation, and market evolution. It spans from humble beginnings in the late 18th century to the present-day powerhouse that influences global finance. Understanding this history provides valuable insights into the market’s resilience, adaptability, and enduring significance.

Early Beginnings of the US Stock Market

The roots of the US stock market can be traced back to the late 18th century, with the formation of the Buttonwood Agreement in 1792. This agreement, signed under a buttonwood tree on Wall Street in New York City, established rules for trading securities among a group of brokers. This gathering later evolved into what is now known as the New York Stock Exchange (NYSE), one of the world’s largest and most prestigious stock exchanges.

Industrial Revolution and Expansion

The 19th century witnessed the rise of the US as an industrial powerhouse, driving significant growth in the stock market. The construction of railroads, expansion of manufacturing, and emergence of new industries fueled investor interest and speculation. Companies such as Standard Oil, U.S. Steel, and General Electric became synonymous with American industrial might and attracted capital from investors seeking to participate in the nation’s economic transformation.

The US Stock Market Crashes and Regulation

Despite periods of prosperity, the US stock market also experienced its share of volatility and crises. Notable among these were the Panic of 1837, the Panic of 1873, and the Panic of 1907, each characterized by bank failures, stock market crashes, and economic downturns. These events underscored the need for financial regulation and stability. In response, the US government established the Securities and Exchange Commission (SEC) in 1934 to oversee securities markets, enforce regulations, and restore investor confidence following the Great Depression.

Modernization and Electronic Trading

The latter half of the 20th century brought significant advancements in technology and finance, reshaping the structure and dynamics of the US stock market. The advent of electronic trading platforms, such as the Nasdaq Stock Market, introduced new levels of efficiency, transparency, and accessibility to investors. Electronic communication networks (ECNs) and high-frequency trading (HFT) further revolutionized market operations, enabling rapid execution of trades and increased market liquidity.

Globalization and Integration

In the 21st century, the US stock market has become increasingly interconnected with global financial markets, reflecting the realities of globalization and cross-border capital flows. International companies seek listings on US exchanges through American Depository Receipts (ADRs), providing investors with access to a diverse range of investment opportunities. Conversely, US investors allocate capital to foreign markets, diversifying their portfolios and capitalizing on emerging market growth prospects.

Challenges and Resilience

Throughout its history, the US stock market has weathered numerous challenges, including economic downturns, geopolitical tensions, and technological disruptions. Yet, it has demonstrated remarkable resilience, bouncing back from setbacks and continuing to innovate and thrive. Regulatory reforms, technological advancements, and investor education have played pivotal roles in strengthening market integrity, enhancing transparency, and fostering investor confidence.

Free Backtesting Spreadsheet

Market Structure

The US stock market comprises various exchanges, with the NYSE and the Nasdaq being the most prominent. These exchanges provide platforms for companies to list their shares and for investors to trade securities. Additionally, there are alternative trading systems (ATS) and electronic communication networks (ECNs) that facilitate trading outside traditional exchanges. The market operates through a complex network of brokers, market makers, institutional investors, and individual traders, all interacting to determine prices and allocate capital.

Major Indices of the US Stock Market

Several benchmark indices serve as barometers of the US stock market’s performance. The most widely recognized among them include:

- S&P 500: The Standard & Poor’s 500, or S&P 500, is the gold standard of US stock market indices. Comprising 500 of the largest publicly traded companies in the US, it covers approximately 80% of the total market capitalization of the equity market. The S&P 500’s broad representation across various sectors, including technology, healthcare, consumer goods, and financials, makes it a widely used benchmark for assessing overall market performance and economic health.

- Dow Jones Industrial Average (DJIA): The Dow Jones Industrial Average, commonly known as the Dow, is one of the oldest and most iconic stock market indices. It consists of 30 blue-chip companies, representing a diverse range of industries such as technology, healthcare, consumer goods, and finance. Despite its limited scope compared to the S&P 500, the Dow’s historical significance and inclusion of iconic companies make it a widely watched indicator of market trends and investor sentiment.

- Nasdaq Composite: The Nasdaq Composite Index, established in 1971 by the Nasdaq Stock Market, focuses on technology and growth-oriented companies. With over 2,500 securities listed on the Nasdaq exchange, including prominent tech giants like Apple, Amazon, and Microsoft, the index reflects the performance of innovative industries such as information technology, biotechnology, and telecommunications. The Nasdaq Composite is often seen as a leading indicator of tech-driven trends and market sentiment.

- Russell 2000: The Russell 2000 Index tracks the performance of small-cap stocks in the US equity market. Comprising approximately 2,000 smaller companies with market capitalizations below those of larger firms in the S&P 500 and Dow, the index provides insights into the performance of small and mid-sized businesses. These companies are often considered drivers of innovation and economic growth, making the Russell 2000 a key benchmark for investors seeking exposure to smaller companies.

Trading Volume of the US Stock Market

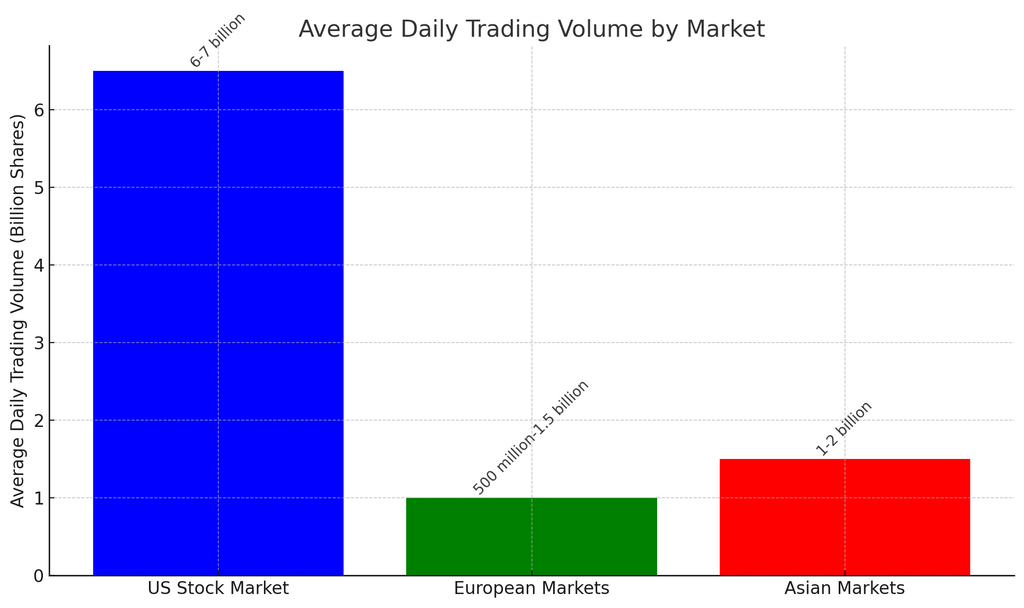

Today the average trading volume in the US stock market is significantly higher than in many other stock markets around the world. On average, the daily trading volume in the US stock market ranges from 6 to 7 billion shares. This high level of liquidity and trading activity is primarily due to the sheer size and depth of the US equity market, which includes thousands of listed companies and attracts a vast number of investors, both institutional and retail, from around the globe.

Comparatively, other major stock markets such as those in Europe and Asia typically have lower average trading volumes. For example, the average daily trading volume in European markets like the London Stock Exchange (LSE) or Euronext may range from 500 million to 1.5 billion shares. Meanwhile, in Asian markets like the Tokyo Stock Exchange (TSE) or the Hong Kong Stock Exchange (HKEX), average daily trading volumes may range from 1 to 2 billion shares.

It’s essential to note that these figures can vary based on market conditions, economic factors, and specific events impacting investor sentiment. Additionally, the comparison of trading volumes across different markets should consider not only the absolute numbers but also the relative size and liquidity of each market.

Market Participants

The US stock market accommodates a diverse array of participants, each with distinct roles and objectives. These include:

- Individual Investors: Retail investors trade stocks through brokerage accounts, seeking capital appreciation or dividend income.

- Institutional Investors: Pension funds, mutual funds, hedge funds, and other institutional investors manage large pools of capital, influencing market trends through their investment decisions.

- Market Makers: These entities facilitate trading by providing liquidity, buying and selling securities to maintain orderly markets.

- Investment Banks: Investment banks underwrite initial public offerings (IPOs) and offer advisory services to companies seeking to raise capital or engage in mergers and acquisitions.

- Regulators: The SEC oversees the US stock market, enforcing regulations to protect investors and maintain market integrity.

US Stock Market Dynamics

The US stock market is subject to various forces that drive price movements and shape investor sentiment. These dynamics include:

- Economic Indicators: Factors such as GDP growth, inflation, employment data, and interest rates influence investor perceptions of economic health and corporate profitability.

- Corporate Earnings: Quarterly earnings reports provide insights into companies’ financial performance, often sparking significant stock price movements.

- Market Sentiment: Investor psychology, sentiment indicators, and market speculation can drive short-term fluctuations in stock prices.

- Geopolitical Events: Global events, such as trade tensions, geopolitical conflicts, and policy decisions, can impact market stability and investor confidence.

- Technological Advancements: Innovations in trading technology, algorithmic trading, and data analytics have transformed market dynamics, accelerating the pace of transactions and market information dissemination.

Investment Strategies

Investors employ various strategies to navigate the complexities of the US stock market and achieve their financial objectives. Some common approaches include:

- Buy and Hold: Long-term investors seek to build wealth by purchasing fundamentally sound companies and holding their investments through market fluctuations.

- Value Investing: Value investors look for undervalued stocks trading below their intrinsic value, based on fundamental analysis of financial metrics.

- Growth Investing: Growth investors focus on companies with strong earnings growth potential, often in innovative sectors such as technology and healthcare.

- Technical Analysis: Traders use technical indicators and chart patterns to analyze price trends and identify entry and exit points for short-term trades.

- Diversification: Investors mitigate risk by diversifying their portfolios across asset classes, industries, and geographic regions, reducing the impact of individual stock volatility.

Challenges and Risks

While the US stock market offers opportunities for wealth creation, it also presents challenges and risks that investors must navigate. These include:

- Market Volatility: Stock prices can fluctuate significantly in response to economic, political, and market-related factors, posing challenges for risk management.

- Systemic Risk: Market-wide events, such as financial crises or sector-specific downturns, can lead to widespread losses across portfolios.

- Regulatory Changes: Shifts in regulatory policies and compliance requirements can impact market participants and influence investment strategies.

- Liquidity Risk: Thinly traded stocks or market disruptions may hinder investors’ ability to buy or sell securities at desired prices.

- Behavioral Biases: Cognitive biases and herd behavior can cloud investors’ judgment, leading to irrational decision-making and suboptimal outcomes.

US Stock Market Regulation

The US stock market is heavily regulated to ensure fairness, transparency, and investor protection. The Securities and Exchange Commission (SEC) plays a central role in regulating securities markets, enforcing securities laws, and overseeing participants such as exchanges, broker-dealers, and investment advisors. Other regulatory bodies, such as the Financial Industry Regulatory Authority (FINRA), also contribute to maintaining market integrity and investor confidence.

Market Trends and Innovations

The US stock market is continuously evolving in response to technological advancements, regulatory changes, and macroeconomic trends. Recent developments, such as the rise of passive investing, the proliferation of exchange-traded funds (ETFs), the emergence of environmental, social, and governance (ESG) investing, and the integration of artificial intelligence and machine learning in investment strategies, have reshaped market dynamics and investor preferences.

US Stock Market Access and Participation

The US stock market offers various avenues for investors to access and participate in equity markets, including traditional brokerage accounts, online trading platforms, robo-advisors, and direct investment plans (DRIPs). Additionally, the democratization of investing through commission-free trading, fractional share ownership, and mobile trading apps has expanded access to a broader segment of the population, empowering individual investors to build diversified portfolios and achieve their financial goals.

Final Thoughts

The US stock market embodies the dynamism and resilience of the global economy, serving as a vital engine of growth and innovation. With its diverse array of participants, complex market structures, and ever-evolving dynamics, it offers both opportunities and challenges for investors seeking to navigate its terrain. By understanding the market’s historical evolution, key participants, driving forces, and investment strategies, stakeholders can make informed decisions to harness the potential of this dynamic marketplace while mitigating associated risks.

Share on Social Media: