In the world of finance, stock options play a significant role in providing investors with the flexibility to manage risks and potentially enhance returns. Whether you are a seasoned investor or just dipping your toes into the financial markets, understanding how call and put options work can be invaluable. In this comprehensive guide, we will delve into the intricacies of call and put options, exploring their definitions, characteristics, trading strategies, and the risks associated with them.

What Are Stock Options?

Before delving into call and put options specifically, it’s essential to grasp the concept of stock options. A stock option is a contract that gives the holder the right, but not the obligation, to buy or sell a specific quantity of a stock at a predetermined price (the strike price) within a set period (until expiration). These contracts are often used as financial instruments to hedge against risk, speculate on price movements, or generate income.

Call Options: The Right to Buy

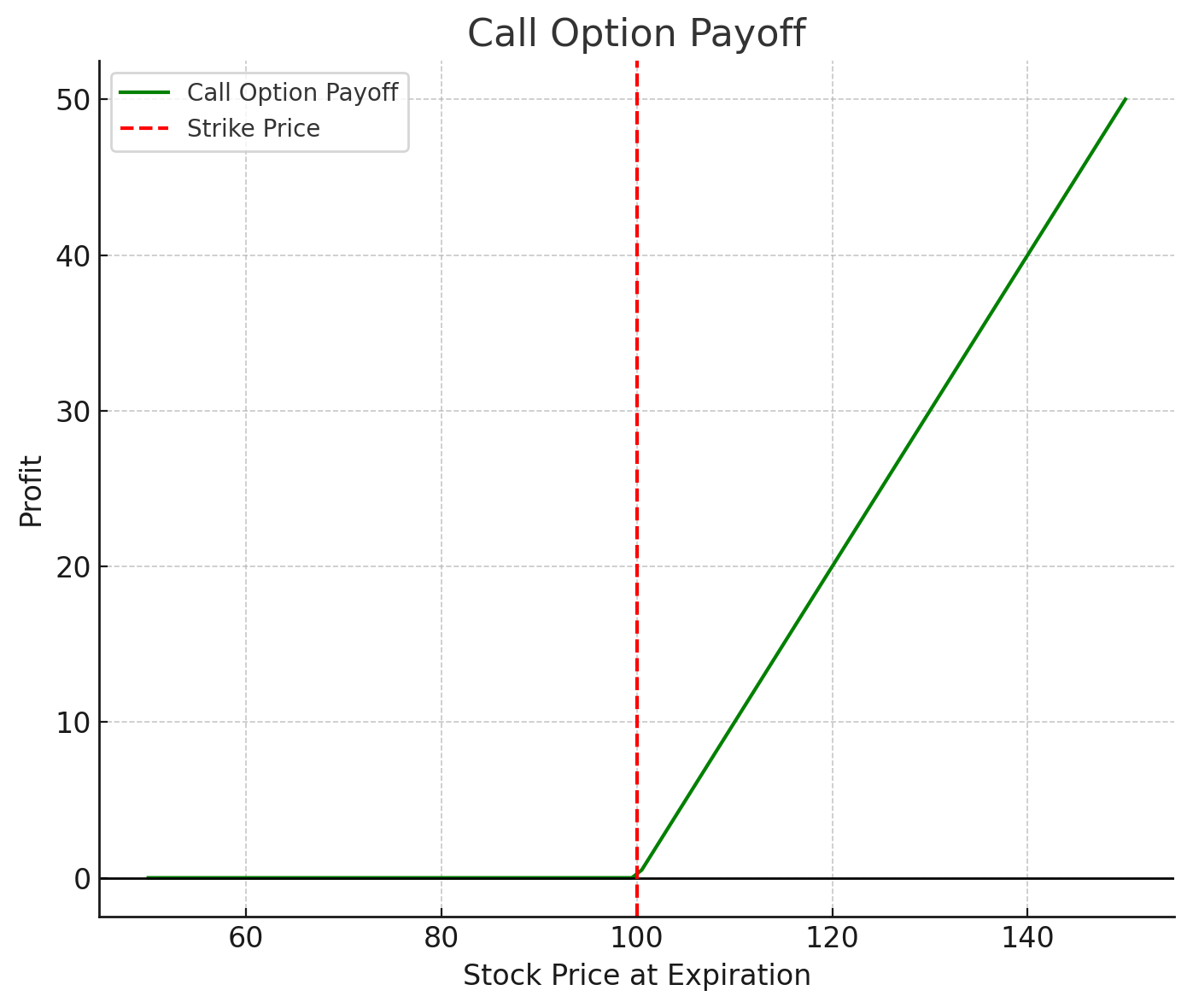

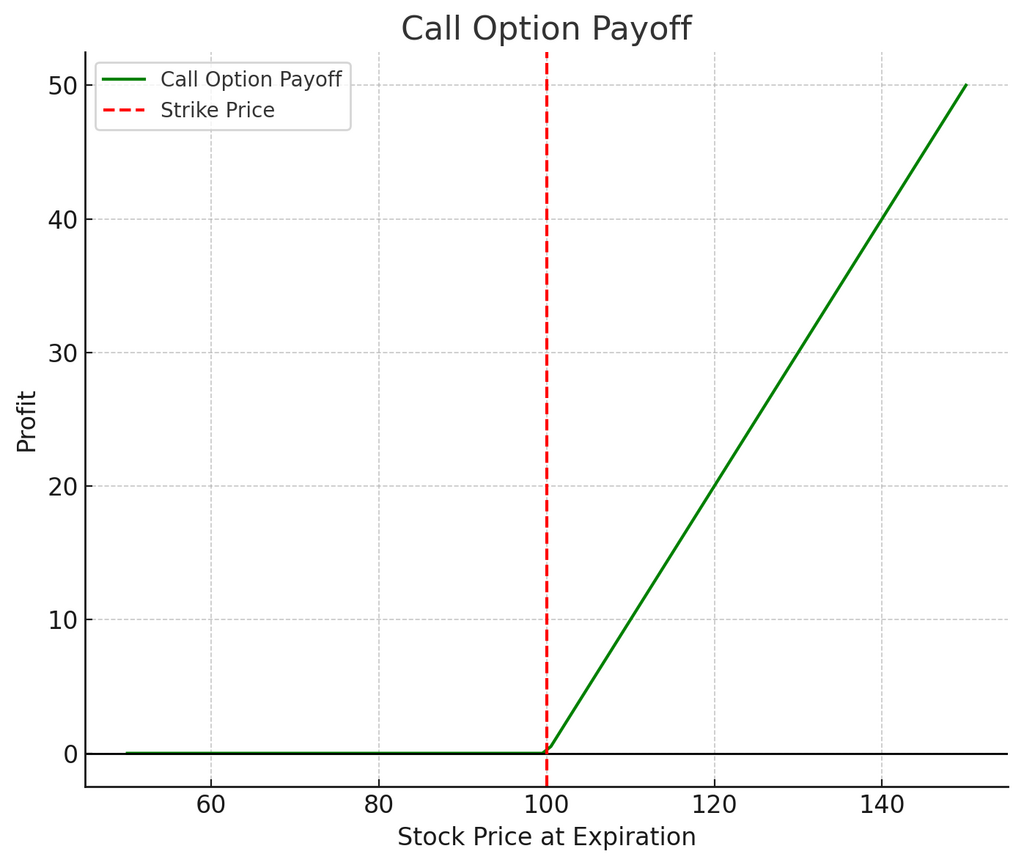

A call option provides the buyer with the right, but not the obligation, to purchase a specified number of shares of the underlying stock at the predetermined strike price within a specified period, known as the expiration date. When an investor buys a call option, they are essentially betting that the price of the underlying stock will rise above the strike price before the option expires.

For example, suppose an investor purchases a call option on Company XYZ with a strike price of $50 and an expiration date one month from now. If the stock price of Company XYZ rises above $50 before the expiration date, the call option holder can exercise their right to buy shares of Company XYZ at $50 per share, regardless of the current market price. This ability to buy shares at a predetermined price, even if the market price is higher, is known as the intrinsic value of the call option.

Call options are often used by investors who are bullish on a particular stock or the overall market. By buying call options, investors can potentially amplify their returns if the price of the underlying stock rises significantly. However, it’s important to note that call options come with a cost, known as the premium, which the buyer must pay to acquire the option contract.

Put Options: The Right to Sell

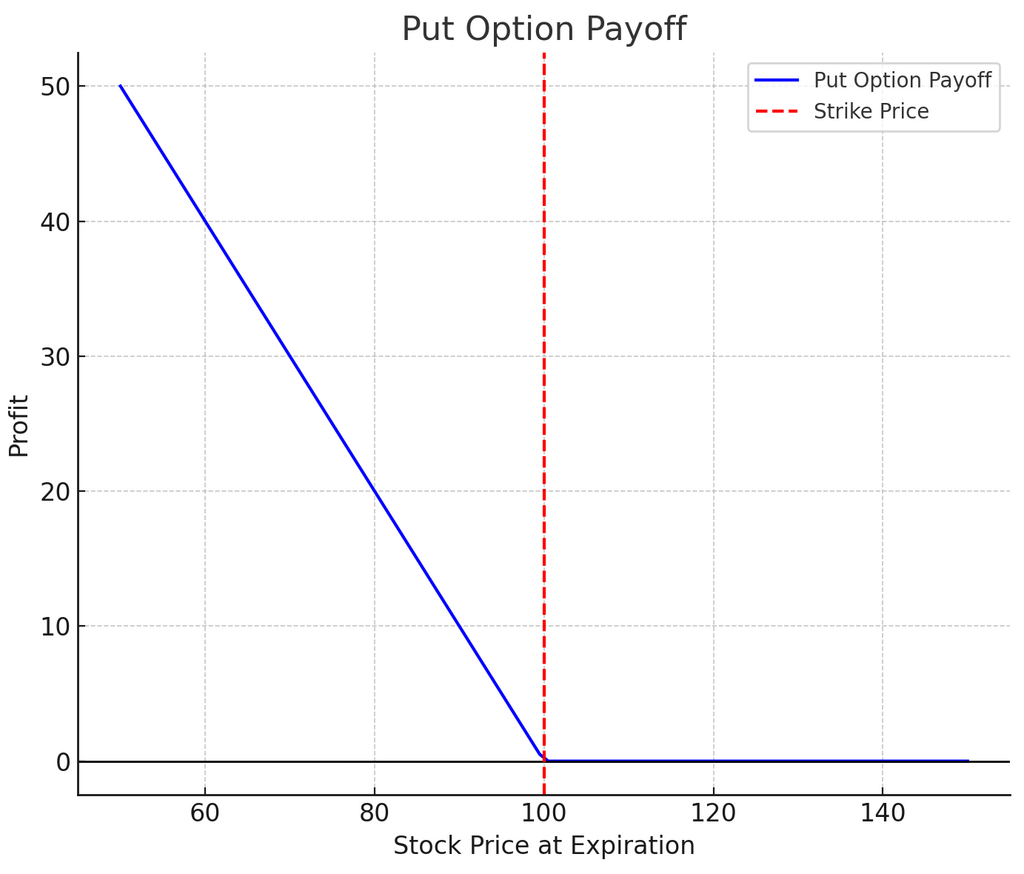

On the other hand, a put option gives the buyer the right, but not the obligation, to sell a specified number of shares of the underlying stock at the predetermined strike price within a specified period, until expiration. Put options are typically used by investors to profit from a decline in the price of the underlying stock or to hedge against downside risk.

Continuing with our example of Company XYZ, suppose an investor purchases a put option on Company XYZ with a strike price of $50 and an expiration date one month from now. If the stock price of Company XYZ falls below $50 before the expiration date, the put option holder can exercise their right to sell shares of Company XYZ at $50 per share, regardless of the current market price. This ability to sell shares at a predetermined price, even if the market price is lower, is the intrinsic value of the put option.

Put options are often employed as a form of insurance against potential losses in a stock portfolio. By purchasing put options on individual stocks or market indices, investors can protect themselves from adverse price movements and mitigate the impact of market downturns. Like call options, put options also come with a premium that the buyer must pay to acquire the option contract.

Key Characteristics of Stock Options

While stock options share some similarities, they also exhibit distinct characteristics that differentiate them from one another. Here are some key features of stock options:

- Limited Risk: The maximum loss for an option buyer is limited to the premium paid for the option contract. This limited risk makes options an attractive instrument for investors looking to manage their downside exposure.

- Unlimited Profit Potential: While the risk is limited for option buyers, the profit potential is theoretically unlimited. If the price of the underlying stock moves significantly in the desired direction, the option buyer can capture substantial profits.

- Expiration Date: Options have a finite lifespan, with expiration dates typically ranging from days to years. Once an option reaches its expiration date, it becomes worthless, and the buyer loses the entire premium paid.

- Leverage: Options provide investors with leverage, allowing them to control a larger position in the underlying stock with a relatively small amount of capital. This leverage can amplify both gains and losses, making options a double-edged sword.

- Volatility Sensitivity: Options are sensitive to changes in volatility, with increasing volatility generally benefiting option buyers and decreasing volatility benefiting option sellers.

Free Backtesting Spreadsheet

Option Chains and Greeks

In options trading, an option chain is a comprehensive listing of all available option contracts for a particular underlying asset. Option chains typically display information such as the strike prices, expiration dates, premiums, and volume for both call and put options. By examining an option chain, traders can evaluate different options contracts and select the ones that best align with their trading objectives and risk tolerance.

Additionally, options traders often use a set of metrics known as the Greeks to assess the risk and potential reward of option positions. The Greeks, which include delta, gamma, theta, vega, and rho, provide insights into how changes in various factors, such as the underlying stock price, volatility, time to expiration, and interest rates, can impact the value of an option contract. Understanding the Greeks can help traders make more informed decisions and manage their options positions effectively.

Option Delta

Delta measures the sensitivity of an option’s price to changes in the price of the underlying stock. A delta of 0.50 indicates that the option’s price will change by $0.50 for every $1 change in the price of the underlying stock, assuming all other factors remain constant.

Option Gamma

Gamma measures the rate of change of an option’s delta in response to changes in the price of the underlying stock. Gamma is highest for at-the-money options and decreases as the option moves further in or out of the money.

Option Theta

Theta measures the rate of decline in an option’s value as time passes. It represents the time decay of an option’s premium and is highest for at-the-money options as expiration approaches.

Option Vega

Vega measures the sensitivity of an option’s price to changes in volatility. A higher vega indicates that the option’s price is more sensitive to changes in volatility, while a lower vega indicates less sensitivity.

Option Rho

Rho measures the sensitivity of an option’s price to changes in interest rates. It represents the impact of changes in interest rates on the value of the option contract.

By understanding how the Greeks influence options pricing and behavior, traders can adjust their strategies to account for different market conditions and maximize their potential for success.

Trading Strategies with Stock Options

The versatility of stock options opens a wide range of trading strategies for investors to explore. Whether you are looking to speculate on price movements, hedge against risk, or generate income, there is a strategy to suit your objectives. Here are brief explanations of some common trading strategies involving call and put options (check links for more details and examples):

Long Call

The long call strategy involves buying call options with the expectation that the price of the underlying stock will rise significantly. The goal is to profit from the increase in the stock price while limiting the downside risk to the premium paid for the option.

Long Put

The long put strategy entails buying put options to profit from a decline in the price of the underlying stock. It is often used as a hedging tool to protect against potential losses in a stock portfolio during market downturns.

Covered Call

In a covered call strategy, investors who already own shares of the underlying stock sell call options against their existing position. This strategy generates income in the form of premiums while potentially allowing the investor to profit from a moderate increase in the stock price.

Protective Put

The protective put strategy involves buying put options to hedge an existing long position in the underlying stock. By purchasing put options, investors can limit their downside risk while maintaining exposure to potential upside gains.

Straddle

A straddle strategy involves buying both a call option and a put option with the same strike price and expiration date. This strategy is used when the investor expects significant price volatility in the underlying stock but is unsure about the direction of the price movement.

Strangle

Like a straddle, a strangle strategy involves buying out-of-the-money call and put options with different strike prices but the same expiration date. This strategy is used to capitalize on volatility while reducing the upfront cost compared to a straddle.

Credit Spread

Credit spread strategies involve selling one option while simultaneously buying another option with the same expiration date but a different strike price. These strategies aim to generate income from the option premiums while limiting risk.

Iron Condor

An iron condor strategy combines a bull put spread and a bear call spread to profit from a range-bound market. This strategy is suitable when the investor expects the price of the underlying stock to remain within a certain range until expiration.

Risks Associated with Stock Options Trading

While stock options can offer numerous benefits to investors, it’s important to recognize that they also come with inherent risks. Here are some key risks associated with options trading:

- Limited Lifespan: Options have a finite lifespan, and if the price of the underlying stock fails to move in the desired direction before expiration, the option may expire worthless, resulting in a loss of the premium paid.

- Time Decay: Options are subject to time decay, meaning their value erodes as the expiration date approaches. Time decay accelerates as the option nears expiration, which can erode profits or exacerbate losses for option buyers.

- Volatility Risk: Options are sensitive to changes in volatility, and unexpected fluctuations in volatility can impact the value of option contracts. High volatility can increase option premiums, while low volatility can decrease premiums.

- Assignment Risk: For options sellers, there is a risk of assignment, whereby the buyer exercises their right to buy or sell the underlying stock. An assignment can occur at any time before expiration, potentially resulting in unexpected positions in the underlying stock.

- Market Risk: Options are subject to market risk, including factors such as economic conditions, geopolitical events, and overall market sentiment. Adverse developments in the market can negatively impact the value of option contracts.

Final Thoughts

Call and put options offer investors versatile tools for managing risks and leveraging market opportunities. Understanding their characteristics, trading strategies, and associated risks is essential for effective decision-making in the financial markets. By grasping concepts such as option chains and the Greeks, investors can navigate options trading more confidently. Whether aiming to speculate, hedge, or generate income, options present numerous strategies to align with diverse investment goals. However, it’s crucial to acknowledge the inherent risks, including time decay, leverage, and market volatility. With diligence and informed decision-making, options can become valuable additions to any investment portfolio.

Share on Social Media: