Cryptocurrency, as we know it today, was created with the invention of Bitcoin, the first decentralized digital currency. Bitcoin was introduced in a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” published in October 2008 by an individual or group using the pseudonym Satoshi Nakamoto. The whitepaper proposed a novel solution to the long-standing problem of creating a digital currency without the need for a central authority or trusted intermediary. It outlined the design and functionality of a peer-to-peer electronic cash system based on cryptographic principles and decentralized consensus.

The cryptocurrency industry has undergone a remarkable evolution since its inception, fundamentally changing the way we perceive and interact with money and finance. Emerging in the early 2000s with the creation of Bitcoin, cryptocurrencies have since grown into a global phenomenon, reshaping traditional financial systems and challenging established norms. Here we provide an overview of the cryptocurrency ecosystem, exploring key components such as crypto trading, mining, trading platforms, wallets, exchanges, and the various digital assets that populate this dynamic landscape.

- Bitcoin: The King of Cryptocurrencies

- Crypto Mining: Unearthing Digital Gold

- Pi Coin and Shiba Inu Coin: Rising Stars in the Crypto Universe

- Crypto Trading: Utilizing Price Changes

- Risks in Cryptocurrency Market

- Crypto Bubbles: Navigating the Ups and Downs

- Cryptocurrency Exchanges: Gateways to Digital Assets

- Crypto Wallets: Safeguarding Digital Assets

Bitcoin: The King of Cryptocurrencies

Bitcoin stands as the pioneering cryptocurrency and introduced the concept of decentralized digital currency and blockchain technology to the world, laying the foundation for subsequent innovations in the cryptocurrency space. With a finite supply capped at 21 million coins, Bitcoin has garnered immense popularity as a store of value and medium of exchange, attracting investors seeking exposure to digital assets and alternative investment opportunities.

Key innovations introduced by Bitcoin include:

- Decentralization: Bitcoin operates on a decentralized network of computers, known as nodes, which collectively maintain a shared ledger called the blockchain. This eliminates the need for a central authority, such as a government or financial institution, to issue or regulate the currency.

- Blockchain Technology: The blockchain is a distributed ledger that records all transactions in a secure and immutable manner. Each block in the chain contains a cryptographic hash of the previous block, creating a chronological and tamper-proof record of transactions.

- Proof of Work (PoW) Consensus: Bitcoin’s consensus mechanism, known as Proof of Work, requires miners to solve complex mathematical puzzles to validate transactions and secure the network. Miners are rewarded with newly minted bitcoins for their computational efforts.

- Limited Supply: Bitcoin has a fixed supply cap of 21 million coins, ensuring scarcity and preventing inflationary pressures. This deflationary model is designed to mimic the scarcity of precious metals like gold and establish Bitcoin as a store of value.

- Pseudonymity: While Bitcoin transactions are recorded on the blockchain and are publicly visible, the identities of the parties involved are pseudonymous. Users are identified by cryptographic addresses rather than personal information, providing a degree of privacy and anonymity.

Bitcoin was officially launched on January 3, 2009, when the first block, known as the “genesis block,” was mined by Satoshi Nakamoto. This event marked the beginning of the Bitcoin network and the broader cryptocurrency revolution. Since then, thousands of alternative cryptocurrencies, often referred to as altcoins, have been created, each with its unique features, use cases, and underlying technologies. However, Bitcoin remains the most well-known and widely adopted cryptocurrency, serving as the foundation for the entire industry.

Crypto Mining: Unearthing Digital Gold

Cryptocurrency miners utilize powerful computer hardware to solve complex mathematical puzzles, contributing to the decentralization and integrity of the network. While Bitcoin mining remains the most well-known form of cryptocurrency mining, other coins like Ethereum, Litecoin, and Pi Coin also employ similar mechanisms. However, mining operations have faced scrutiny due to their environmental impact and energy consumption, leading to debates about sustainability and the adoption of more eco-friendly alternatives.

As of February 2024, the total supply of Bitcoin is capped at 21 million coins, as defined in the original Bitcoin protocol. However, not all of these bitcoins have been mined yet. The rate at which new bitcoins are mined (or created) is halved approximately every four years in a process known as the “halving.” This halving event is built into the Bitcoin protocol and is designed to control the rate of inflation and ensure that the total supply of bitcoins approaches its predetermined limit gradually.

As of the latest halving event in May 2020, the block reward for miners was reduced from 12.5 bitcoins per block to 6.25 bitcoins per block. This means that approximately 900 new bitcoins are mined each day, given the current rate of block production.

To estimate how many bitcoins are left to mine, we can calculate the difference between the total supply cap of 21 million bitcoins and the current circulating supply. According to available data, as of February 2024, over 18.7 million bitcoins have already been mined, leaving approximately 2.3 million bitcoins yet to be mined.

Free Backtesting Spreadsheet

Pi Coin and Shiba Inu Coin: Rising Stars in the Crypto Universe

Pi Coin and Shiba Inu Coin are among the newer entrants to the cryptocurrency market, each gaining attention for its unique value proposition and community-driven ethos. Pi Coin aims to create a decentralized network of interconnected users, leveraging a novel consensus mechanism known as the Proof of Stake (PoS). On the other hand, Shiba Inu Coin seeks to capitalize on the popularity of the Shiba Inu meme, offering a decentralized ecosystem for token swaps, liquidity provision, and decentralized finance (DeFi) initiatives. Despite facing skepticism and scrutiny, both coins have amassed sizable followings and market capitalizations, reflecting the diverse and dynamic nature of the cryptocurrency landscape.

Crypto Trading: Utilizing Price Changes

Crypto trading has emerged as one of the most prominent activities within the cryptocurrency industry, offering individuals the opportunity to engage in speculative activities and generate profits from price movements in digital assets. The proliferation of cryptocurrencies like Bitcoin, Ethereum, Pi Coin, and Shiba Inu Coin has created a diverse and dynamic trading environment, attracting traders from all walks of life. Traders employ various strategies, ranging from day trading and swing trading to long-term investing, to capitalize on market opportunities and mitigate risks.

Risks in Cryptocurrency Market

Trading cryptocurrencies is widely considered to be a risky endeavor, and there are several reasons for this assessment:

1st Risk: Cryptocurrency Volatility

Cryptocurrency markets are known for their extreme price volatility. Prices can fluctuate dramatically within short periods, leading to significant gains or losses for traders. This volatility is influenced by various factors, including market sentiment, regulatory developments, technological advancements, and macroeconomic trends.

2nd Risk: Lack of Regulation

Cryptocurrency markets operate with limited regulation compared to traditional financial markets. The absence of regulatory oversight can contribute to price manipulation, fraud, and market manipulation, exposing traders to additional risks.

3rd Risk: Liquidity Risks of Cryptocurrency

Some cryptocurrencies, particularly smaller or less established ones, may suffer from low liquidity, meaning that there are fewer buyers and sellers in the market. This lack of liquidity can lead to wider bid-ask spreads and difficulty executing large trades without affecting market prices.

4th Risk: Security Concerns

Cryptocurrency exchanges and trading platforms are frequent targets for hackers and cybercriminals due to the potential for large financial gains. Security breaches can result in the loss of funds for traders, highlighting the importance of robust security measures and risk management practices.

5th Risk: Cryptocurrency Market Manipulation

Cryptocurrency markets are susceptible to manipulation due to their relatively small size and decentralized nature. Pump-and-dump schemes, wash trading, and other forms of market manipulation can artificially inflate or deflate prices, leading to losses for unsuspecting traders.

6th Risk: Regulatory Risks

Regulatory uncertainty remains a significant concern for cryptocurrency traders, as governments around the world continue to grapple with how to regulate digital assets effectively. Regulatory changes, enforcement actions, and legislative developments can impact market sentiment and prices.

7th Risk: Technological Risks

Cryptocurrencies rely on complex technological infrastructure, including blockchain networks, wallets, and trading platforms. Technical glitches, software bugs, and network disruptions can disrupt trading activities and result in financial losses for traders.

8th Risk: Psychological Factors

Trading cryptocurrencies can be emotionally challenging, as traders may experience fear, greed, and FOMO (fear of missing out) when making investment decisions. Emotional biases can cloud judgment and lead to impulsive or irrational trading behavior.

While trading cryptocurrencies can potentially yield high returns, it is essential for traders to understand and manage the associated risks effectively. This includes conducting thorough research, diversifying investment portfolios, implementing risk management strategies, and exercising caution when navigating volatile markets. Additionally, traders should stay informed about market developments, regulatory changes, and security best practices to mitigate potential risks and protect their investments.

Crypto Bubbles: Navigating the Ups and Downs

The cryptocurrency market is notorious for its price volatility and speculative nature, leading to the formation of bubbles and subsequent crashes. These periods of rapid price appreciation are often fueled by hype, speculation, and investor frenzy, resulting in unsustainable price levels and eventual corrections. While Bitcoin has experienced several boom-and-bust cycles throughout its history, newer coins like Pi Coin and Shiba Inu Coin have also witnessed meteoric rises followed by steep declines, highlighting the inherent risks and uncertainties associated with cryptocurrency investing.

Cryptocurrency Exchanges: Gateways to Digital Assets

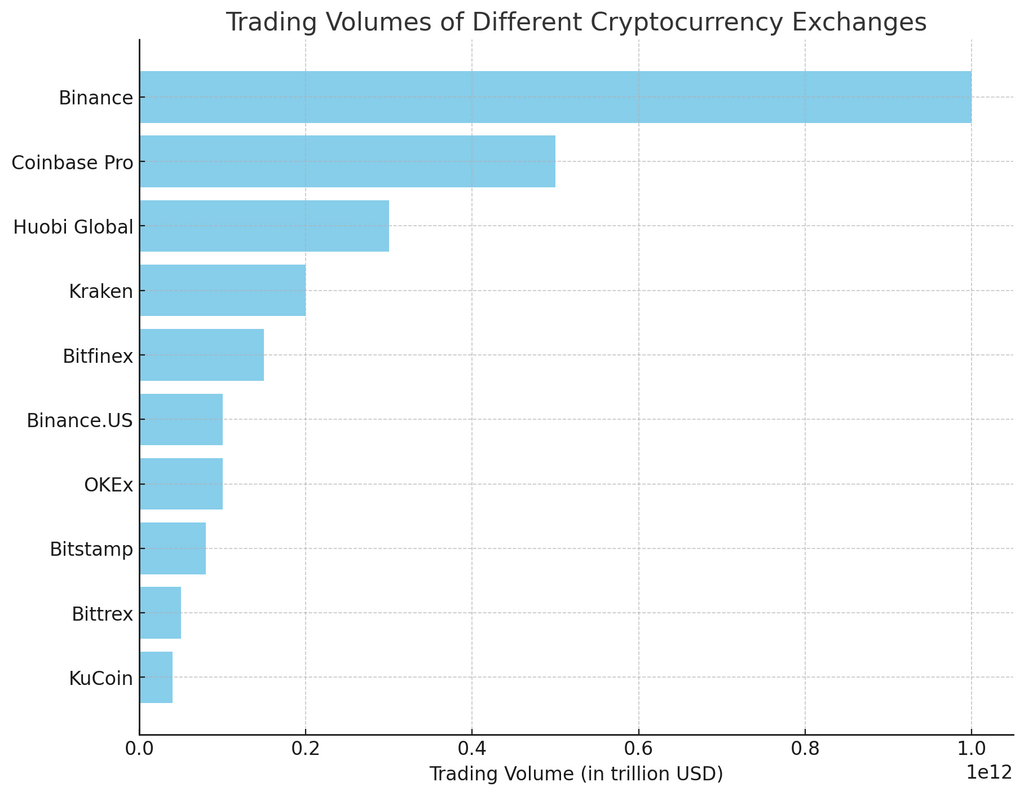

Cryptocurrency exchanges serve as vital infrastructure within the crypto ecosystem, providing liquidity, price discovery, and trading opportunities for users worldwide. From centralized exchanges like Binance, Coinbase, and Kraken to decentralized platforms like Uniswap, SushiSwap, and PancakeSwap, there is a diverse array of exchanges catering to different preferences and needs. These exchanges play a crucial role in facilitating the buying, selling, and trading of digital assets, serving as the primary gateway for individuals to access the cryptocurrency market. These platforms offer a range of features, including real-time market data, cryptocurrency futures and options for leverage, trading tools, and security measures.

As of February 2024, here is a list of some of the top cryptocurrency exchanges by monthly trading volume, along with their approximate trading volumes:

- Binance – Approximately $1 trillion

- Coinbase Pro – Approximately $500 billion

- Huobi Global – Approximately $300 billion

- Kraken – Approximately $200 billion

- Bitfinex – Approximately $150 billion

- Binance.US – Approximately $100 billion

- OKEx – Approximately $100 billion

- Bitstamp – Approximately $80 billion

- Bittrex – Approximately $50 billion

- KuCoin – Approximately $40 billion

Crypto Wallets: Safeguarding Digital Assets

Crypto wallets are digital tools that enable users to store, send, and receive cryptocurrencies securely. They come in various forms, including hardware wallets, software wallets, and paper wallets, each offering different levels of security and convenience. As custodians of digital wealth, crypto wallets play a crucial role in protecting assets from theft and unauthorized access, emphasizing the importance of robust security practices and risk management strategies.

Types of crypto wallets

- Hardware Wallets: Hardware wallets are physical devices that store users’ private keys offline, making them immune to online hacking attacks. These wallets are considered one of the most secure options for storing large amounts of cryptocurrency, as they are not connected to the internet except when making transactions. Popular hardware wallet brands include Ledger and Trezor.

- Software Wallets: Software wallets are applications or software programs that run on electronic devices such as smartphones, computers, or tablets. These wallets can be further categorized into:

- Desktop Wallets: Installed on a desktop or laptop computer, desktop wallets provide users with full control over their private keys and offer a higher level of security compared to online wallets.

- Mobile Wallets: Designed for use on mobile devices, mobile wallets offer convenience and accessibility for users who frequently make transactions on the go. While mobile wallets are convenient, users should exercise caution and ensure their devices are adequately protected against security threats.

- Web Wallets: Web wallets are hosted on online platforms and accessible through web browsers. While convenient, web wallets are considered less secure than hardware and desktop wallets since they rely on third-party service providers to manage users’ private keys.

- Paper Wallets: Paper wallets are physical documents or printouts that contain a user’s public and private keys. Paper wallets offer a high level of security since they are not susceptible to hacking attacks or malware. However, users must take precautions to protect their paper wallets from physical damage, loss, or theft.

- Multi-Signature Wallets: Multi-signature wallets require multiple private keys to authorize transactions, adding an extra layer of security and control. These wallets are commonly used by organizations, businesses, and cryptocurrency exchanges to protect their funds against unauthorized access and fraud.

Final Thoughts

The cryptocurrency industry continues to evolve and expand, driven by innovation, adoption, and market forces. While challenges and uncertainties persist, the underlying technology and principles behind cryptocurrencies hold immense potential to reshape finance and empower individuals globally. As participants navigate the complexities of this dynamic ecosystem, understanding the various facets outlined in this article will be crucial for informed decision-making and participation in the digital economy.

Share on Social Media: