In the ever-evolving landscape of finance, where trends shift and technologies disrupt, one investment strategy has stood the test of time: value investing. Championed by renowned investors like Benjamin Graham and Warren Buffett, value investing has proven to be a timeless strategy for generating wealth over the long term. In this comprehensive exploration, we delve into the essence of value investing, its principles, strategies, and enduring relevance in today’s dynamic markets.

Understanding Value Investing

At its core, value investing is a strategy that centers on the belief that the market sometimes misprices assets, presenting opportunities for astute investors to buy stocks or other securities at a discount to their intrinsic value. Unlike speculative approaches that rely on market momentum or trends, value investing focuses on the fundamental analysis of companies, seeking those with strong financials, stable earnings, and solid growth prospects trading below their intrinsic worth.

Principles of Value Investing

Value investors adhere to several key principles that guide their investment decisions:

- Margin of Safety: Benjamin Graham, considered the father of value investing, emphasized the importance of a margin of safety—the difference between the intrinsic value of a stock and its market price. By purchasing stocks at a significant discount to their intrinsic value, investors mitigate downside risk and enhance potential returns.

- Long-Term Perspective: Value investing is inherently long-term oriented. Investors patiently wait for the market to recognize the true worth of undervalued assets, often holding positions for years or even decades. This approach requires discipline and conviction, as short-term market fluctuations are disregarded in favor of underlying business fundamentals.

- Focus on Fundamentals: Rather than speculating on market trends or relying on technical indicators, value investors analyze the fundamental characteristics of companies. This includes assessing financial statements, evaluating competitive advantages, and scrutinizing management quality. By understanding the underlying business, investors can make informed decisions based on intrinsic value rather than market sentiment.

- Contrarian Mindset: Value investing often entails going against the prevailing market sentiment. Contrarian investors are willing to buy when others are selling, provided that the underlying fundamentals remain strong. This requires a certain degree of independence and the ability to withstand short-term fluctuations without losing sight of long-term value.

Free Backtesting Spreadsheet

How to Determine Intrinsic Value of Companies

Intrinsic value represents the true worth of a company based on its underlying fundamentals, earnings potential, and cash flow generation capacity. While determining intrinsic value involves a degree of subjectivity, there are several methods and approaches that investors commonly employ to assess the worth of a business.

1. Discounted Cash Flow (DCF) Analysis: DCF analysis is one of the most widely used methods for estimating the intrinsic value of a company. This approach involves forecasting future cash flows generated by the business and discounting them back to their present value using a predetermined discount rate, often the company’s cost of capital or a required rate of return. By discounting future cash flows, DCF analysis accounts for the time value of money and provides a comprehensive assessment of the company’s intrinsic value based on its ability to generate cash over time. DCF analysis requires careful consideration of revenue projections, operating expenses, capital expenditures, and other factors influencing cash flow generation.

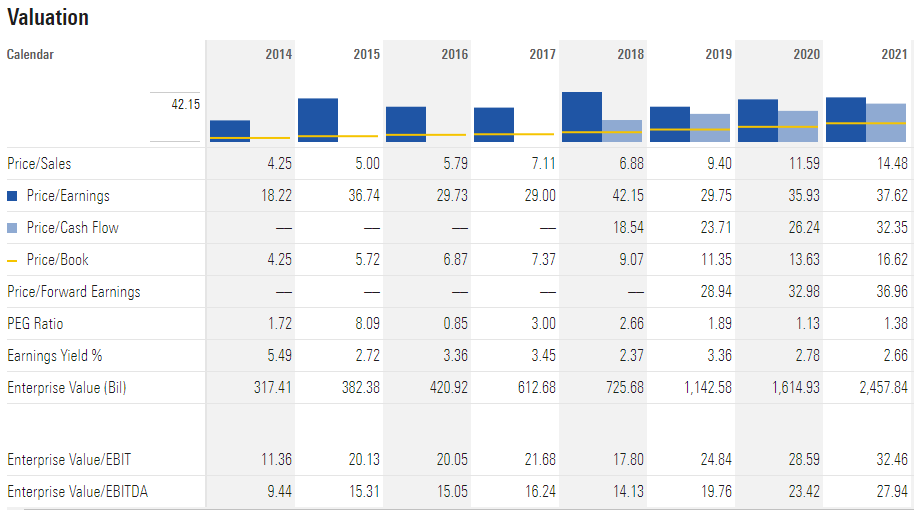

2. Comparable Company Analysis (CCA): CCA, also known as relative valuation, involves comparing the financial metrics and valuation multiples of a target company to those of comparable firms within the same industry or sector. Common valuation multiples used in CCA include price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio, among others. By analyzing the valuation multiples of comparable companies and applying them to the target company’s financial metrics, investors can estimate its intrinsic value relative to its peers. CCA provides valuable insights into how the market is pricing similar companies and can help investors identify potential mispricing.

3. Asset-Based Valuation: Asset-based valuation involves assessing the intrinsic value of a company based on the value of its underlying assets, including tangible assets such as real estate, inventory, and equipment, as well as intangible assets such as patents, trademarks, and intellectual property. Asset-based valuation methods include book value, liquidation value, and replacement cost. Book value represents the net asset value of the company as reported on its balance sheet, while liquidation value estimates the proceeds that would be realized if the company were to be liquidated. Replacement cost assesses the cost of replacing the company’s assets at current market prices. Asset-based valuation is particularly useful for companies with substantial tangible assets or those operating in industries with volatile earnings.

MSFT Valuation/source: morningstar.com

4. Earnings Multiples Approach: The earnings multiples approach involves estimating the intrinsic value of a company based on its earnings per share (EPS) or other earnings metrics multiplied by a predetermined valuation multiple. Common earnings multiples used in this approach include the price-to-earnings (P/E) ratio, price-to-earnings-to-growth (PEG) ratio, and price-to-free cash flow (P/FCF) ratio. By applying an appropriate earnings multiple to the company’s earnings, investors can derive an estimate of its intrinsic value. The choice of earnings multiple depends on factors such as the company’s growth prospects, industry dynamics, and risk profile. The earnings multiples approach provides a straightforward method for valuing companies based on their earnings potential relative to market expectations.

5. Dividend Discount Model (DDM): The dividend discount model (DDM) is a valuation method that estimates the intrinsic value of a company based on the present value of its future dividend payments. DDM assumes that the value of a company is equal to the sum of all its expected future dividends discounted back to their present value at a required rate of return. The two main variations of DDM are the Gordon Growth Model, which assumes a constant growth rate in dividends, and the Two-Stage DDM, which allows for multiple growth rates over time. DDM is particularly relevant for income-oriented investors seeking companies with stable dividend payments and consistent dividend growth.

5 Strategies of Value Investing

#1. Deep Value Investing Strategy

Deep value investing involves seeking out stocks that are trading significantly below their intrinsic value. These companies often face temporary challenges, such as poor quarterly earnings, regulatory issues, or industry downturns, leading to depressed stock prices. Deep value investors meticulously analyze financial statements, scrutinize balance sheets, and assess business fundamentals to identify these hidden gems. By purchasing these stocks at a substantial discount, investors create a margin of safety, providing downside protection and potential for substantial returns when the market eventually corrects its valuation error.

#2. Growth at a Reasonable Price (GARP) Strategy

The Growth at a Reasonable Price (GARP) strategy combines elements of both value and growth investing. GARP investors seek out companies with strong growth prospects trading at reasonable valuations relative to their earnings potential. Rather than focusing solely on traditional value metrics like price-to-earnings (P/E) or price-to-book (P/B) ratios, GARP investors consider factors such as earnings growth rates, industry dynamics, and competitive positioning. By identifying companies poised for sustainable growth trading at attractive prices, GARP investors aim to capitalize on the best of both worlds.

#3. Contrarian Investing Strategy

Contrarian investing involves going against the prevailing market sentiment and purchasing assets that are out of favor with the majority of investors. Contrarian investors believe that market overreactions and herd mentality can lead to mispricing of securities, presenting opportunities for savvy investors to capitalize on irrational market behavior. By buying when others are selling and selling when others are buying, contrarian investors aim to exploit market inefficiencies and generate outsized returns. This strategy requires patience, conviction, and a willingness to withstand short-term volatility in pursuit of long-term gains.

#4. Special Situations Investing Strategy

Special situations investing involves capitalizing on unique events or circumstances that create temporary mispricing in the market. This may include corporate events such as spin-offs, mergers and acquisitions, bankruptcies, or regulatory changes. Special situations often result in dislocations between stock prices and intrinsic value, offering opportunities for nimble investors to profit from market inefficiencies. By conducting thorough research and understanding the specific dynamics driving each situation, investors can identify mispriced assets and position themselves to capture value as events unfold.

#5. Dividend Investing Strategy

Dividend investing focuses on selecting stocks with attractive dividend yields and strong dividend growth potential. Value investors favor companies with stable earnings and cash flows capable of sustaining dividend payments over the long term. Dividends not only provide a source of income for investors but also serve as a measure of a company’s financial health and shareholder alignment. Dividend investing emphasizes the importance of passive income generation and long-term wealth accumulation through the power of compounding dividends.

Enduring Relevance in Modern Markets

Despite the rise of algorithmic trading, quantitative models, and rapid market information dissemination, the principles of value investing remain as relevant as ever. In fact, in today’s increasingly complex and volatile markets, the discipline and rationality inherent in value investing offer a beacon of stability and long-term success.

- Behavioral Finance: Value investing capitalizes on behavioral biases and market inefficiencies that persist despite advancements in technology and market sophistication. Behavioral finance principles such as herd mentality, overreaction to news, and cognitive biases contribute to market mispricing, providing opportunities for value investors to exploit.

- Market Volatility: Value investing thrives in volatile market environments where fear and uncertainty drive irrational pricing. During market downturns or periods of economic turmoil, value investors remain steadfast in their commitment to fundamental analysis, seizing opportunities to acquire quality assets at discounted prices.

- Risk Management: The margin of safety principle inherent in value investing serves as a robust risk management tool. By focusing on downside protection and preserving capital, value investors mitigate the impact of market volatility and unexpected events. This disciplined approach helps investors navigate turbulent market conditions while maintaining a long-term perspective.

- Sustainable Investing: Increasingly, investors are prioritizing sustainability and corporate responsibility in their investment decisions. Value investing aligns with these principles by emphasizing the importance of ethical business practices, transparent governance, and long-term value creation. Companies that demonstrate strong environmental, social, and governance (ESG) performance are often well-positioned to deliver sustainable returns over time.

Final Thoughts

Value investing embodies a philosophy grounded in discipline, patience, and a rigorous focus on fundamentals. While market trends may come and go, the timeless principles of value investing endure, offering a roadmap for navigating the complexities of modern finance. By adhering to the principles of margin of safety, long-term perspective, and fundamental analysis, investors can uncover opportunities, mitigate risk, and build wealth over the long term. In a world of uncertainty and volatility, value investing stands as a beacon of rationality and resilience, guiding investors towards enduring success in the pursuit of wealth creation.

Share on Social Media: